Top 10 Best Car Insurance Companies Reviewed (2025 Edition) – Expert Rankings & Comparisons

Published on July 29, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

Top 10 Best Car Insurance Companies Reviewed (2025 Edition) – Expert Rankings & Comparisons

Finding reliable car insurance is no longer just about price—it’s about trust, value, customer service, and coverage that works when you need it most. In this in-depth review, we present the Top 10 Best Car Insurance Companies Reviewed (2025 Edition) to help you make an informed decision this year. Whether you’re a new driver or switching providers, this guide offers expert comparisons, customer insights, and everything you need to choose the right policy confidently.

Why Choosing the Right Car Insurance Company Matters

Coverage You Can Rely On

The right insurer doesn’t just save you money—it protects your car, your wallet, and your future. A top-rated company ensures that when an accident occurs, you’re supported every step of the way.

Claims Satisfaction and Speed

One of the biggest deal-breakers for policyholders is how an insurer handles claims. Top providers deliver fast, fair, and stress-free claims processes, backed by responsive support teams.

Discounts and Affordability

Today’s best companies offer custom discounts based on safe driving, bundling, usage, and even job affiliations—making premiums far more affordable.

Evaluation Criteria for Ranking the Top Insurance Companies

To create this trusted 2025 ranking, we used the following criteria:

Financial Strength and Stability

A company must be financially capable of paying claims in the event of widespread disasters or high claim volumes. We consulted ratings from AM Best, Moody’s, and S&P.

Customer Service and Claims Support

We analyzed J.D. Power’s 2024 customer satisfaction surveys, BBB reviews, and Trustpilot ratings to evaluate how companies treat policyholders.

Policy Options and Flexibility

From basic liability to full coverage with extras like gap protection or rideshare coverage, top insurers offer flexible packages for every lifestyle.

Affordability and Discounts

We compared national premium averages and evaluated the availability of discounts like safe driver, multi-policy, low mileage, and telematics-based savings.

Digital Tools and Mobile App Experience

In 2025, your insurer should offer user-friendly apps, online quote tools, and digital claims filing for a smooth experience.

Top 10 Car Insurance Companies in 2025

#1 – State Farm

- Best For: Overall value and local agent support

- Strengths: Extensive agent network, reliable claims service, student and safe driver discounts

- Mobile App: State Farm Drive Safe & Save

- AM Best Rating: A++

#2 – GEICO

- Best For: Budget-conscious drivers

- Strengths: Low premiums, great mobile app, fast online quotes

- Mobile App: GEICO Mobile

- AM Best Rating: A++

#3 – Progressive

- Best For: High-risk or non-standard drivers

- Strengths: Snapshot usage-based program, flexible payment options

- Mobile App: Progressive App

- AM Best Rating: A+

#4 – Allstate

- Best For: Comprehensive digital experience

- Strengths: Drivewise telematics, wide coverage options, strong online tools

- Mobile App: Allstate Mobile

- AM Best Rating: A+

#5 – USAA (For Military Families)

