Home Insurance Inflation Guard 2025: Why You Absolutely Need It Now

Published on August 1, 2025

Sarah Patel

Homeowners & Property Insurance Expert.

Sarah Patel is a property underwriter-turned-writer with 10 years in the field; she focuses on flood, wildfire, and replacement-cost planning for homeowners.

In a world where building costs and material prices continue to climb, being underinsured can be a financial disaster. Enter the home insurance inflation guard 2025—a feature more essential now than ever before. This powerful provision ensures your home insurance coverage keeps pace with inflation so you’re never left footing the bill for rising rebuild costs.

Whether you're renewing a policy or buying your first home, understanding inflation guard is crucial for smart financial protection in 2025.

What Is Inflation Guard in Home Insurance?

Inflation guard is a built-in or optional feature in many home insurance policies that automatically increases your dwelling coverage limit over time. The goal is to prevent you from being underinsured due to inflationary changes in:

- Construction costs

- Labor expenses

- Material prices

For example, if you purchased a policy with $300,000 in coverage three years ago, inflation guard might increase that amount to $330,000 today—without requiring you to manually adjust your policy.

Why Inflation Guard Is Crucial in 2025

Inflation isn’t just a buzzword—it’s a real financial threat to homeowners.

What’s Driving the Need in 2025?

- Supply chain disruptions have increased the cost of imported materials like wood, copper, and cement.

- Skilled labor shortages are pushing hourly wages higher.

- Climate disasters have triggered rebuilding booms, driving up demand.

Without inflation guard, you could face a situation where your policy doesn’t cover the full cost of rebuilding, leaving you to pay thousands—or more—out of pocket.

How Inflation Guard Adjusts Coverage Limits

Most inflation guard endorsements adjust your coverage by a fixed annual percentage, often between 3% and 8%. Some insurers use proprietary indexes or tie adjustments to the Consumer Price Index (CPI) or construction cost indexes.

Example:

Let’s say your policy covers your home for $400,000. With a 6% inflation guard, your coverage would automatically increase by $24,000 annually to account for market changes.

This ensures your Coverage A (Dwelling) remains aligned with current rebuild costs—even if you forget to review your policy.

Real-Life Scenarios: When Inflation Guard Saves You

Scenario 1: Partial Loss from a Kitchen Fire

The cost of cabinets, appliances, and plumbing has increased by 20%. With inflation guard, your policy adjusts to these price hikes—saving you from a $15,000 shortfall.

Scenario 2: Total Loss After a Wildfire

Your original policy covered $350,000, but rebuild costs now total $390,000. Without inflation guard, you’re short. With it, you're fully covered.

Is Inflation Guard Included in All Policies?

Not always. Some insurers include it automatically in standard HO-3 policies, while others offer it only as an optional endorsement.

How to Check:

- Review your declarations page

- Look for terms like "inflation protection", "inflation adjustment", or "automatic dwelling increase"

- Ask your agent or broker for clarity

How Much Does Inflation Guard Add to Your Premium?

The cost varies based on the inflation rate and your insurer’s pricing model, but in most cases, it adds $15 to $40 annually—a small price for a big layer of protection.

Cost vs. Benefit:

How Often Are Inflation Guard Adjustments Made?

It depends on your insurer. In 2025, many companies are offering more dynamic update schedules, including:

- Annual adjustments (most common)

- Quarterly reviews in high-inflation regions

- Real-time algorithmic updates (emerging with digital insurers)

Be sure to ask how frequently your policy updates and how it's calculated.

