Health Insurance for Babies 2025: Best Coverage Options, Enrollment Tips & Newborn Benefits Explained

Published on August 6, 2025

Alex Thompson

Insurance Data Analyst & Content Strategist

Alex Thompson analyzes insurer data and market trends to produce objective rate comparisons, annual cost studies, and interactive saving guides.

Welcoming a baby into the world is a joyful experience—but it also brings a flood of responsibilities, including ensuring your newborn is protected with reliable health insurance. In 2025, medical costs continue to rise, and having coverage from day one can save families thousands of dollars.

From hospital care and immunizations to pediatric checkups and emergency visits, your baby needs access to care—immediately after birth. Fortunately, U.S. laws support early enrollment through Special Enrollment Periods (SEPs) and offer a range of affordable options, even for families without employer-sponsored coverage.

When and How to Add a Baby to Health Insurance in 2025

A baby’s birth is considered a qualifying life event, which means you’re eligible for a Special Enrollment Period to add your child to a health plan.

Key Deadlines:

- Employer Plans: Usually 30 days to add your baby.

- ACA Marketplace Plans: You get 60 days from birth to enroll or update your plan.

Steps to Add Your Baby:

- Notify your insurer or HR department immediately after the birth.

- Provide documentation (birth certificate or hospital paperwork).

- Select the right plan (upgrade from individual to family if needed).

- Check when coverage starts—many plans retroactively cover the baby from the birth date.

Act quickly to avoid coverage gaps or claim denials.

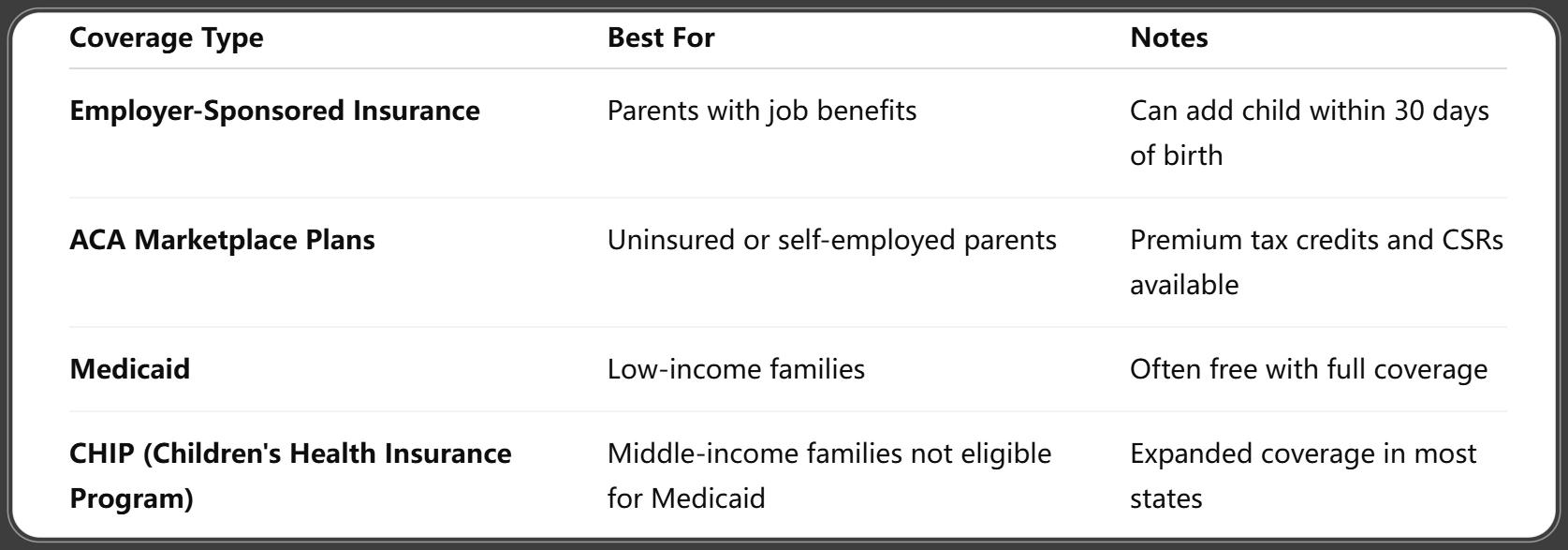

Coverage Options for Babies in 2025

Parents have several options when choosing health insurance for their newborn:

Centers for Medicare & Medicaid Services. (2025, May). Medicaid & CHIP Enrollment Data Highlights: May 2025. Retrieved August 29, 2025.