- Best For: Military personnel and veterans

- Strengths: Exceptional customer service, competitive rates

- Eligibility: Limited to military families

- AM Best Rating: A++

#6 – Liberty Mutual

- Best For: Customizable coverage

- Strengths: Add-ons like accident forgiveness, new car replacement

- Mobile App: Liberty Mutual Mobile

- AM Best Rating: A

#7 – Farmers Insurance

- Best For: Bundling with home and life

- Strengths: Multiple discount layers, solid claims handling

- Mobile App: Farmers Mobile

- AM Best Rating: A

#8 – Nationwide

- Best For: Older drivers and retirees

- Strengths: SmartRide rewards, financial stability

- Mobile App: Nationwide App

- AM Best Rating: A+

#9 – Travelers

- Best For: Multi-policy and renters insurance combos

- Strengths: Strong discounts, dependable service

- Mobile App: MyTravelers

- AM Best Rating: A+

#10 – American Family Insurance

- Best For: Midwestern drivers

- Strengths: Great for young families and students, robust policy options

- Mobile App: MyAmFam

- AM Best Rating: A

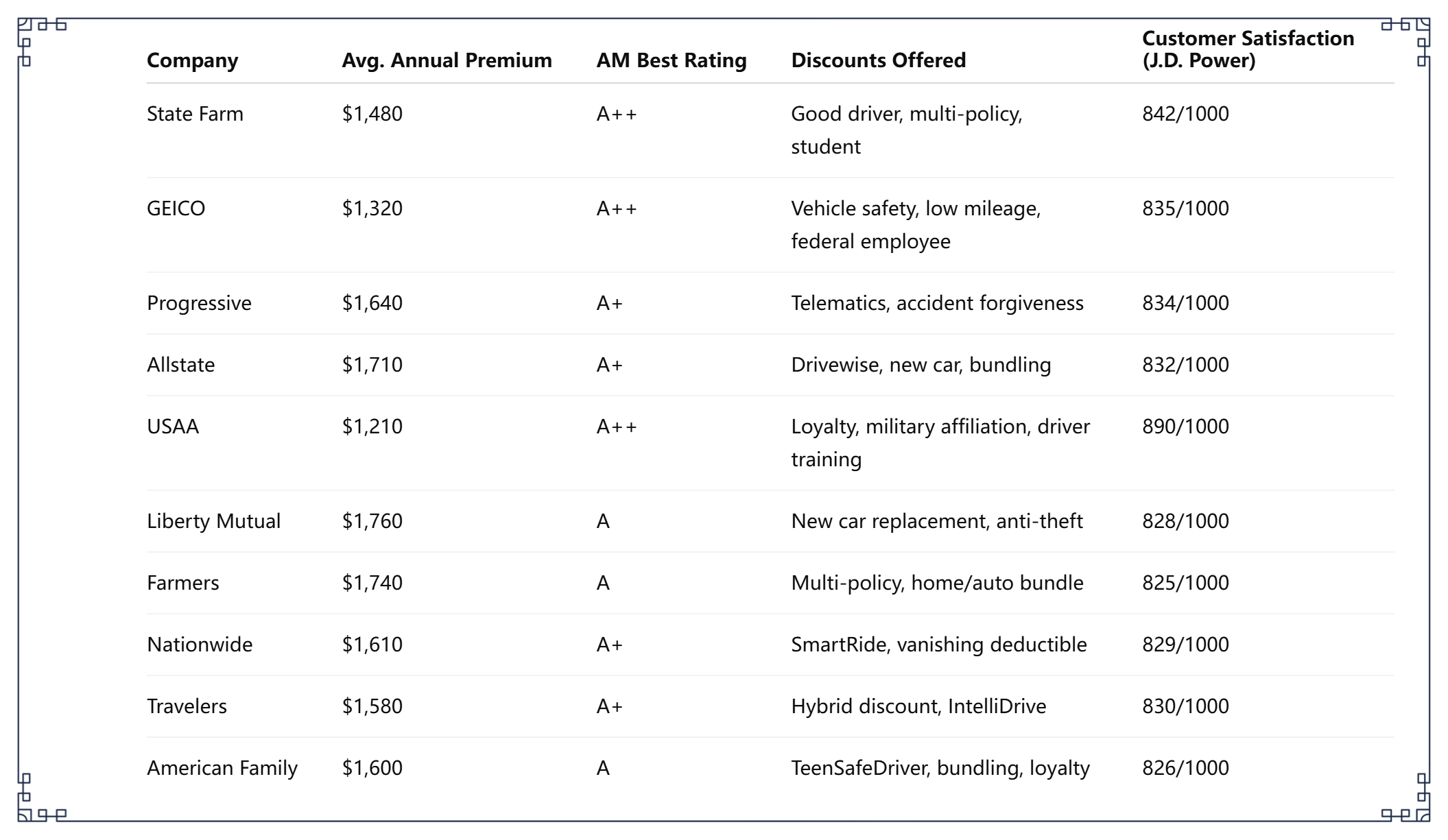

Detailed Comparison Table: Coverage, Discounts & Ratings

ValuePenguin (LendingTree). (2025, January 7). The State of Auto Insurance in 2025: Rate increases are slowing down in 2025 [Press release].

