Health Insurance for Pre-existing Conditions 2025: New Rules, Better Coverage & What You Need to Know

Published on August 6, 2025

Alex Thompson

Insurance Data Analyst & Content Strategist

Alex Thompson analyzes insurer data and market trends to produce objective rate comparisons, annual cost studies, and interactive saving guides.

Introduction: Why Pre-existing Conditions Still Matter in 2025

In 2025, millions of Americans continue to live with chronic and pre-existing medical conditions—from asthma and arthritis to diabetes, depression, and cancer. Health insurance for pre-existing conditions remains a cornerstone issue in the healthcare debate, as it directly impacts financial stability, access to care, and peace of mind for families nationwide.

The good news? Protections for individuals with pre-existing conditions remain strong in 2025. Yet, it's more important than ever to understand your rights, know your options, and be proactive during enrollment.

The Legal Landscape: Protections Under Current Law

Thanks to the Affordable Care Act (ACA), health insurers cannot deny coverage or charge higher premiums based on pre-existing conditions. These safeguards have held firm into 2025, though ongoing political debates have aimed at refining and, in some cases, expanding these protections.

Key Regulations in 2025:

- Guaranteed issue: Insurers must offer coverage to anyone who applies, regardless of health status.

- Community rating: Premiums cannot vary based on medical history.

- Essential health benefits: Chronic disease management, mental health care, and maternity care must be included in all ACA-compliant plans.

Some states have even expanded coverage protections through their own healthcare legislation, offering additional subsidies or bolstering Medicaid access for those with long-term conditions.

Types of Pre-existing Conditions Most Commonly Covered

In 2025, a wide range of health issues fall under the umbrella of “pre-existing conditions.” These include:

- Chronic diseases: Diabetes, asthma, hypertension, and arthritis.

- Cardiovascular conditions: Heart disease, stroke recovery, and cholesterol issues.

- Mental health disorders: Depression, anxiety, bipolar disorder, and PTSD.

- Cancer (past or present): All forms, regardless of remission status.

- COVID-19 and Long COVID: Lingering symptoms like fatigue, brain fog, and respiratory issues now qualify as pre-existing conditions in most plans.

This broad inclusion ensures that individuals can maintain or gain coverage without facing financial penalties or discriminatory exclusions.

How Health Insurers Handle Pre-existing Conditions in 2025

By law, ACA-compliant insurers must treat applicants with pre-existing conditions the same as any other applicant. However, the methods insurers use to manage risk have evolved:

- No medical underwriting: Insurers do not require medical exams or detailed histories to determine pricing.

- No coverage waiting periods: Policies begin full coverage immediately upon activation.

- AI-powered care matching: Insurers use technology to match patients with providers, care plans, and medications optimized for their condition.

These tools help reduce costs for both patients and insurers, while improving outcomes and minimizing hospital visits.

Impact of the Affordable Care Act in 2025

Despite various attempts to repeal or replace the ACA in previous years, its core protections remain intact and even expanded in many states by 2025.

ACA Highlights for Pre-existing Conditions:

- All marketplace plans cover chronic conditions and preventive services.

- Medicaid expansion allows more low-income individuals with chronic illness to qualify for full coverage.

- Enhanced subsidies (continued from 2021’s American Rescue Plan) have helped lower premiums and out-of-pocket costs for millions.

The article continues below with more sections including:

- Private vs Public Insurance Options

- Employer-Sponsored Coverage Trends

- Navigating Enrollment & Short-Term Plan Risks

- Global Coverage Comparison

- Appeals, Cost Management, and Real-Life Stories

- Resources and FAQs

Private vs Public Insurance Options for High-Risk Individuals

For individuals managing pre-existing conditions, choosing between public and private insurance options in 2025 is all about balancing cost, coverage, and care quality. Fortunately, the market has matured with more choices and protections than ever before.

Public Insurance Options:

- ACA Marketplace Plans: These remain the most accessible for individuals without employer coverage. They guarantee comprehensive benefits, including chronic disease management, mental health support, and prescription drugs.

- Medicaid (where expanded): Offers no-cost or low-cost coverage to low-income individuals with chronic conditions. States with expanded Medicaid offer broader access to preventive services and long-term care.

- Medicare for People Under 65 with Disabilities: Available to individuals with qualifying conditions such as end-stage renal disease or ALS.

Private Insurance Options:

- Employer-Sponsored Plans: Still the most common type of insurance. All employer plans must cover pre-existing conditions under the ACA.

- Individual Private Plans: Purchased outside the exchange; these are ACA-compliant and cover chronic conditions but may have different provider networks or premiums.

- Short-Term Plans (with caution): While cheaper, many short-term or non-ACA-compliant plans may exclude coverage for pre-existing conditions—even in 2025.

