Full Coverage Car Insurance: Is It Worth the Extra Cost? (2025 Breakdown)

Published on July 29, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

Full Coverage Car Insurance: Is It Worth the Extra Cost? (2025 Breakdown)

Car insurance is a necessary expense, but deciding on the right level of coverage can be confusing. Among the most debated options is full coverage car insurance. It sounds comprehensive—and expensive—but is it really the right choice for you?

In this guide, we’ll break down everything you need to know about full coverage car insurance: is it worth the extra cost? From what it includes to who needs it (and who doesn’t), this 2025 edition will help you decide with confidence.

What Is Full Coverage Car Insurance?

The Standard Definition

Contrary to what the name suggests, “full coverage” doesn’t mean everything is covered. Instead, it typically refers to a combination of multiple types of coverage that offer broad financial protection.

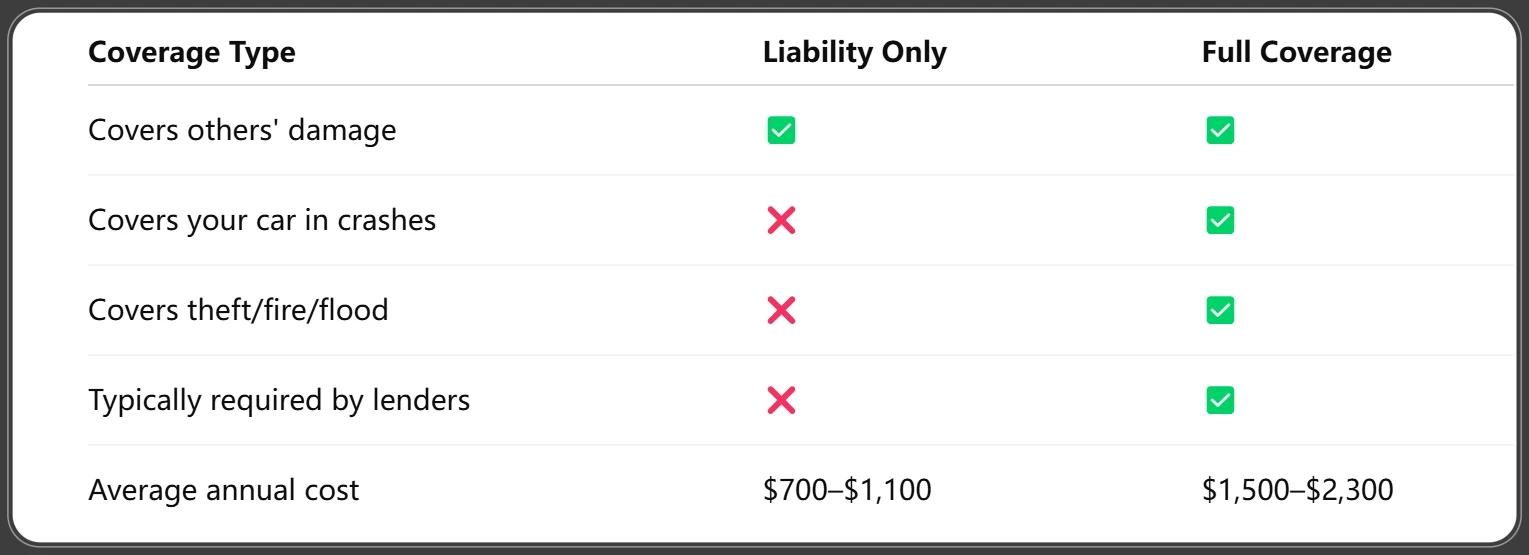

What Full Coverage Typically Includes

- Liability Insurance – Covers damage and injury you cause to others.

- Collision Coverage – Pays for damage to your vehicle in an accident.

- Comprehensive Coverage – Covers non-collision incidents like theft, fire, vandalism, or natural disasters.

Full Coverage vs Liability Only

ValuePenguin (LendingTree). (2025, July 8). State of Auto Insurance in 2025 [Web report].