Best Car Insurance by Category (2025 Picks)

- Young Drivers: GEICO, American Family

- Families: State Farm, Farmers

- Seniors: Nationwide, Liberty Mutual

- Low-Mileage Drivers: Travelers, Progressive

- High-Risk Drivers: Progressive, The General (Honorable Mention)

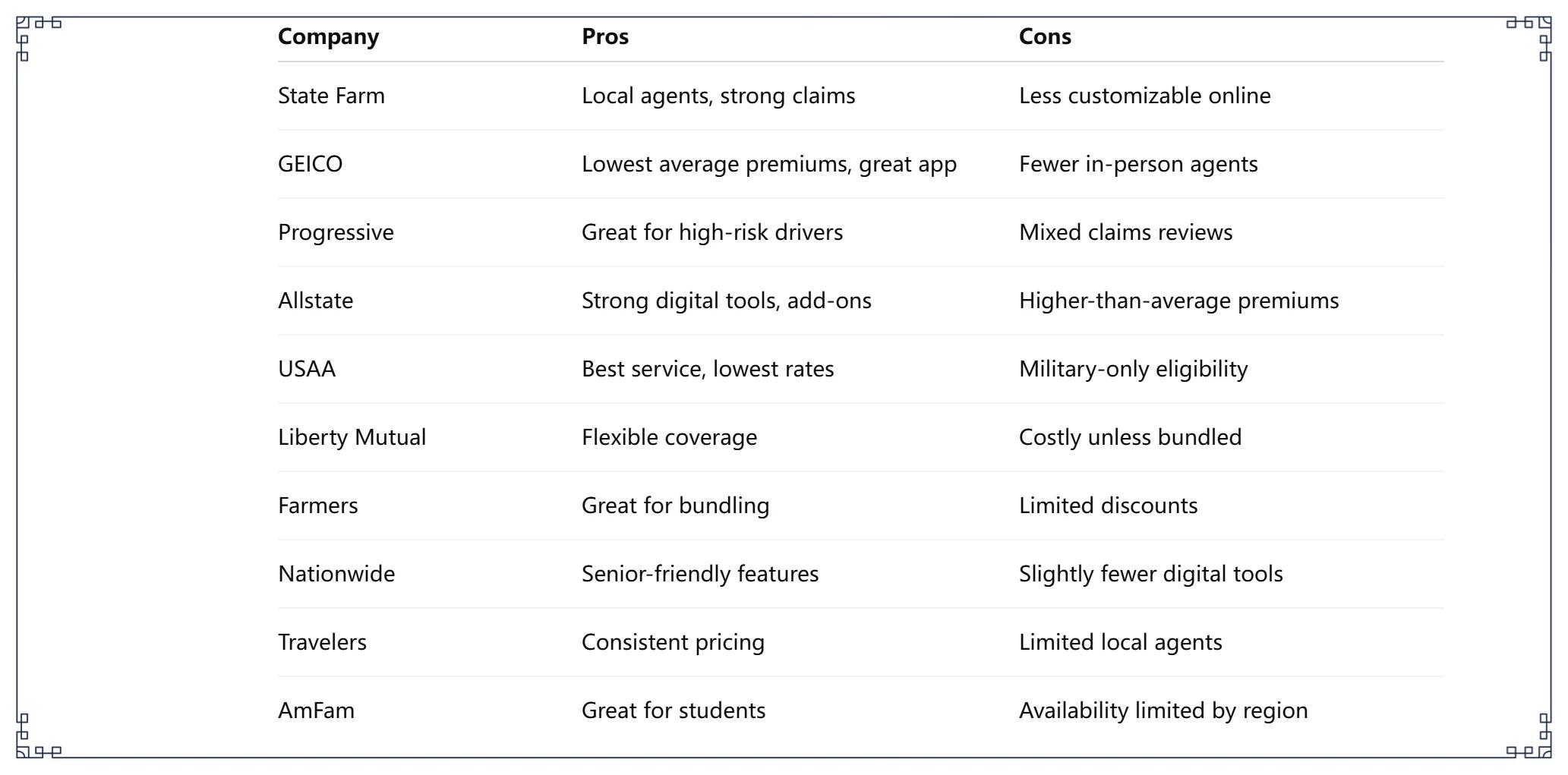

Pros and Cons of Each Top-Ranked Insurer

Each provider shines in its own way. Here’s a quick snapshot:

ValuePenguin (LendingTree). (2025, July 8). State of Auto Insurance in 2025 [Web report].

What Customers Say – Real Reviews and Testimonials

Trustpilot and BBB Feedback

- State Farm: “They helped me after my accident within hours. Agent was kind and responsive.”

- GEICO: “Best prices year after year. Easy claims via app.”

- USAA: “Hands down the best insurer for military. Fast, fair, and trustworthy.”

Positive Trends Across Providers

- Great apps and digital experiences (GEICO, Progressive, Allstate)

- Reliable claims processing (State Farm, USAA)

- Responsive customer support (Farmers, Nationwide)

Common Complaints

- Premium hikes after one claim (Progressive, Liberty Mutual)

- Limited local agent access (GEICO, Travelers)

How to Choose the Right Insurer for Your Needs

Matching Coverage with Lifestyle

Do you commute 60 miles daily or drive once a week? Own a luxury car or a used sedan? Match your coverage accordingly.

Budgeting for Premiums and Deductibles

Choose the highest deductible you can afford to save on premiums—but ensure you can pay it when needed.

Checking for Eligibility and Discounts

Always ask: “What discounts do I qualify for?” You might be surprised how many you can stack.

How to Switch Car Insurance Providers Without Gaps

Steps to Take Before Switching

- Compare identical coverages.

- Get your new policy set to activate on the cancellation date.

- Print and save confirmation emails.

Avoiding Cancellation Fees