Employer-Sponsored Plans and Pre-existing Conditions

Employers continue to play a vital role in offering robust health coverage. By 2025, with the rise of hybrid and remote workforces, employers are increasingly opting for customized health benefit packages that prioritize inclusivity and chronic condition care.

Current Trends:

- Guaranteed Coverage Regardless of Health History: Group plans must include pre-existing condition protections.

- Telehealth & Chronic Disease Monitoring: Plans now often include wearable support and remote consultations for condition management.

- Care Coordination Services: Employers are partnering with care management firms to help employees with complex health issues navigate their treatment efficiently.

Portable coverage and remote access features make it easier for workers managing health issues across state lines to stay insured.

Innovations in Coverage: What’s New in 2025?

Technology is reshaping how health insurance supports individuals with chronic illness and long-term care needs.

Leading Innovations:

- AI-Driven Risk Assessment Tools: Used for care coordination, not premium pricing, helping insurers direct policyholders to the best treatment paths.

- Condition-Specific Coverage Modules: Add-ons for conditions like diabetes, cardiovascular diseases, and autoimmune disorders.

- Wearable Integration: Fitness trackers and medical devices now integrate directly with insurance platforms, unlocking rewards and discounts for consistent condition monitoring.

These innovations are not just flashy tech—they’re designed to reduce hospitalization, improve adherence to medication, and ultimately lower costs for both patients and insurers.

Navigating Health Insurance Enrollment in 2025

Enrollment can still feel overwhelming—especially for those managing complex health conditions. But in 2025, there are more tools, support, and simplified processes than ever before.

Enrollment Tips:

- Use licensed navigators or state exchange assistance programs to evaluate plan details.

- Compare formularies carefully if you’re managing a condition that requires expensive or specialty medications.

- Check provider networks to ensure your current doctors and specialists are in-network.

- Keep documentation handy for any past claims or treatments—these can help during disputes or coverage transitions.

If you’ve lost coverage due to job change or relocation, you may qualify for a Special Enrollment Period (SEP), which allows you to sign up outside the standard open enrollment window.

Short-Term and Catastrophic Plans: A Risky Bet?

While tempting for their lower premiums, short-term health plans and catastrophic policies can be a dangerous choice for anyone with a pre-existing condition.

Risks to Watch Out For:

- Exclusion clauses: Many short-term plans explicitly deny coverage for pre-existing conditions.

- Caps and lifetime limits: May not cover expensive treatments or ongoing therapies.

- No out-of-pocket maximums: Financial risk is significantly higher if you need frequent care.

In most cases, it’s better to enroll in a qualified ACA plan to guarantee protection—especially for individuals needing regular treatment or expensive medications.

