Home Insurance Replacement Cost 2025: The Ultimate Guide to Full Home Protection

Published on August 1, 2025

Sarah Patel

Homeowners & Property Insurance Expert.

Sarah Patel is a property underwriter-turned-writer with 10 years in the field; she focuses on flood, wildfire, and replacement-cost planning for homeowners.

Home Insurance Replacement Cost 2025: The Ultimate Guide to Full Home Protection

Your home is likely your biggest investment—so protecting it with the right insurance is critical. In 2025, rising construction costs, supply chain challenges, and climate-related risks have made accurate coverage more important than ever. That’s why understanding home insurance replacement cost 2025 is key to avoiding financial shock after a loss.

This complete guide will walk you through what replacement cost means, how it’s calculated, and how to make sure your home is properly covered—now and in the future.

What Is Replacement Cost in Home Insurance?

Replacement cost is the amount of money it would take to rebuild your home with materials of like kind and quality at today’s prices, without deducting for depreciation.

It ensures your payout will cover the actual cost to rebuild—not what your home is worth on the market or after years of wear and tear.

Why Replacement Cost Matters More in 2025

Due to inflation and natural disasters, the gap between coverage and actual rebuilding costs has grown.

Why It Matters Now:

- Lumber and labor costs have risen 10–20% in many regions.

- Permit, energy code, and safety upgrades are now required by many cities.

- Post-disaster rebuilds often cost significantly more due to material shortages and contractor backlogs.

Without proper replacement cost coverage, homeowners are often left paying tens of thousands out-of-pocket.

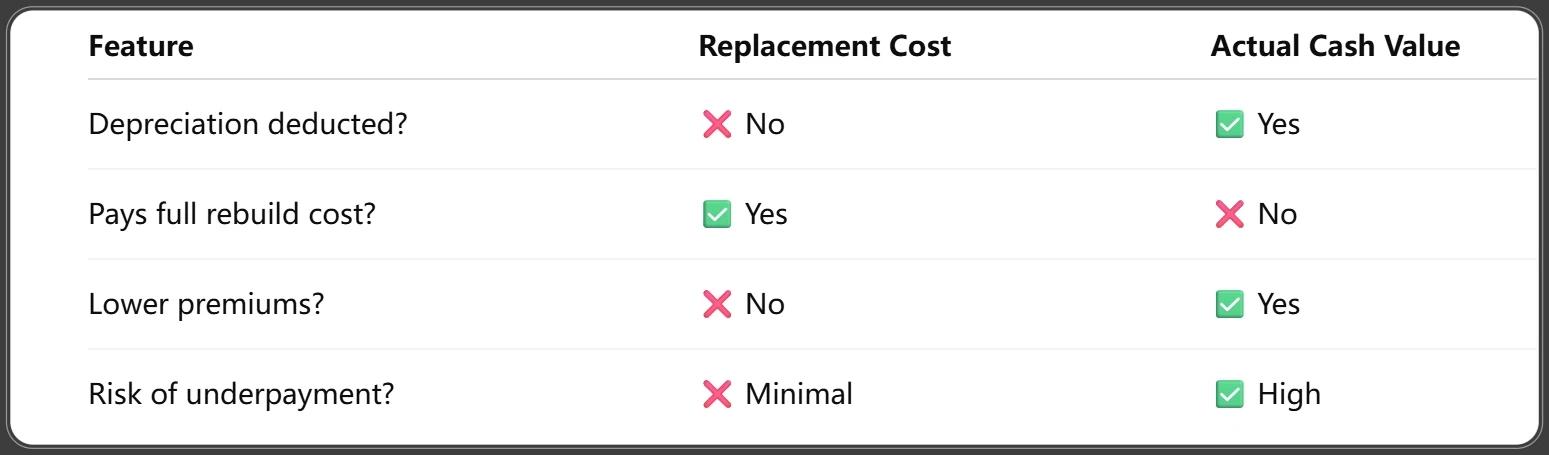

Replacement Cost vs. Actual Cash Value: Key Differences

If you choose actual cash value, your claim payout will be significantly lower—especially for older homes or items.

Types of Replacement Cost Coverage in 2025

1. Standard Replacement Cost

Covers rebuilding up to a predetermined limit.

2. Extended Replacement Cost

Adds a cushion (e.g., 25% more than your dwelling limit) to cover inflation or unexpected costs.

3. Guaranteed Replacement Cost

Covers whatever it takes to rebuild your home, no matter the cost—even if it exceeds your policy limit. Premiums are higher, but so is the protection.

What’s Included in Replacement Cost Coverage?