Some insurers charge $25–$50 for early cancellation. Ask about this before making changes.

Getting a Refund for Unused Premiums

If you’ve prepaid your premium, you’re typically entitled to a prorated refund when switching.

Frequently Asked Questions

Who has the cheapest car insurance in 2025?

GEICO and USAA (for military) have the lowest average premiums.

Which insurer has the best claims service?

USAA, State Farm, and Nationwide consistently score highest for claims satisfaction.

Is online car insurance reliable?

Yes. Just make sure to compare on trusted platforms and verify coverage matches.

What coverage do most people need?

Liability plus collision and comprehensive is common. Add extras like roadside assistance as needed.

Can I qualify for more than one discount?

Absolutely. Most drivers qualify for 2–5 discounts, which can be stacked.

Should I get a local or national provider?

Local agents can offer personalized service, while national brands often offer better apps and tools.

Conclusion: Choose the Right Insurance Partner in 2025

The best car insurance company is the one that fits your driving habits, budget, and lifestyle—not just the one with the lowest price. Use this list of the Top 10 Best Car Insurance Companies Reviewed (2025 Edition) to narrow down your options, get quotes, and make the smartest choice for you and your family. The road ahead is safer when you're covered by the right insurer.

You Might Also Like

Full Coverage Car Insurance: Is It Worth the Extra Cost? (2025 Breakdown)

Jul 29, 2025Compare Car Insurance: A Step‑by‑Step Guide to Finding the Right Policy (Expert 2025 Update)

Jul 29, 2025Maximize Your Savings: 17 Car Insurance Discounts and How to Qualify in 2025

Jul 28, 20252025 How to Find the Best Car Insurance Near You

Jul 28, 20252025 Car Insurance Guide for Young Drivers: Actionable Tips to Lower Your Rates

Jul 28, 2025