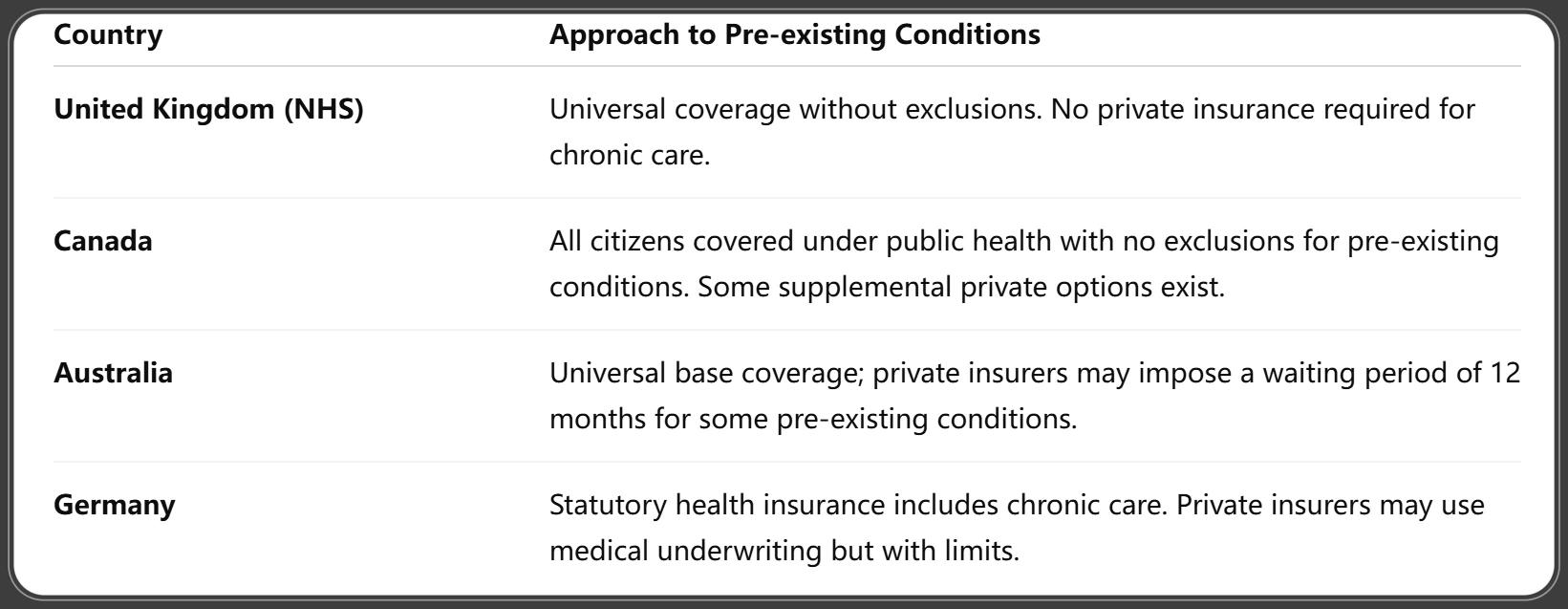

International Perspectives: How Other Countries Handle Pre-existing Conditions

In 2025, healthcare systems worldwide vary in their approach to pre-existing condition coverage:

CDC/NCHS. (2025, June 26). Health Insurance Coverage: Early Release of Estimates, via FastStats. Retrieved June 26, 2025.

The U.S., while not offering universal healthcare, provides more individual plan choice—though navigating the system requires awareness and effort.

How to Appeal a Denied Claim Related to Pre-existing Conditions

Even in 2025, claim denials can happen—but you have the right to appeal, especially when the denial is based on a misunderstanding of your pre-existing condition coverage.

Steps to Appeal:

- Review the denial letter carefully. It must state the reason for denial and your right to appeal.

- Gather medical documentation. Include doctor notes, diagnosis history, and treatment plans.

- Submit an internal appeal. Most insurers must respond within 30 days.

- File an external review (if needed). If the insurer upholds the denial, you can request an independent review.

- Get support. Insurance navigators, nonprofit legal groups, or your state’s Department of Insurance can guide you through the appeal process.

Appeals have a high success rate when properly documented, especially when the care in question is considered essential under ACA provisions.

Cost Management Strategies for Chronic Illnesses

While ACA protections help ensure access, out-of-pocket costs can still burden individuals managing pre-existing conditions. That’s why strategic cost management is essential.

Top Strategies:

- Apply for ACA subsidies and cost-sharing reductions. Income-based aid can significantly reduce premiums and deductibles.

- Use Health Savings Accounts (HSAs): These tax-advantaged accounts help save for eligible medical expenses if you have a high-deductible health plan (HDHP).

- Choose generic or biosimilar medications. Ask your provider for lower-cost alternatives when available.

- Negotiate with providers. Many hospitals offer sliding scales or payment plans for uninsured services.

- Explore patient assistance programs. Nonprofits and pharma companies often provide support for expensive treatments.

With inflation-adjusted limits in 2025, more people are qualifying for savings—especially under enhanced ACA tax credits.

Real-Life Case Studies: Navigating Coverage with Pre-existing Conditions

Case 1: Sarah, 47 – Managing Lupus on an ACA Plan

After leaving a corporate job, Sarah turned to the ACA marketplace. Despite her lupus diagnosis, she secured coverage without premium hikes. With enhanced subsidies and access to a lupus care network, her out-of-pocket costs dropped 35% compared to 2020.

Case 2: Jamal, 29 – Type 1 Diabetes & Employer Insurance

Jamal works remotely for a tech company. His employer’s plan offers wearable glucose monitoring coverage and includes tele-endocrinologist consultations. His employer also contributes to an HSA, helping cover insulin costs.

Case 3: Maria, 62 – Recovering from Cancer with Medicare

After a breast cancer diagnosis in 2023, Maria retired early and qualified for Medicare due to disability. Her Medicare Advantage plan now covers follow-up care, physical therapy, and mental health services—all with no pre-existing condition exclusions.

These stories reflect a more inclusive and responsive insurance landscape for chronic conditions in 2025.