Components of Full Coverage

Collision Coverage

Covers your vehicle when it’s damaged in an accident, regardless of who is at fault. It's especially helpful for newer cars or in high-traffic areas.

Comprehensive Coverage

Protects against “everything else”—from a tree falling on your car to your vehicle being stolen. It’s valuable for areas with severe weather or high theft rates.

Liability Coverage

Still a required base—it includes:

- Bodily Injury Liability

- Property Damage Liability

This is mandatory in most states, whether or not you add full coverage.

Optional Add-Ons

You can further expand your policy with:

- Gap Insurance – Covers the difference between your loan balance and car’s market value.

- Rental Reimbursement – Pays for a rental while your car is being repaired.

- Roadside Assistance – For breakdowns, flat tires, towing, etc.

How Much Does Full Coverage Car Insurance Cost?

National Averages (2025 Data)

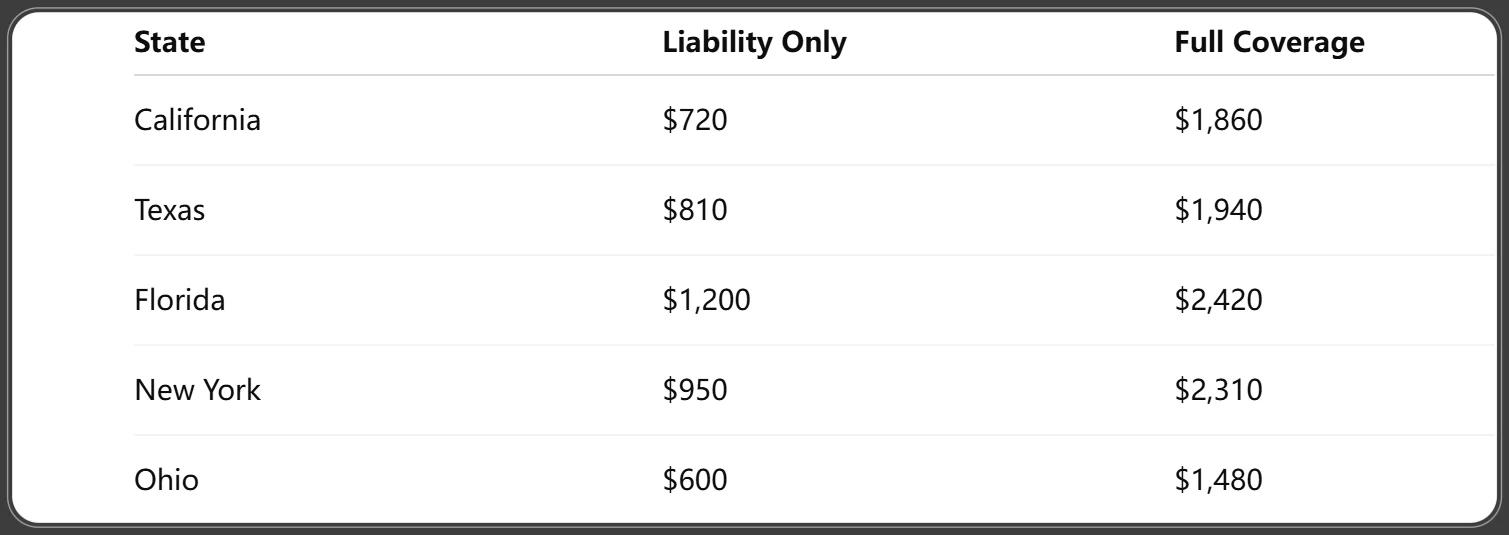

As of 2025, the average annual cost of full coverage in the U.S. is around $1,880, while liability-only coverage costs about $860.

Cost Comparison by State

PropertyCasualty360. (2025, April 14). NAIC: Top auto insurers of 2025 [Web article].

Factors That Impact Your Premium

- Age and driving history

- Vehicle make/model

- Zip code (urban vs rural)

- Credit score

- Claims history

- Deductible chosen

Who Should Consider Full Coverage?

New or Leased Vehicle Owners

If your car is new or financed, your lender or lease agreement will likely require full coverage to protect their investment.

