Health Insurance Premium Tax Credit 2025: Maximize Savings with These New Rules

Published on August 6, 2025

Alex Thompson

Insurance Data Analyst & Content Strategist

Alex Thompson analyzes insurer data and market trends to produce objective rate comparisons, annual cost studies, and interactive saving guides.

Introduction: Why the Premium Tax Credit Matters in 2025

As healthcare premiums continue to rise, many Americans are turning to the health insurance premium tax credit 2025 to make quality coverage affordable. Whether you're self-employed, retired early, or between jobs, this powerful subsidy can lower your monthly costs—sometimes down to $0.

In 2025, updates to eligibility thresholds and income limits mean more people qualify and can save more than ever before. Let's break down how this tax credit works, how to claim it, and what’s changed for this year.

What Is the Health Insurance Premium Tax Credit (PTC)?

The Premium Tax Credit (PTC) is a federal subsidy that helps lower-income and middle-income individuals and families pay for insurance purchased through the HealthCare.gov or a state-based marketplace.

There are two ways to receive the PTC:

- Advance Premium Tax Credit (APTC): Paid monthly directly to your insurer to reduce premiums.

- Reconciliation at Tax Time: Claim the full amount when you file your tax return, or reconcile what you received in advance with your actual income.

The tax credit ensures that Americans don’t spend more than a certain percentage of their income on health insurance premiums, based on a sliding scale.

Who Qualifies for the Premium Tax Credit in 2025?

To qualify for the PTC in 2025, you must meet the following criteria:

- Income between 100% and 400% of the Federal Poverty Level (FPL) (in some cases, above 400% under expanded rules).

- No access to affordable employer-sponsored insurance.

- U.S. citizenship or lawful presence.

- Must file a federal tax return and not be claimed as a dependent.

Eligibility is based on Modified Adjusted Gross Income (MAGI) and the number of people in your tax household.

2025 Federal Poverty Guidelines and Eligibility Table

Research on Disability. (2025, [mid-2025]). Section 9: Health Insurance Coverage – Compendium (2025). Retrieved 2025.

Note: These numbers are for the continental U.S. and subject to slight regional variations.

How to Apply for the Premium Tax Credit

Applying is simple but requires attention to detail. You can apply through:

- HealthCare.gov

- Your state’s insurance exchange (Covered California, NY State of Health, etc.)

What You'll Need:

- Estimated income for the year.

- Social Security numbers for everyone in your household.

- Immigration documents if applicable.

- Employer coverage information (if available).

Pro Tip: Use the built-in calculator on your exchange to see how much credit you’ll get before completing the application.

Monthly Advance vs Year-End Tax Reconciliation

When applying for the premium tax credit, you have two options:

1. Advance Premium Tax Credit (APTC):

Most people opt for this. The government sends the estimated monthly credit directly to your insurance provider, reducing your premium in real time.

2. Year-End Tax Credit (Reconciliation):

You can also choose to pay full premiums monthly and claim the credit on your 2025 tax return in 2026. This may result in a larger refund—but it requires more upfront cash flow.

Caution:

If your income turns out higher than estimated, you might have to repay part or all of the APTC at tax time. That’s why it’s essential to update your exchange profile any time your income or household size changes.

Changes to the Premium Tax Credit in 2025

Thanks to continued legislation and inflation adjustments, PTC rules in 2025 are even more generous:

- Enhanced subsidies from the American Rescue Plan (ARP) remain in effect, eliminating the 400% FPL "subsidy cliff."

- Maximum premium cap remains at 8.5% of income, even for higher-income households.

- Greater support for older Americans and those in rural areas where premiums tend to be higher.

What's New in 2025:

- Income calculation includes simplified MAGI rules, making it easier to estimate eligibility.

- The “family glitch” fix is fully implemented, allowing dependents access to subsidies even if one family member has employer coverage.

