9 Critical Steps for Getting Home Insurance After a Claim in 2025

Published on August 1, 2025

Sarah Patel

Homeowners & Property Insurance Expert.

Sarah Patel is a property underwriter-turned-writer with 10 years in the field; she focuses on flood, wildfire, and replacement-cost planning for homeowners.

In 2025, navigating the world of home insurance is more complicated than ever—especially if you’ve recently filed a claim. Many homeowners find themselves wondering, “Can I even get coverage again?” or “Will my rates skyrocket forever?”

The good news? Getting home insurance after a claim in 2025 is absolutely possible—with the right knowledge, tools, and timing. This guide walks you through expert-backed steps to regain coverage and even lower your premiums after a loss.

Why Filing a Home Insurance Claim Affects Future Coverage

Filing a home insurance claim puts you on insurers' radar. While it’s your right to file, every claim—especially recent ones—can raise red flags to underwriters evaluating your risk level.

Key Considerations:

- Claim Frequency: Multiple small claims (like $1,000 water leaks) may hurt more than one major loss.

- Claim Type: Fire and liability claims typically trigger higher premium increases than theft or wind damage.

- Claim Amount: Higher payouts = greater perceived risk = increased premiums or non-renewals.

In short, insurers interpret past claims as indicators of potential future issues.

How Claims Are Recorded and Tracked in 2025

Insurers use national databases to share your claim history—even across different companies.

The CLUE Report

- Comprehensive Loss Underwriting Exchange (CLUE) is the most common database.

- Tracks claim type, amount, date, and outcome.

- Claims remain visible for up to 7 years.

You can request a free copy of your CLUE report from LexisNexis to check accuracy before shopping for insurance.

Can You Be Denied Home Insurance After a Claim?

Unfortunately, yes—especially in 2025, as insurers tighten risk standards due to climate change, fraud concerns, and rising costs.

Reasons You May Be Denied:

- Multiple claims in a short period

- Large liability claims

- Unresolved repairs or open damages

- Living in a high-risk zone (e.g., wildfire, flood)

What to Do If Denied:

- Ask for a written reason.

- Dispute errors in CLUE or claim details.

- Explore state-sponsored FAIR Plans or surplus-line carriers.

9 Steps to Get Home Insurance After a Previous Claim

Whether you were dropped or simply need to renew, follow these steps:

- Review Your CLUE Report: Spot and correct any mistakes.

- Correct Any Open Issues: Complete repairs and document the work.

- Shop With Specialty Insurers: Some companies specialize in high-risk policies.

- Bundle Policies: Combining home and auto can soften perceived risk.

- Increase Your Deductible: Opt for $2,500+ to reduce premium and show confidence.

- Install Smart Home Tech: Leak detectors, cameras, and fire sensors reduce risk.

- Secure Your Home: Upgrade locks, add fencing, improve lighting.

- Write a Claim Explanation Letter: Share context if your claim was a one-time event.

- Work With an Independent Broker: They can access dozens of companies on your behalf.

The Role of High-Risk Home Insurance Providers in 2025

If standard insurers won’t touch your file, don’t panic. Alternatives exist.

High-Risk Solutions:

- FAIR Plans (state-sponsored last-resort options)

- Surplus Lines Carriers (non-admitted insurers willing to take on risk)

- Assigned Risk Pools (where insurers share high-risk applicants)

These policies may cost more but offer a bridge until you're eligible for standard coverage again.

How to Rebuild Trust with Insurance Companies

Time and proactive measures matter.

- Wait it out: Most insurers ease up after 3-5 claim-free years.

- Prevent new claims: Invest in maintenance and early detection systems.

- Document improvements: Keep receipts and photos of repairs.

Trust can be earned again—especially if you show effort to reduce future risk.