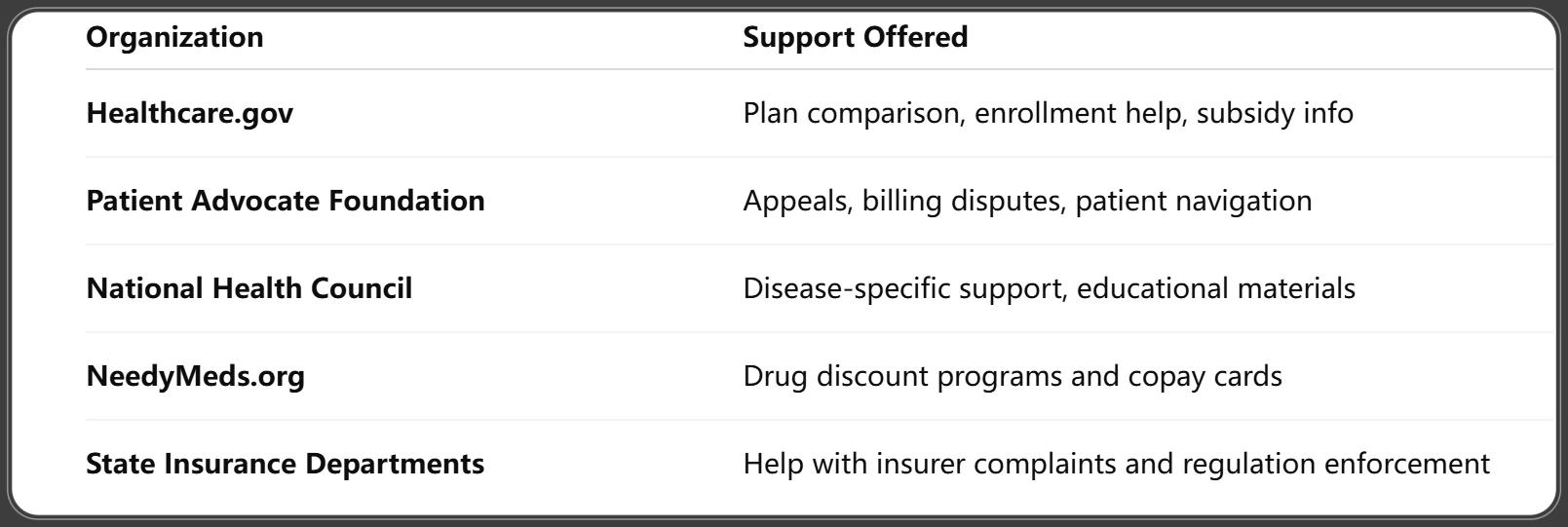

Resources and Support for Patients with Chronic Conditions

Navigating insurance with a chronic condition can be overwhelming. Fortunately, several trusted organizations offer free or low-cost support:

Investopedia. (2025, around July). Why Your Health Insurance Expenses Might Soar in 2026, and Steps to Take Now. Retrieved July 2025.

Taking advantage of these resources can simplify plan selection, claims, and ongoing condition management.

FAQs on Health Insurance for Pre-existing Conditions 2025

Q1: Are all pre-existing conditions covered in 2025?

A1: Yes. Under ACA-compliant plans, all pre-existing conditions are covered with no premium increase or denial of service.

Q2: Can an insurer still deny coverage if I have a chronic illness?

A2: No. As of 2025, insurers cannot deny coverage or limit benefits due to a pre-existing condition.

Q3: Do short-term plans cover pre-existing conditions?

A3: Typically no. Most short-term and non-ACA plans exclude coverage for any medical condition diagnosed before enrollment.

Q4: What should I do if my claim is denied?

A4: File an internal appeal and, if needed, request an external review. Free help is available from patient advocates and legal nonprofits.

Q5: Are subsidies available for people with chronic conditions?

A5: Yes. ACA subsidies are income-based and available to anyone eligible, including those with pre-existing conditions.

Q6: What counts as a pre-existing condition?

A6: Any diagnosed illness or condition—physical or mental—that existed before the date your new health plan started.

Conclusion: Empowering Patients Through Transparent and Inclusive Insurance

In 2025, health insurance for pre-existing conditions is stronger, smarter, and more inclusive than ever before. Legal protections ensure access, technological innovations personalize care, and expanded plan options make it easier to manage chronic illness without fear or financial strain.

The key for consumers? Stay informed, compare your options carefully, and use the many tools and resources available to get the best possible coverage for your needs.

The future of healthcare is about empowerment—and with the right plan, individuals with pre-existing conditions can live longer, healthier, and more financially secure lives.

You Might Also Like

Health Insurance for Babies 2025: Best Coverage Options, Enrollment Tips & Newborn Benefits Explained

Aug 6, 2025Health Insurance After Job Loss 2025: Best Options, New Rules, and How to Stay Covered

Aug 6, 2025Health Insurance Premium Tax Credit 2025: Maximize Savings with These New Rules

Aug 6, 2025Top 17 Groundbreaking Health Insurance Trends 2025: What You Need to Know

Aug 6, 2025Health Insurance Waiting Period 2025: What You Must Know Before Enrolling

Jul 31, 2025