Health Insurance After Job Loss 2025: Best Options, New Rules, and How to Stay Covered

Published on August 6, 2025

Alex Thompson

Insurance Data Analyst & Content Strategist

Alex Thompson analyzes insurer data and market trends to produce objective rate comparisons, annual cost studies, and interactive saving guides.

Introduction: Why Losing Job-Based Insurance in 2025 Is a Big Deal

Losing a job is stressful—but losing your health insurance at the same time can make things even more overwhelming. In 2025, employer-sponsored health insurance still covers nearly 50% of working Americans, so a job loss usually means an immediate end to coverage.

The good news? You have multiple affordable options to stay insured—even if you're unemployed. Thanks to updates in the Affordable Care Act (ACA), expanded subsidies, and Medicaid, many individuals and families can now access low- or no-cost coverage within days of losing a job.

What Happens to Your Health Insurance When You Lose Your Job?

When you're laid off or voluntarily leave a job, your employer-sponsored health insurance typically ends on your last day or the end of that month—depending on your company’s policy.

Here’s what usually happens:

- You receive a COBRA notice within 14 days, offering you the chance to keep your plan.

- You qualify for a Special Enrollment Period (SEP) on the HealthCare.gov marketplace or your state’s exchange.

- Your Flexible Spending Account (FSA) or Health Savings Account (HSA) remains yours, but with some limitations.

It’s important to act fast—especially within the 60-day SEP window—to avoid a gap in coverage.

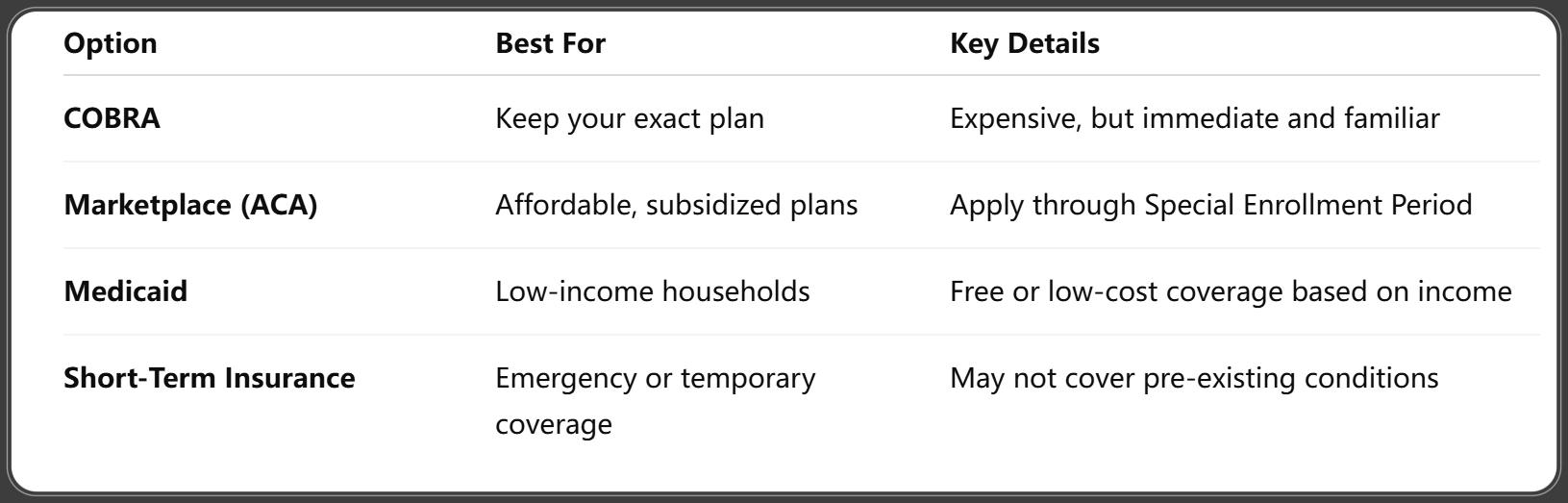

Your Immediate Options for Health Insurance After Job Loss

When you lose your job, you typically have four main paths for health coverage in 2025:

Connecticut Insider. (2025, August). Opinion: ACA funding changes jeopardize thousands in Connecticut. Retrieved August 2025.

Understanding COBRA in 2025

COBRA (Consolidated Omnibus Budget Reconciliation Act) allows you to continue your employer’s health plan for up to 18 months after job loss. However, it’s expensive—you pay the full premium plus a 2% administrative fee.

Pros:

- Immediate coverage continuity

- Keep your doctors, deductibles, and benefits

Cons:

- Costs 2–3 times more than you paid while employed

- No subsidies or financial assistance

When to choose COBRA: If you’re in the middle of treatment, pregnant, or have complex healthcare needs, and can afford it.