Each has different rules, premiums, and benefits—so comparing options is key.

What Does Health Insurance Cover for Newborns?

Whether through private insurance or public programs, health coverage for babies in 2025 includes:

- Hospital stay and delivery-related costs

- Newborn screenings

- Routine well-baby visits

- Immunizations (vaccines)

- Sick visits and emergency care

- Developmental monitoring

Under the ACA’s essential health benefits, all compliant plans must cover these services without charging extra copays or deductibles for preventive care.

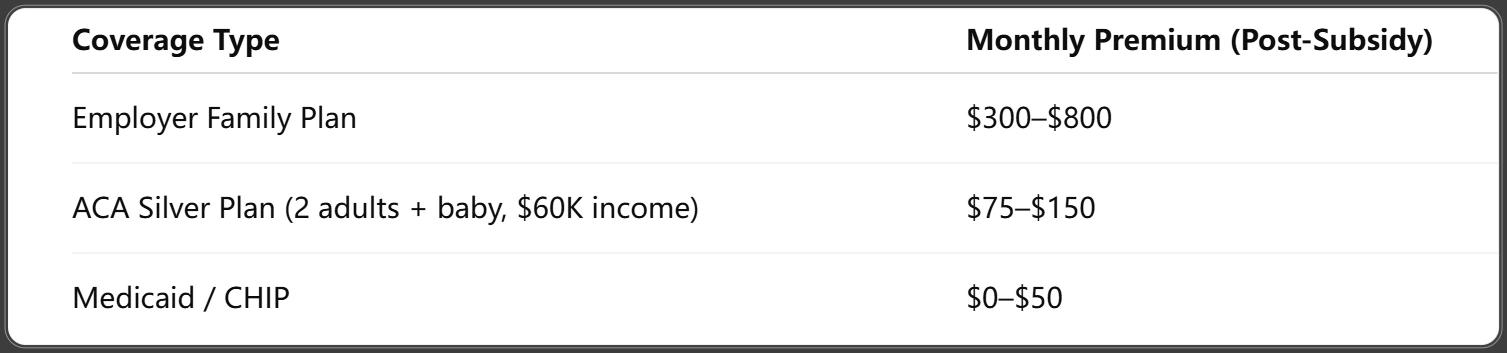

The Cost of Adding a Baby to Health Insurance

Adding a baby to your health insurance may increase your monthly premium, but the peace of mind and protection are well worth it.

Cost Factors Include:

- Plan Tier: Bronze, Silver, Gold, or Platinum plans vary in premiums and deductibles.

- Employer vs ACA Marketplace: Employer plans may charge a set “family rate,” while ACA plans adjust based on household income and age.

- Subsidies: Many families qualify for premium tax credits or cost-sharing reductions that lower costs significantly.

Example Cost Range:

Commonwealth Fund. (2025, June 18). 2025 Scorecard on State Health System Performance. Retrieved June 18, 2025.

Pro tip: Always compare total cost of care (not just premiums), including deductibles, copays, and max out-of-pocket limits.

Special Enrollment Period (SEP) for Newborns

The birth of a child automatically triggers a Special Enrollment Period (SEP), which gives you a limited window to enroll the baby in health insurance.

Important SEP Rules for 2025:

- ACA Marketplace: 60 days to enroll or update your plan.

- Employer Plans: Usually limited to 30 days from the date of birth.

- Coverage is retroactive to the baby’s date of birth when applied for during the SEP window.

Missing the deadline could mean your baby goes uninsured until the next Open Enrollment Period, which could result in denied claims or high medical bills.

Medicaid and CHIP for Babies in 2025

Both Medicaid and the Children’s Health Insurance Program (CHIP) offer vital options for covering infants at little to no cost.

Medicaid Eligibility (2025):

- Household income below 138% of the Federal Poverty Level (FPL)

- Varies by state; some cover pregnant women and babies up to 300% FPL

- Offers comprehensive coverage: doctor visits, hospital care, prescriptions, dental, and vision

CHIP Highlights:

- Available in all 50 states

- For families earning too much for Medicaid, but still needing affordable care

- Low or no premiums with no deductibles or copays for preventive care

Parents can apply through their state’s Medicaid agency or HealthCare.gov, and many receive immediate approval for newborns.