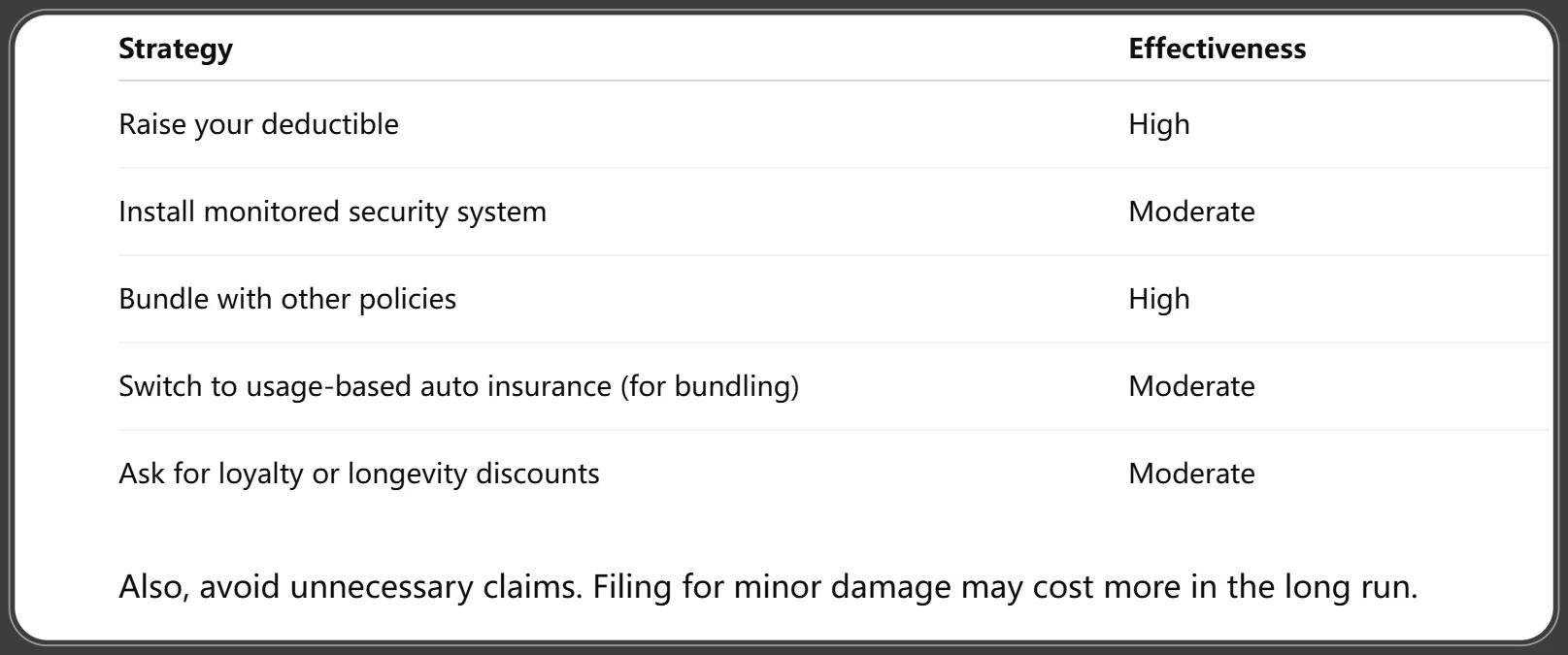

Tips to Lower Premiums After a Claim

Even if you’re seen as “high-risk,” there are ways to reduce your costs:

Also, avoid unnecessary claims. Filing for minor damage may cost more in the long run.

When and How to Switch Insurers After a Claim

Timing is everything. You can switch at any time—but be strategic.

- Avoid switching mid-claim unless absolutely necessary.

- Compare quotes at least 45 days before renewal.

- Disclose prior claims honestly—insurers check databases anyway.

- Ask which claims are “non-chargeable” (e.g., weather-related).

Insurers like Hippo, Lemonade, and Progressive are known for being lenient post-claim, depending on the situation.

Should You Always File a Claim? Lessons for 2025

Here’s a smart rule: If the repair cost is less than twice your deductible, consider paying out of pocket.

When Filing Makes Sense:

- Large losses (fire, flood, roof collapse)

- Liability concerns (someone injured)

- Catastrophic events

When to Think Twice:

- Cosmetic damage

- Preventable incidents (burst pipes with known issues)

- Small theft losses

Think long-term—not just about immediate savings.