Drivers in High-Theft or High-Risk Areas

Live in a city with a high accident or crime rate? Comprehensive and collision provide essential protection.

Young or Inexperienced Drivers

Teens and young adults face higher accident risks, making full coverage a wise investment.

Those With Limited Savings

If you can't afford to replace your car out of pocket, full coverage ensures you're not left stranded financially.

Who Might Not Need Full Coverage?

Older Vehicles With Low Market Value

If your car is worth less than $3,000–$4,000, the payout from a total loss may not justify the cost of full coverage.

Drivers With Emergency Funds

If you can self-insure (i.e., pay for repairs or a new car yourself), you might choose to skip full coverage.

High Deductible Preference

Opting for a high deductible can reduce your premium, but also means you’re assuming more risk—evaluate your comfort level.

Pros and Cons of Full Coverage Car Insurance

Benefits of Full Coverage

- Peace of mind from financial protection

- Protects both your liability and your vehicle

- Required for most leases and auto loans

Drawbacks to Consider

- Higher premiums

- May not be worth it for older cars

- Still doesn’t cover mechanical breakdowns

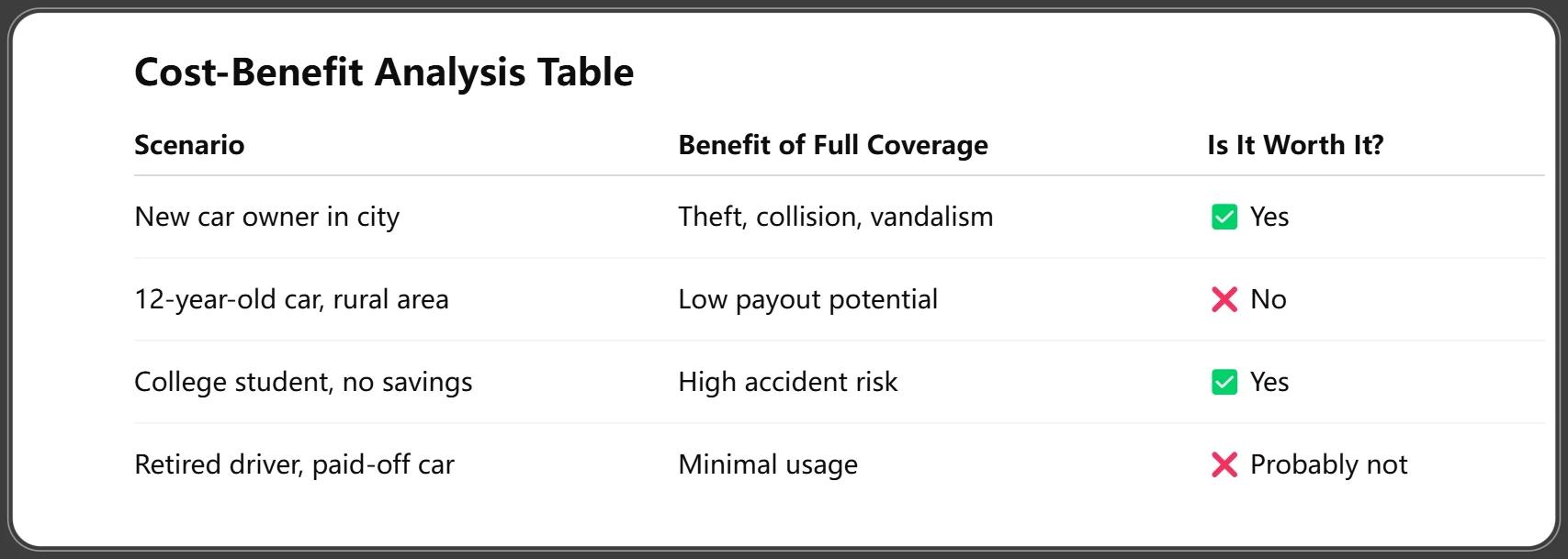

Cost-Benefit Analysis Table

Insurance Research Council. (2025, March 27). Personal Auto Insurance Affordability: Countrywide Trends and State Comparisons [Research Brief].