ACA Marketplace Plans for Newborns

If you’re not eligible for Medicaid and don’t have job-based insurance, the ACA Marketplace provides robust, subsidized options.

Key Benefits:

- Coverage starts from the baby’s birthdate (if enrolled during SEP).

- Premium tax credits are based on estimated household income.

- You can select family coverage tiers, and switching from an individual to a family plan is allowed mid-year.

Example: A family of three making $55,000 in 2025 may qualify for a $900/month tax credit, reducing their plan cost to under $150/month.

Employer Health Plans and Adding a Newborn

If you have employer-sponsored insurance, adding your newborn usually means moving from employee-only to employee + family coverage.

Steps to Take:

- Notify HR within 30 days of the birth.

- Submit a birth certificate or hospital proof of birth.

- Understand your new premium tier—family coverage typically costs more.

Most group health plans will cover:

- Well-child visits

- Vaccinations

- Emergency services

- Developmental screenings

Choosing the Best Pediatrician Covered by Your Plan

Selecting a pediatrician is one of the first important healthcare decisions you'll make for your child.

How to Choose:

- Use your insurer’s online provider directory to find in-network pediatricians.

- Ask your OB-GYN or hospital for referrals.

- Check ratings on health websites and read parent reviews.

- Confirm the provider’s office is accepting new patients—many pediatricians fill up quickly.

Dental and Vision Coverage for Babies

While dental and vision coverage for infants might not seem urgent, these services are increasingly included in pediatric health plans under the ACA.

What’s Covered in 2025:

- Dental: Oral health assessments by age 1, fluoride treatments, and basic dental care

- Vision: Eye screenings during well-child visits, glasses if needed (depending on the plan)

All ACA-compliant marketplace plans must offer pediatric dental and vision either embedded in the plan or as a standalone add-on.

Medicaid and CHIP often provide more comprehensive coverage than private plans, with no copays for preventive dental and vision services.

Health Insurance for Premature or High-Risk Infants

Babies born prematurely or with medical conditions can incur massive hospital bills—especially if they require Neonatal Intensive Care Unit (NICU) services.

Why Coverage Is Critical:

- NICU stays can cost $3,000 to $10,000+ per day.

- Specialized treatments (surgeries, ventilation, feeding tubes) are essential but costly.

- Ongoing needs like physical therapy, home monitoring, and early intervention services must be covered.

Most ACA and employer-sponsored plans fully cover NICU stays, provided the baby is enrolled in time. Medicaid and CHIP also offer full coverage for high-risk infants, including follow-up care and specialists.

Important Tip: If you expect a high-risk delivery, contact your insurer ahead of time to understand your plan’s NICU network and coverage policies.

What Happens If You Miss the Enrollment Window?

Failing to enroll your newborn within the required timeframe can result in denied claims, uncovered services, and unpaid medical bills.

If You Miss the Deadline:

- You may have to wait until Open Enrollment to add your baby to a plan.

- Some insurers allow late enrollment with penalties or require proof of extenuating circumstances.

- Medicaid or CHIP may be your only immediate fallback if you qualify.

Action Step: Don’t wait for the birth certificate—most insurers accept hospital-issued documentation to process enrollment.