How Natural Disasters Are Changing Claim Risk in 2025

In 2025, the frequency and intensity of natural disasters have pushed many insurers to rethink their risk models. Homes located in vulnerable zones are now subject to stricter underwriting rules and higher premiums—even if you’ve only filed one claim.

Key Risk Zones:

- Wildfire-prone areas (California, Colorado)

- Flood zones (Gulf Coast, Southeast U.S.)

- Tornado alley (Midwest states)

New Risk Assessment Tools:

- AI-driven risk scoring systems now evaluate home vulnerability in real time.

- Homes without mitigation upgrades (like fire-resistant siding or flood vents) are penalized with higher rates.

If your claim was related to a natural disaster, expect surge pricing or even coverage limitations unless you address environmental vulnerabilities.

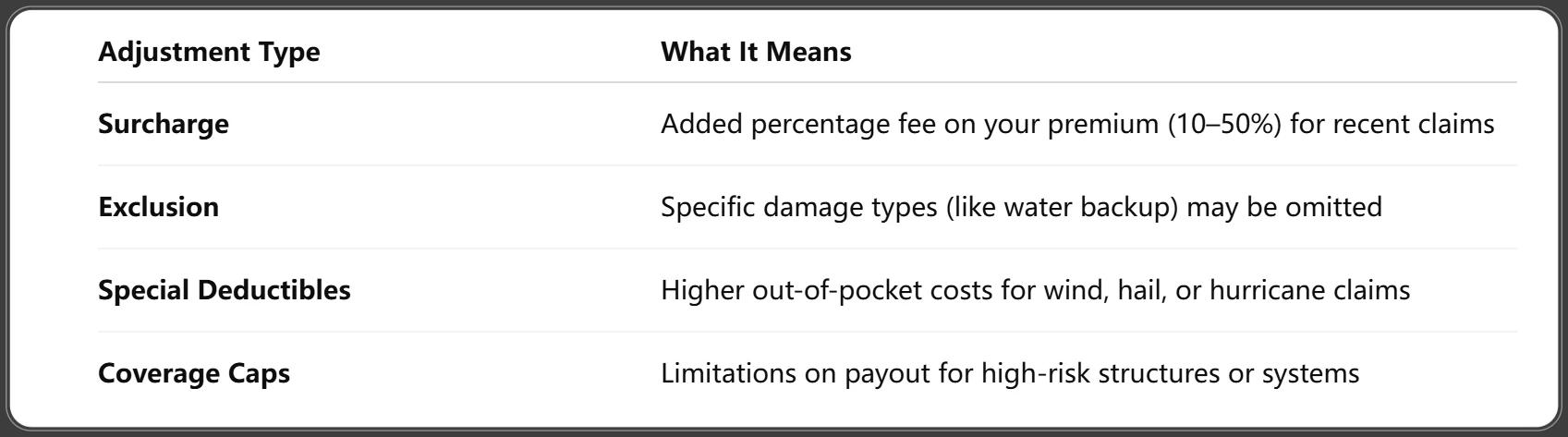

Understanding Surcharges and Policy Exclusions Post-Claim

After filing a claim, many homeowners are surprised to find new exclusions or surcharges on their next policy.

Common Post-Claim Adjustments:

Always read your policy’s declarations page to understand changes post-claim.

Alternatives to Traditional Home Insurance After a Claim

If standard and high-risk insurers don’t meet your needs, emerging options in 2025 are shaking up the market.

Non-Traditional Options:

- Peer-to-Peer Insurance: Community-based models like Lemonade pool funds and often forgive first-time claims.

- Parametric Insurance: Pays a fixed sum when a predefined event (like a 6.0 earthquake or 5-inch rain) occurs—no adjuster required.

- Self-Insurance: Setting aside a personal emergency fund instead of paying premiums—risky but preferred by some high-net-worth homeowners.

These models aren’t for everyone but can be great fits if you're tech-savvy or insurable only under strict conditions.