Real-World Examples and Case Scenarios

Example 1 – New Car in Urban Area

Michael just bought a 2024 Toyota Camry in downtown Chicago. With frequent traffic and a high theft rate, full coverage protects his $30,000 investment.

Example 2 – 10-Year-Old Vehicle in Rural Town

Susan drives a 2013 Honda Civic in a quiet town. The vehicle is worth $2,200. Her premium for full coverage is $1,100/year—not worth it.

Example 3 – First-Time Driver in College

Jake, 19, is a student with no driving history. His risk profile is high, so full coverage gives him protection while building his insurance record.

Full Coverage Misconceptions Debunked

“Full Coverage Covers Everything” Myth

It does not include mechanical failures, routine maintenance, or personal belongings inside the vehicle.

Misunderstanding Deductibles

Even with full coverage, you’ll still have to pay your deductible before insurance kicks in—often $500 to $1,000.

Coverage Gaps You Didn’t Expect

- No coverage if you use your car for commercial use (Uber, delivery) unless you buy specific add-ons.

- Towing limits or rental coverage are not standard.

How to Lower the Cost of Full Coverage

Safe Driving Discounts

Maintain a clean record to qualify for up to 25% in savings.

Increasing Your Deductible

Raising your deductible from $500 to $1,000 can cut your premium by 10–15%.

Telematics and Usage-Based Programs

Apps like Progressive’s Snapshot or State Farm’s Drive Safe & Save track your driving and reward safe habits.

Bundling Policies

Combine auto with home or renters insurance for multi-policy discounts.

Comparing Full Coverage Quotes Effectively

What to Look for in the Fine Print

- Coverage limits

- Exclusions (especially natural disasters or floods)

- Rental car terms

Using Online Comparison Tools

Platforms like The Zebra, Gabi, and Compare.com let you compare multiple quotes quickly.

Talking to an Insurance Agent

If your needs are complex, an independent agent can help you customize coverage without overspending.

Alternatives to Full Coverage Insurance

Liability + Comprehensive Only

Skip collision if your car’s value is low, but keep comprehensive for non-collision risks.

Pay-Per-Mile Insurance

For low-mileage drivers, insurers like Metromile and Mile Auto offer cost-effective plans.

Self-Insurance for Older Cars

Set aside money in an emergency fund instead of paying for collision or comprehensive on an old car.

Frequently Asked Questions

Does full coverage cover engine damage?

No. Mechanical failures or wear and tear are not covered unless caused by a covered incident.

Can I drop full coverage at any time?

Yes, but if you’re financing or leasing your vehicle, you may violate your contract.

Is full coverage required by law?

No. Only liability is required by law. Full coverage is optional but often required by lenders.

Will full coverage pay off my loan if I total my car?

Not entirely. You may need gap insurance to cover the difference between your loan balance and the car’s value.

What’s the cheapest way to get full coverage?

- Increase your deductible

- Use telematics programs

- Bundle policies

- Ask for every discount available

Does my deductible apply to all parts of full coverage?

No. Deductibles typically apply to collision and comprehensive claims, not liability.

Conclusion: Is Full Coverage Worth the Extra Cost for You?

The decision to get full coverage depends on your vehicle’s value, risk profile, and financial situation. For new, financed, or valuable vehicles, it’s usually worth the extra cost. But if you’re driving an older car or have a strong emergency fund, liability coverage may be all you need.

Evaluate your situation, compare quotes, and never assume one-size-fits-all when it comes to insurance. With the right approach, you can protect your vehicle without overpaying.

You Might Also Like

Top 10 Best Car Insurance Companies Reviewed (2025 Edition) – Expert Rankings & Comparisons

Jul 29, 2025Compare Car Insurance: A Step‑by‑Step Guide to Finding the Right Policy (Expert 2025 Update)

Jul 29, 2025Maximize Your Savings: 17 Car Insurance Discounts and How to Qualify in 2025

Jul 28, 20252025 How to Find the Best Car Insurance Near You

Jul 28, 20252025 Car Insurance Guide for Young Drivers: Actionable Tips to Lower Your Rates

Jul 28, 2025