Replacement cost typically covers:

- The structure of the home (roof, walls, floors)

- Built-in features (cabinets, plumbing, lighting, HVAC)

- Attached structures (garage, deck)

What’s Not Included:

- Land value

- Detached buildings (unless listed separately)

- Personal property (unless you add replacement cost for contents)

How to Calculate Your Home’s Replacement Cost in 2025

There’s no one-size-fits-all formula, but here are your best options:

1. Online Rebuild Cost Estimators

Tools offered by insurers or third parties based on local building data.

2. Cost per Square Foot

Multiply your home’s square footage by local average rebuild costs ($150–$350+ per sq ft in 2025).

3. Professional Appraisal or Contractor Estimate

Ideal for custom homes or older buildings with unique materials.

Common Mistakes Homeowners Make with Replacement Cost

Avoid these costly errors:

- Confusing market value with replacement cost

- Failing to update coverage after renovations

- Relying solely on insurer-provided estimates without review

- Ignoring inflation or building code updates

Staying underinsured could delay your rebuild or leave you financially burdened.

Factors That Influence Replacement Cost in 2025

Several factors affect how much it would cost to rebuild your home:

- Square footage and layout complexity

- Type of materials used (luxury vs. standard finishes)

- Roof type, HVAC systems, and plumbing

- Geographic location and local labor rates

- Age of home and code compliance requirements

Keep these factors in mind when reviewing your coverage each year.

How Inflation Guard Affects Replacement Cost

Many policies now include an inflation guard endorsement, which automatically increases your dwelling limit each year (typically 3–8%).

In 2025:

- Some insurers use real-time inflation tracking to adjust your policy.

- Others tie adjustments to the Consumer Price Index or construction cost indexes.

Check your declarations page to confirm inflation protection is active—and adjust it if necessary.

What Happens If You're Underinsured?

Being underinsured can be financially devastating—especially in 2025, when rebuild costs are unpredictable and often surge after a disaster.

Here’s What Can Go Wrong:

- Partial Payouts: If your coverage limit is too low, you’ll only get a portion of what it actually costs to rebuild.

- Out-of-Pocket Expenses: You may need to cover tens or even hundreds of thousands of dollars on your own.

- Mortgage Violations: Most lenders require full replacement coverage. Falling short could put your loan at risk or trigger forced insurance placement.

Underinsurance is one of the most common homeowner mistakes. Review your policy annually to avoid this pitfall.

Replacement Cost for Older and Historic Homes

Older or historic homes often cost more to rebuild due to:

- Unique materials (e.g., slate roofs, plaster walls)

- Custom craftsmanship

- Specialty permits and inspections

Special Considerations:

- Ask your insurer if they offer “historic home endorsements.”

- Ensure your policy includes ordinance or law coverage to comply with modern building codes.

- You may need a custom appraiser or contractor to estimate rebuild cost accurately.

Replacement Cost for Custom-Built and Luxury Homes

Luxury and custom-built homes have specialized materials, high-end finishes, and unique architectural designs. As a result:

- Rebuilding can cost significantly more per square foot.

- Basic policies may have coverage caps that don’t match your actual needs.

- You should strongly consider guaranteed replacement cost coverage or a high-value homeowner policy.

Insurers like Chubb, AIG, and PURE specialize in custom-home insurance with broader replacement cost protections.

The Role of Home Inventory in Replacement Cost Accuracy

A detailed home inventory helps ensure you’re covered for the true value of your contents.

How to Create One:

- List items room by room.

- Include receipts, serial numbers, and estimated replacement values.

- Take photos or videos of each room.

- Store your inventory in the cloud or an offsite location.

Apps like Sortly, Encircle, or your insurer’s inventory tool can simplify the process.