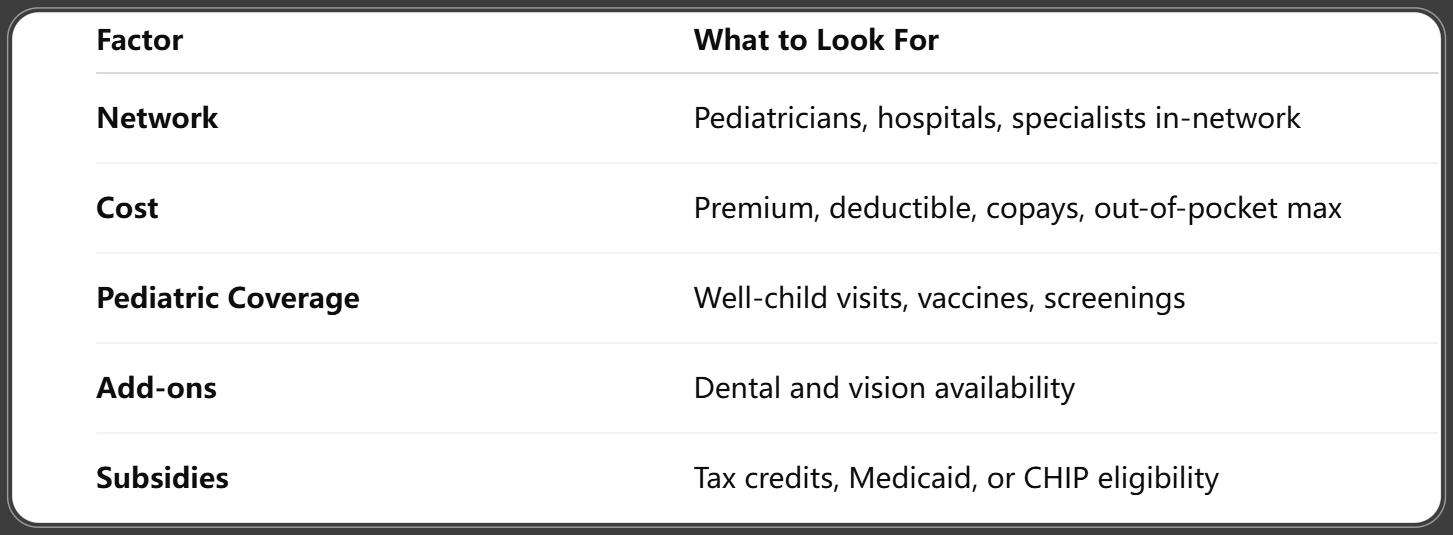

Comparing Plans: How to Choose the Best One for Your Baby

When comparing health insurance plans for your baby in 2025, consider more than just the premium. Use these criteria:

Use comparison tools on HealthCare.gov or your state exchange to see side-by-side benefit details.

Real-Life Scenarios: Coverage Stories from New Parents in 2025

Sofia & Leo, First-Time Parents with Employer Insurance

They added their daughter within 20 days of birth to Leo’s work plan. Though premiums increased by $200/month, they kept their pediatrician and had no issues with NICU coverage.

Tanya, Self-Employed Graphic Designer

Tanya used the ACA Marketplace to add her baby during the SEP. With an income of $50,000, her family qualified for a $700/month tax credit, reducing her Silver plan to just $130/month.

Mark & Elena, Low-Income Family

Their newborn qualified for CHIP in their state. They received comprehensive coverage for $0, including dental and vision, plus early developmental support for speech delays.

FAQs About Health Insurance for Babies 2025

Q1: When does a baby need to have insurance?

A1: From birth—hospital bills and pediatric care start immediately, so coverage must begin on day one.

Q2: Can I enroll my baby without a Social Security Number yet?

A2: Yes. Most insurers allow enrollment with hospital paperwork or proof of birth while you wait for the SSN.

Q3: Does Medicaid really cover all newborn care?

A3: Yes. In most states, Medicaid offers 100% coverage for medical services for eligible infants.

Q4: Can both parents list the baby on their insurance?

A4: Usually not. Only one plan can be the baby’s primary insurer. Coordination of benefits may apply if both parents have coverage.

Q5: What if my baby is born early—can I enroll them before the due date?

A5: No. Enrollment starts after birth—but coverage can be retroactive to that date if you enroll within the SEP window.

Q6: How long do I have to enroll my baby in health insurance?

A6: Typically 30 days for employer plans and 60 days for ACA marketplace plans.

Conclusion: Start Your Baby’s Life Right with Smart Coverage Choices

Bringing a new baby into the world is an emotional and financial journey—but securing health insurance for your baby in 2025 doesn’t have to be stressful. With the right information, you can choose a plan that offers:

- Comprehensive newborn care

- Affordable monthly costs

- Trusted pediatric providers

- Peace of mind for the entire family

Whether you’re covered through work, the ACA marketplace, or Medicaid, make sure to act quickly, compare plans, and enroll your baby on time.

A healthy start begins with smart planning—and nothing is more important than your baby’s first days of care.

You Might Also Like

Health Insurance After Job Loss 2025: Best Options, New Rules, and How to Stay Covered

Aug 6, 2025Health Insurance Premium Tax Credit 2025: Maximize Savings with These New Rules

Aug 6, 2025Health Insurance for Pre-existing Conditions 2025: New Rules, Better Coverage & What You Need to Know

Aug 6, 2025Top 17 Groundbreaking Health Insurance Trends 2025: What You Need to Know

Aug 6, 2025Health Insurance Waiting Period 2025: What You Must Know Before Enrolling

Jul 31, 2025