ACA Marketplace Coverage After Job Loss

Thanks to the ACA, you qualify for a Special Enrollment Period (SEP) when you lose your job. This gives you 60 days to shop for a new plan on HealthCare.gov or your state’s marketplace.

Why ACA Plans in 2025 Are a Game Changer:

- Subsidies (Premium Tax Credits) are bigger than ever.

- Many people pay $10/month or less for Silver-tier plans.

- You may also qualify for Cost Sharing Reductions (CSRs) that lower out-of-pocket expenses.

You can also estimate your expected income for the year to calculate your savings.

Medicaid and CHIP Options After Job Loss

If your income drops significantly after losing your job, you may qualify for Medicaid—a public health insurance program designed for low-income individuals and families.

Who Qualifies for Medicaid in 2025?

- Income below 138% of the Federal Poverty Level (FPL) in Medicaid expansion states.

- Children and pregnant individuals usually qualify at higher income levels.

- States that expanded Medicaid (through ACA) offer broader eligibility, while others may have stricter rules.

For families with children, the Children’s Health Insurance Program (CHIP) is another great option, often providing low- or no-cost coverage with dental, vision, and pediatric care.

How to Apply:

- Visit HealthCare.gov or your state’s Medicaid website.

- Coverage may begin retroactively up to 3 months before the application if eligible during that time.

New Changes to Health Insurance Rules in 2025 for the Unemployed

Several recent federal updates have made coverage after job loss more accessible and affordable than ever before:

✅ Key Updates in 2025:

- Extended subsidies from the American Rescue Plan continue, allowing people earning up to 600% of the FPL to get tax credits.

- Zero-premium Silver plans now available to many unemployed Americans.

- The “family glitch” fix enables dependents to receive PTCs even if one household member has employer coverage.

- Improved automatic enrollment tools ensure no one unintentionally goes uninsured.

These changes dramatically reduce monthly premiums and improve access for workers in transition.

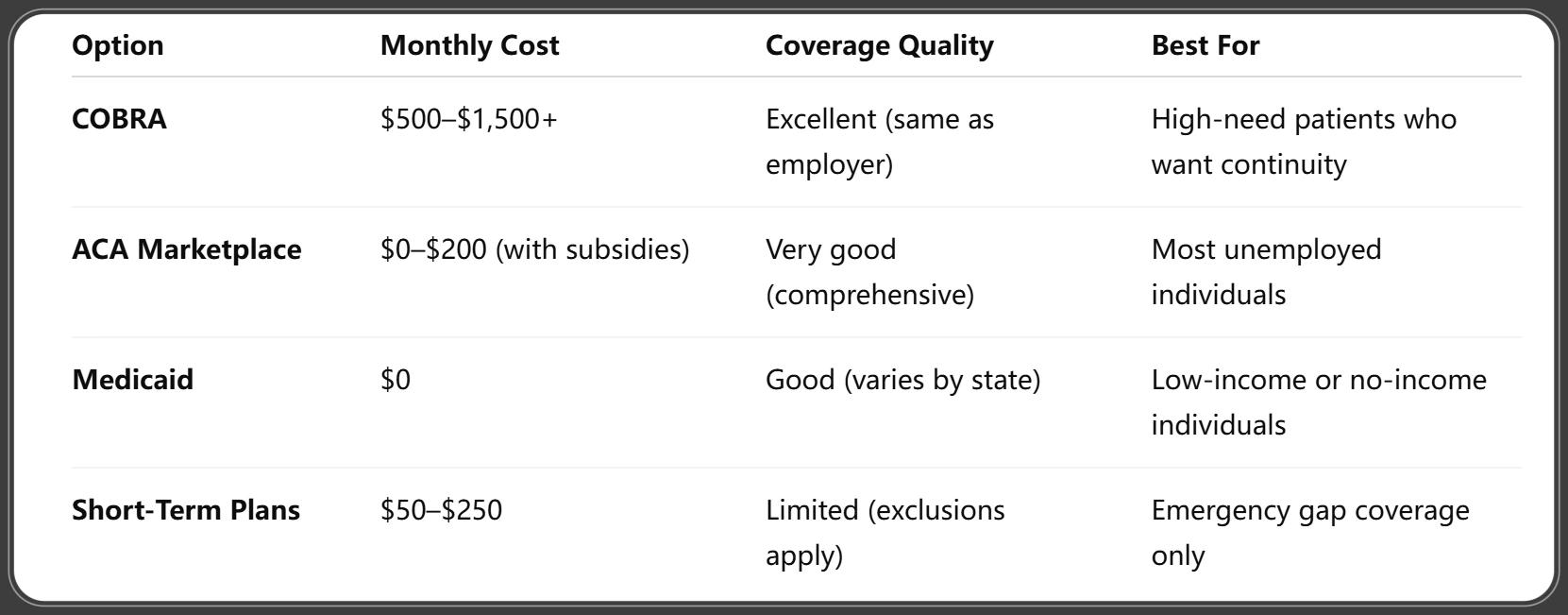

Comparing Health Insurance Options Side by Side

Here’s a comparison of your main options for health insurance after job loss in 2025:

MarketWatch. (2025, January). As UnitedHealth shooting puts health insurance in focus... Retrieved January 2025.