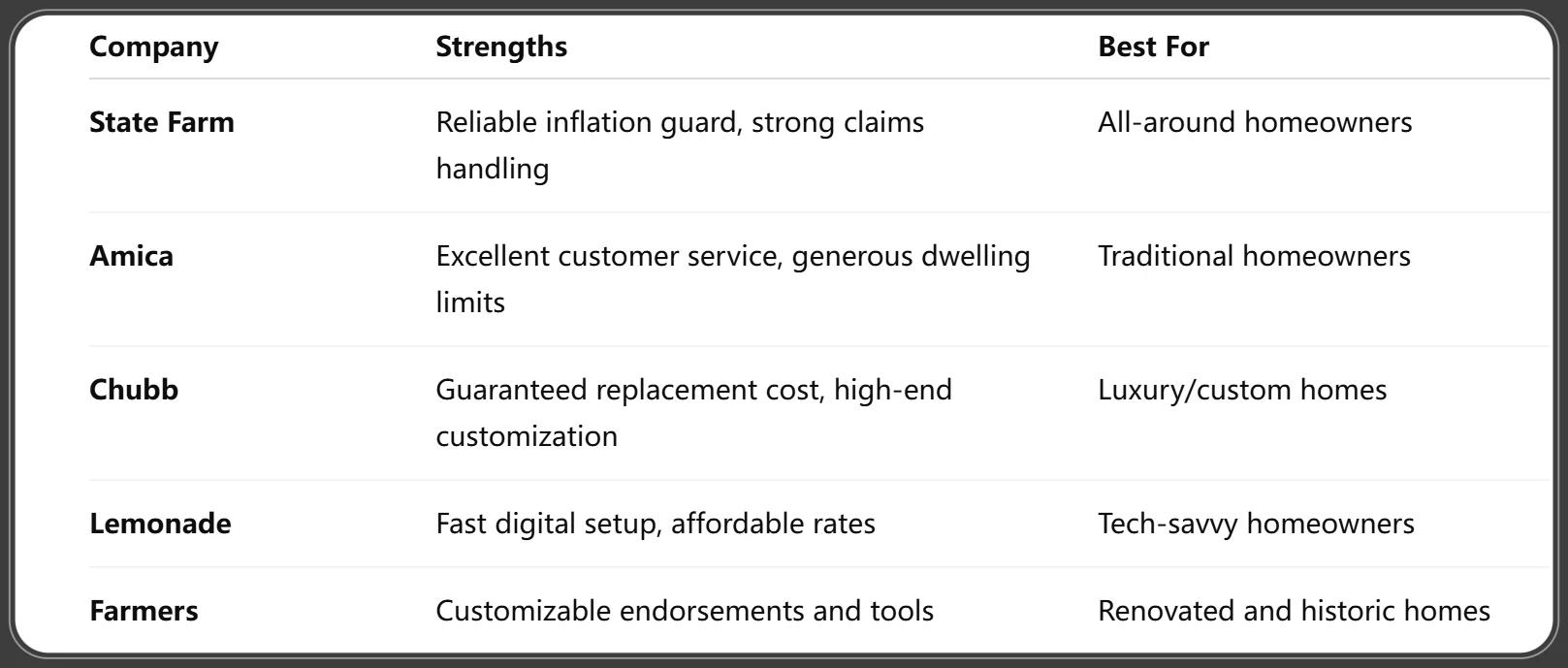

Best Insurance Companies Offering Strong Replacement Cost Policies in 2025

Here’s a look at some of the top providers in 2025 known for comprehensive replacement cost coverage:

Compare quotes and coverage features—especially limits, exclusions, and add-ons—before deciding.

Frequently Asked Questions About Replacement Cost in 2025

1. Does replacement cost include land value?

No. Replacement cost applies only to the structure and attached fixtures, not the land beneath your home.

2. How often should I update my replacement cost estimate?

At least once a year, or anytime you make renovations or property upgrades.

3. Can I upgrade from actual cash value to replacement cost?

Yes, but you’ll likely pay more in premiums. Contact your insurer to modify your policy.

4. What happens if construction prices spike after a disaster?

Extended or guaranteed replacement cost coverage is your best protection against sudden post-disaster inflation.

5. Is replacement cost coverage more expensive?

Typically, yes—but it’s far less costly than being underinsured during a major loss.

6. Does replacement cost apply to personal belongings?

Not automatically. You’ll need to opt in for replacement cost coverage on contents, or add a rider.

Conclusion: Secure the True Value of Your Home in 2025

In a rapidly changing insurance landscape, home insurance replacement cost 2025 is no longer a luxury—it’s a necessity.

Final Checklist:

- ✅ Know your home’s true rebuild cost—not just its market value.

- ✅ Choose the right replacement cost type (standard, extended, or guaranteed).

- ✅ Review and adjust your coverage annually.

- ✅ Include inflation guard and law/ordinance endorsements.

- ✅ Keep a complete home inventory to streamline future claims.

By staying informed and proactive, you can ensure your most valuable asset is fully protected—no matter what 2025 brings.

You Might Also Like

Home Insurance for Rental Property 2025: 15 Key Updates Landlords Must Know

Aug 1, 2025Home Insurance Cancellation Rights 2025: Know Your Legal Protections & Next Steps

Aug 1, 2025Home Insurance Inflation Guard 2025: Why You Absolutely Need It Now

Aug 1, 20259 Critical Steps for Getting Home Insurance After a Claim in 2025

Aug 1, 2025Top 17 Must-Know Facts About Home Insurance for Condos 2025

Aug 1, 2025