How the Tax Credit Affects Monthly Premiums

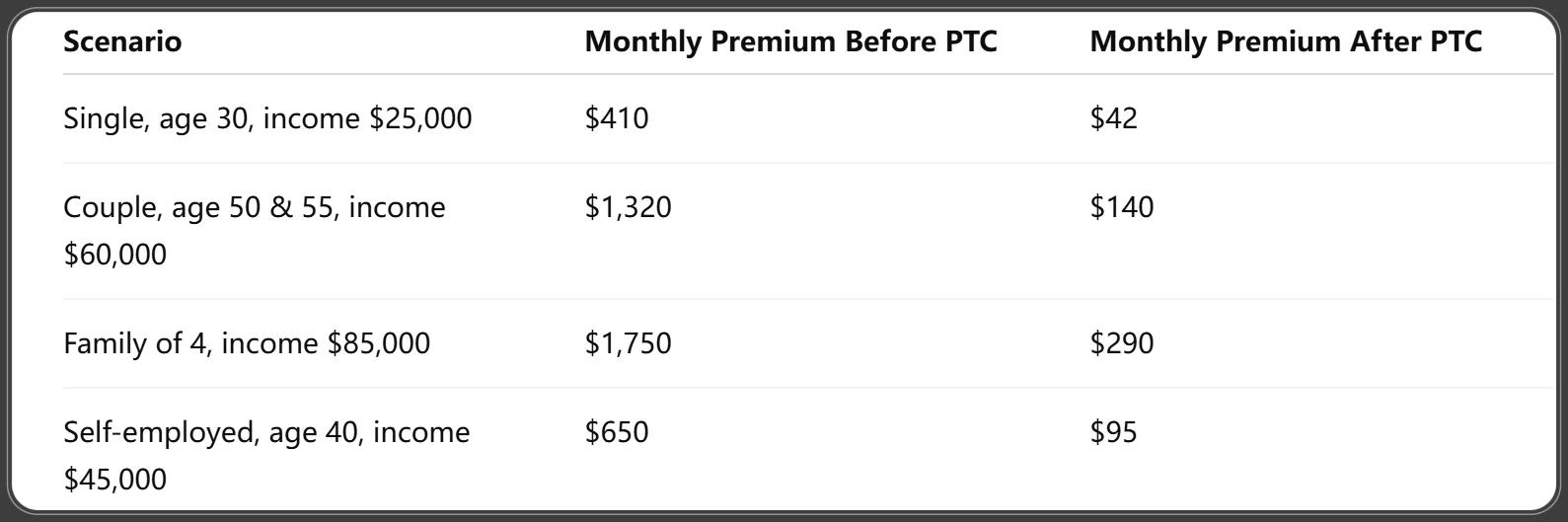

Let’s look at real-world examples of how the PTC helps reduce premiums:

Census Bureau. (2025, April). 2025 Health Insurance Cost Study (MEPS-10 Questionnaire). Retrieved April 2025.

These numbers vary by zip code, age, and plan selection—but the savings are substantial. Many qualify for Silver plans with reduced deductibles and co-pays through Cost Sharing Reductions (CSR), in addition to PTC.

Premium Tax Credit for Self-Employed Individuals

Freelancers, gig workers, and small business owners rely heavily on PTC to stay insured.

Tips for the Self-Employed:

- Estimate your net self-employment income accurately.

- Deduct business expenses to lower your Modified Adjusted Gross Income (MAGI).

- Consider using Schedule C and Form 1040 early in the year to plan.

- Revisit your application mid-year if income shifts—this helps avoid surprises at tax time.

In 2025, many self-employed individuals are paying less than $100/month for comprehensive ACA plans, thanks to generous PTC rates.

PTC and Family Glitch Fix in 2025

Before 2023, if a family had access to “affordable” employer insurance—even if it only covered the employee—it disqualified the entire household from ACA subsidies. This was known as the “family glitch.”

In 2025, the fix is fully enforced:

- Each household member is now evaluated individually.

- If dependent coverage from an employer is unaffordable (costs more than 8.5% of income), the spouse and children may now qualify for PTC on the marketplace.

This update has expanded affordable insurance access to millions of families who were previously excluded.

How to Report the Premium Tax Credit on Your 2025 Tax Return

When tax season arrives, you’ll receive Form 1095-A from your insurance exchange. Use this to complete IRS Form 8962, which:

- Calculates your total credit.

- Compares it with what you received in advance (APTC).

- Determines if you owe additional tax or get a refund.

Common Mistakes to Avoid:

- Forgetting to include Form 8962 (can delay your refund).

- Not updating income changes with the exchange.

- Misreporting MAGI or household size.

Pro tip: Use a tax professional familiar with ACA provisions or trusted software that walks you through Form 8962 accurately.

What Happens If You Earn More or Less Than Expected?

Income changes during the year are common—and in 2025, the premium tax credit still depends on your actual annual income.

If You Earn More Than Expected:

- You may owe back some or all of the advance premium tax credit you received.

- Repayment caps apply based on income level, especially for those under 400% FPL.