Always evaluate cost, network, coverage limits, and duration before deciding.

Timing Is Key: Special Enrollment Period Explained

Once you lose your job (and your health coverage), you automatically qualify for a Special Enrollment Period (SEP).

What to Know:

- You have 60 days from the date your coverage ends to enroll in a new plan.

- Missing this window may leave you uninsured until the next Open Enrollment Period (typically in November).

- SEP is available only once per qualifying event, so act promptly.

How to Estimate Your New Income for Subsidy Calculations

Your eligibility for ACA subsidies (Premium Tax Credits) is based on your Modified Adjusted Gross Income (MAGI)—which can be tricky after job loss.

Steps to Estimate:

- Add unemployment benefits, freelance income, rental income, and other sources.

- Subtract allowed deductions like student loan interest or HSA contributions.

- Use marketplace calculators to preview subsidies.

Pro Tip: Always report income updates to avoid repayment surprises during tax season.

Health Insurance for Freelancers and Gig Workers Post-Job Loss

If you’ve started freelancing or driving for a rideshare company after your job loss, you’re considered self-employed—and still eligible for ACA plans.

Benefits for Gig Workers:

- Can claim business deductions to reduce income and increase subsidies.

- Choose plans tailored to variable income and flexible coverage needs.

- Some states offer freelancer health insurance programs with negotiated rates.

Short-Term and Temporary Plans: Pros and Cons in 2025

Short-term plans are meant to bridge gaps in coverage, but they’re not for everyone.

Pros:

- Lower premiums.

- Immediate coverage in most cases.

Cons:

- Often exclude pre-existing conditions.

- May have caps on coverage or exclude maternity/mental health.

Only use short-term plans if you are ineligible for ACA, COBRA, or Medicaid and need stopgap coverage for a brief period.

Health Insurance for Spouses and Dependents After Job Loss

When you lose your job, your family could also lose their coverage—unless you plan ahead.

Here Are Your Options:

- Join a spouse’s employer-sponsored plan: Losing your own coverage is a qualifying event, allowing you to be added to your spouse’s plan within 30 days.

- Enroll dependents in CHIP or Medicaid: Children often qualify for coverage even if the parent does not.

- Marketplace family plans: You can enroll the entire family under one ACA plan, with subsidies based on total household income.

It’s crucial to coordinate benefits and compare total out-of-pocket costs, especially if your spouse’s plan has high premiums or limited coverage.

Real-World Scenarios: Making the Right Choice Post-Employment

Scenario 1: Jen, Age 29, Single, Recently Laid Off

Jen lost her hospitality job and expects to earn $20,000 for the rest of the year through gig work. She qualifies for an ACA Silver plan at $0/month thanks to the premium tax credit and reduced deductibles via Cost Sharing Reductions.

Scenario 2: Mike & Anna, Married with Kids

Mike lost his tech job, and Anna works part-time. Their household income drops to $55,000. They qualify for $1,000/month in ACA subsidies, covering most of their family plan costs. Their kids are eligible for CHIP at low or no cost.

Scenario 3: Bill, 60, Pre-Retirement

Bill is retiring early and won’t qualify for Medicare for five more years. He’s living off savings and estimates $35,000 in taxable income. With subsidies, he secures a Gold-tier ACA plan for $90/month, with low deductibles.

These examples show how individuals and families across income levels and ages can strategically use ACA, CHIP, and Medicaid after a job loss.

Avoiding Common Mistakes When Switching Plans

Making hasty or uninformed decisions can lead to gaps in coverage or excessive out-of-pocket costs.

Top Mistakes to Avoid:

- Missing the Special Enrollment Period (60-day window).

- Overpaying for COBRA when ACA offers a better deal.

- Not updating your income, leading to tax repayments.

- Failing to compare provider networks, causing you to lose access to your doctors.

- Relying on short-term plans that don't cover essential services.

Take time to compare options, and seek help if you're unsure.