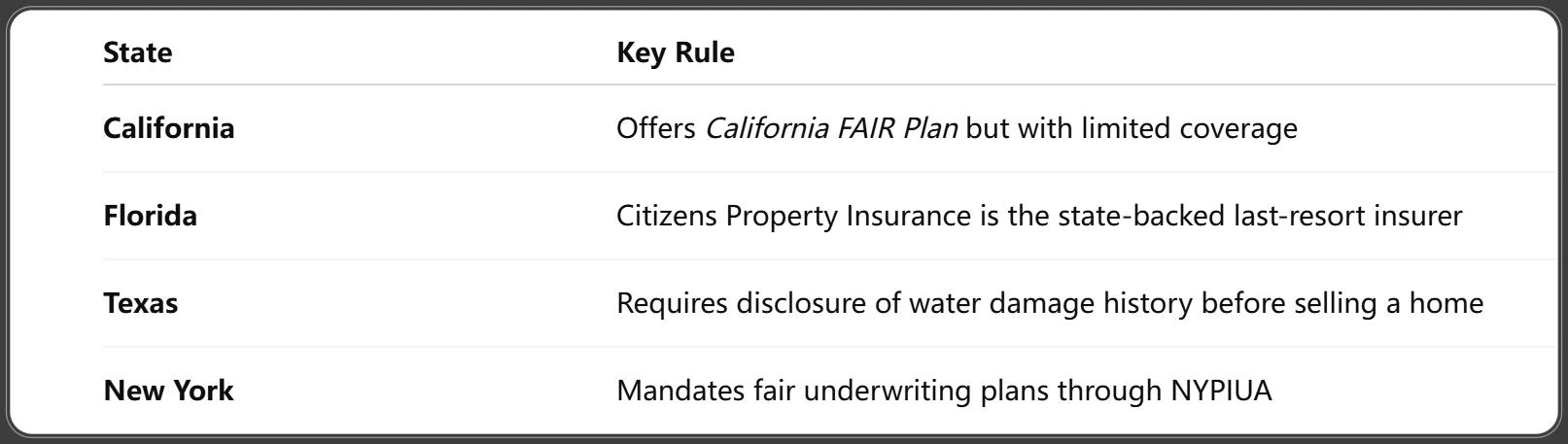

State-Specific Rules for High-Risk Policyholders

Home insurance laws vary widely by state, especially for those labeled high-risk.

Notable State Rules:

Always check your Department of Insurance website for your state’s consumer rights and insurance alternatives.

Frequently Asked Questions About Post-Claim Insurance in 2025

1. How long do claims stay on my insurance record?

Most stay visible for 5 to 7 years, depending on the insurer and type of claim.

2. Will my premium increase even for a small claim?

Yes. Even small claims can trigger rate hikes or surcharges, especially if you’ve filed more than one in a short period.

3. What if I made a claim under a previous owner’s name?

Claims tied to your property can still impact rates. You can dispute or clarify these through a CLUE report correction request.

4. Is it legal for insurers to drop me after a claim?

Yes—but they must provide a written reason and abide by your state’s cancellation notice laws.

5. Can I get insurance from the same company again after being dropped?

It’s unlikely, but some companies reconsider after several years of claim-free status.

6. Are there policies that don’t penalize you for claims?

Some innovative insurers offer “Claim Forgiveness” or no-penalty first claim options, especially for long-term customers.

Conclusion: Getting Back on Track After a Claim

Filing a home insurance claim may feel like the end of your affordable coverage options—but it’s not. With planning and persistence, getting home insurance after a claim in 2025 is not only doable but can lead to smarter, more customized protection.

Key Takeaways:

- Always verify your claim history and fix errors.

- Use brokers or state programs if traditional insurers say no.

- Improve your home’s safety and document it.

- Rebuild your insurance credibility over time.

Stay informed, proactive, and strategic—and you’ll turn one rough patch into a stronger insurance future.

You Might Also Like

Home Insurance Replacement Cost 2025: The Ultimate Guide to Full Home Protection

Aug 1, 2025Home Insurance for Rental Property 2025: 15 Key Updates Landlords Must Know

Aug 1, 2025Home Insurance Cancellation Rights 2025: Know Your Legal Protections & Next Steps

Aug 1, 2025Home Insurance Inflation Guard 2025: Why You Absolutely Need It Now

Aug 1, 2025Top 17 Must-Know Facts About Home Insurance for Condos 2025

Aug 1, 2025