- If you exceed 400% FPL, you may still qualify due to the American Rescue Plan extension—no sudden subsidy loss (no more “subsidy cliff”).

If You Earn Less Than Expected:

- You may qualify for more PTC at tax time, resulting in a bigger refund.

- In some cases, you might qualify for Medicaid or additional cost-sharing reductions (CSRs).

Best Practice:

Report any income or household changes to your marketplace as soon as possible to adjust your subsidy in real time and avoid tax surprises.

Medicaid vs Premium Tax Credit Eligibility

Understanding where you fall between Medicaid and PTC eligibility is crucial.

Medicaid:

- Generally for those earning less than 138% of the FPL (in expansion states).

- Offers comprehensive coverage with little or no premiums or deductibles.

- You cannot receive PTC if you’re eligible for Medicaid.

Premium Tax Credit:

- Available for incomes starting at 100% of FPL, up to 400% and beyond (with ARP extensions).

- You must not be eligible for Medicaid or affordable employer coverage.

In states that didn’t expand Medicaid, some low-income adults fall into a coverage gap and may still qualify for special subsidies depending on 2025 federal updates or state programs.

Premium Tax Credit and Citizenship or Immigration Status

In 2025, the PTC is available to individuals who are:

- U.S. citizens

- U.S. nationals

- Lawfully present immigrants

This includes:

- Green card holders

- Refugees/asylees

- DACA recipients (under certain state programs)

- Work visa holders

Undocumented immigrants do not qualify for PTC, but many mixed-status families are eligible if at least one member is lawfully present and applying.

Real-Life Scenarios: How the PTC Helps Families Save

Carlos, 32 – Freelance Photographer

Carlos earns $38,000/year and lives in Arizona. Thanks to the premium tax credit, he pays just $83/month for a Silver plan that includes dental, vision, and low copays.

Jasmine & Leo, Retired Early at 60

The couple’s income is $55,000 from investments. With no employer coverage, they qualify for $1,200/month in PTC, making their Gold plan cost only $195/month total.

Aliya, Single Mom of Two

Aliya earns $29,000 working part-time. Her PTC covers nearly 100% of her premiums, giving her and her kids full health coverage for less than $15/month.

These examples show how the premium tax credit in 2025 continues to level the playing field for diverse Americans, regardless of age or job status.

FAQs About the Health Insurance Premium Tax Credit 2025

Q1: Can I get the premium tax credit if I already have employer insurance?

A1: No, unless your employer plan is unaffordable or doesn’t meet minimum coverage standards.

Q2: What if I don’t file taxes?

A2: You must file a federal tax return to claim or reconcile the PTC. Failure to do so may disqualify you from receiving it in the future.

Q3: Are older adults eligible for the PTC?

A3: Yes. Age is not a disqualifier. In fact, those 50–64 often receive larger credits due to higher plan costs.

Q4: What if I lose my job midyear?

A4: That triggers a Special Enrollment Period, and you can apply for a marketplace plan with full PTC eligibility.

Q5: Do I have to pay back the tax credit if I misestimated my income?

A5: Possibly, but repayment caps protect most low- to middle-income earners from large liabilities.

Q6: Is the 8.5% income cap still in place?

A6: Yes. In 2025, no one pays more than 8.5% of household income toward the benchmark plan, regardless of income level.

Conclusion: Making the Most of the Premium Tax Credit in 2025

The health insurance premium tax credit 2025 remains one of the most effective tools for making healthcare affordable and accessible. With expanded eligibility, higher subsidies, and critical fixes to longstanding gaps, millions of Americans now have unprecedented access to comprehensive health insurance.

If you're unsure whether you qualify or how to apply, use your state's marketplace or HealthCare.gov as a starting point—and remember to update your income regularly throughout the year.

By understanding how the credit works and planning wisely, you can save thousands of dollars annually, ensure reliable healthcare, and protect your family from financial uncertainty.

You Might Also Like

Health Insurance for Babies 2025: Best Coverage Options, Enrollment Tips & Newborn Benefits Explained

Aug 6, 2025Health Insurance After Job Loss 2025: Best Options, New Rules, and How to Stay Covered

Aug 6, 2025Health Insurance for Pre-existing Conditions 2025: New Rules, Better Coverage & What You Need to Know

Aug 6, 2025Top 17 Groundbreaking Health Insurance Trends 2025: What You Need to Know

Aug 6, 2025Health Insurance Waiting Period 2025: What You Must Know Before Enrolling

Jul 31, 2025