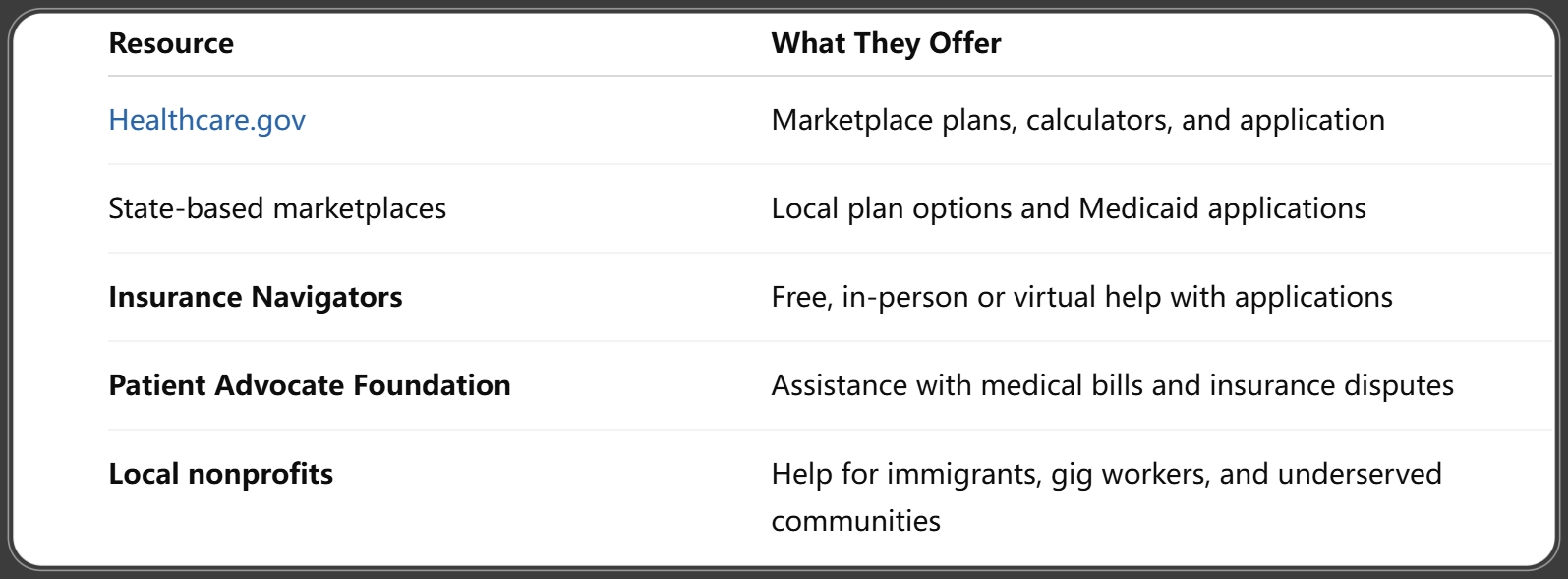

Resources to Help You Choose and Apply for a New Plan

Whether you're looking for financial help or need guidance, there are free resources to assist with the process.

Capgemini. (2025). Top 10 Health Insurance Industry Trends 2025. Retrieved 2025.

These tools can make the transition to new coverage smoother and less stressful.

FAQs About Health Insurance After Job Loss in 2025

Q1: How long do I have to enroll in a new plan after losing my job?

A1: You have 60 days from the date your coverage ends to enroll through the ACA marketplace.

Q2: Is COBRA my only option?

A2: Not at all. COBRA is one of several options—you may qualify for cheaper plans via ACA or Medicaid.

Q3: What if I only lost part of my income?

A3: You may still qualify for reduced premiums through ACA based on your new estimated annual income.

Q4: Can I get coverage for my children even if I don’t qualify for subsidies?

A4: Yes. CHIP or Medicaid often covers children at higher income levels than adults.

Q5: Does unemployment income count toward ACA eligibility?

A5: Yes. All taxable income, including unemployment, is factored into your Modified Adjusted Gross Income (MAGI).

Q6: Can I go without coverage for a few months?

A6: While it’s possible, it’s risky. Even a short gap can lead to unexpected medical bills or a coverage denial if you later need immediate care.

Conclusion: Staying Insured, Even Between Jobs

Losing your job doesn’t mean you have to go uninsured. With the right information and timing, you can find affordable, comprehensive health coverage that protects you and your family through your transition.

In 2025, expanded ACA subsidies, Medicaid flexibility, and improved tools make it easier than ever to stay covered, reduce your premiums, and protect your health. The key is to act quickly, explore every option, and stay informed.

You Might Also Like

Health Insurance for Babies 2025: Best Coverage Options, Enrollment Tips & Newborn Benefits Explained

Aug 6, 2025Health Insurance Premium Tax Credit 2025: Maximize Savings with These New Rules

Aug 6, 2025Health Insurance for Pre-existing Conditions 2025: New Rules, Better Coverage & What You Need to Know

Aug 6, 2025Top 17 Groundbreaking Health Insurance Trends 2025: What You Need to Know

Aug 6, 2025Health Insurance Waiting Period 2025: What You Must Know Before Enrolling

Jul 31, 2025