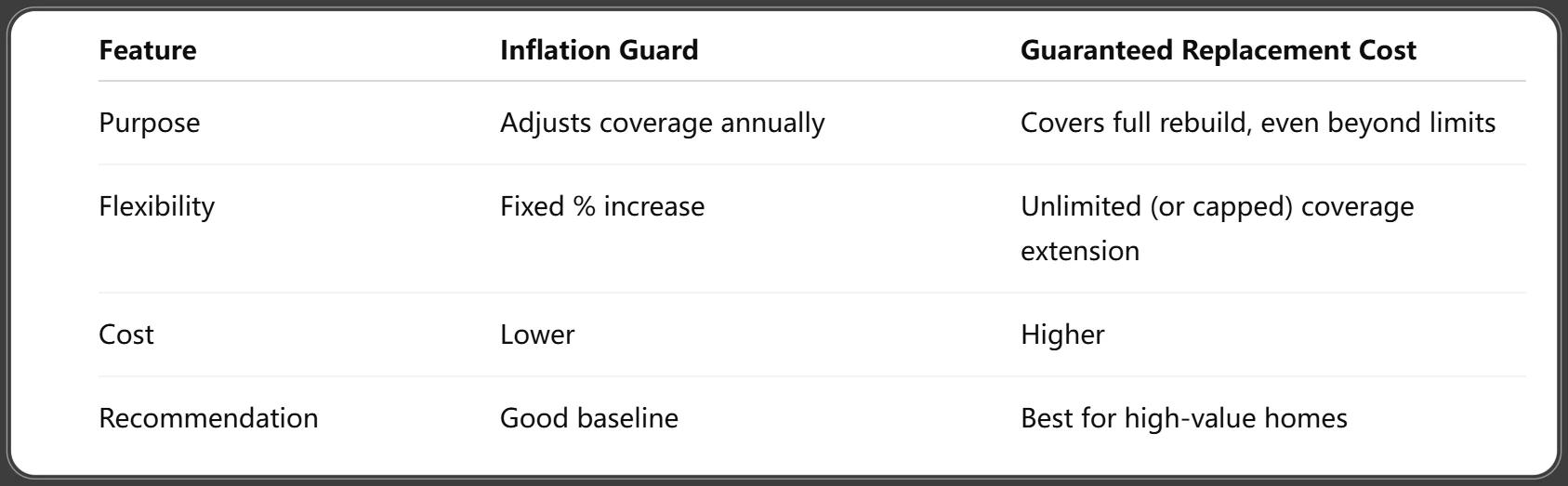

Key Differences Between Inflation Guard and Guaranteed Replacement Cost

These terms often get confused, but they serve different roles:

How to Check If Your Policy Has Enough Coverage in 2025

Being “covered” isn’t the same as being fully protected. Review your policy by:

- Using online home replacement cost calculators

- Hiring a local contractor for rebuild estimates

- Consulting your agent annually

- Reviewing your Coverage A vs. current market rebuild costs

Don’t rely solely on purchase price or tax assessments—they rarely reflect true rebuild values.

Which Homeowners Should Prioritize Inflation Guard in 2025?

Every homeowner benefits, but some must prioritize it:

- Owners of older homes with outdated replacement values

- High-value home or custom-built property owners

- Rural property owners where contractor costs are unpredictable

- Homeowners in high-inflation zones, especially post-disaster regions

Inflation Guard and Mortgage Lender Requirements

Most mortgage lenders require you to maintain sufficient insurance coverage to protect their interest in your property. In 2025, more lenders are encouraging or even mandating inflation guard provisions, especially in high-risk or high-cost markets.

Why Lenders Prefer Inflation Guard:

- Ensures the property remains fully insurable.

- Reduces risk of underinsurance gaps after a total loss.

- Helps homeowners comply with loan-to-value (LTV) requirements post-claim.

If your policy lacks inflation guard, your lender may request an endorsement or force-place additional insurance, which is often more expensive and less comprehensive.

Risks of Skipping Inflation Guard Coverage

Without inflation guard, your policy’s original limits may fall far short of actual rebuilding costs—even after just a few years.

Key Risks:

- Partial Payouts: You could receive only a portion of the funds needed to rebuild.

- Out-of-Pocket Costs: You may need to cover thousands in gaps.

- Delays and Disputes: Claim settlements take longer due to coverage disputes.

Worse still, without proper inflation protection, your coverage could technically violate lender insurance terms, putting your mortgage in jeopardy.

How to Add or Update Inflation Guard on Your Current Policy

Good news: adding or adjusting inflation guard is usually simple.

Steps:

- Contact Your Agent: Ask if inflation guard is active and what percentage is used.

- Request a Review: Ask for a recalculation based on 2025 costs.

- Adjust the Endorsement: If needed, raise the inflation adjustment percentage (some insurers allow custom limits).

- Get Written Confirmation: Ensure it's reflected on your declarations page.

Updating this one feature can significantly boost your post-loss security.

Top Insurance Companies Offering Strong Inflation Guard Protection in 2025

Some insurers have refined their inflation guard options to adapt to volatile market conditions.

Always compare policy limits, adjustment methods, and whether inflation guard is optional or built-in.

State Regulations Affecting Inflation Guard Coverage

In some states, inflation guard is not just smart—it may be required or regulated.

Examples:

- California: Strong building code updates post-disaster often require updated cost evaluations.

- Florida: Insurers must disclose how coverage keeps pace with inflation.

- Texas: Certain FAIR plans automatically adjust for inflation.

Your state’s Department of Insurance can provide detailed guidance on inflation coverage standards and consumer rights.

Frequently Asked Questions About Inflation Guard in 2025

1. Is inflation guard the same as replacement cost coverage?

No. Inflation guard adjusts your policy over time, while replacement cost coverage pays the full cost to repair or replace damaged property without depreciation.

2. Do I have to pay extra for inflation guard?

Sometimes. It may be included or offered as a small-cost endorsement, depending on your insurer and state.

3. How much coverage increase should I expect annually?

Most policies increase between 3% and 8% annually, but it can vary based on inflation rates and your specific insurer.

4. Does inflation guard cover personal property too?

Typically, it applies to dwelling coverage, but some insurers offer broader inflation protection across all coverages.

5. Can I customize my inflation guard percentage?

Yes, with many insurers you can request a higher or lower adjustment rate depending on market trends.

6. What if my inflation guard limit still isn’t enough?

You may want to combine it with guaranteed or extended replacement cost coverage for maximum protection.

Conclusion: Don’t Let Inflation Undermine Your Protection in 2025

As construction and material prices climb, being underinsured isn’t a matter of “if”—it’s a matter of “when.” The home insurance inflation guard 2025 feature is your best defense against skyrocketing rebuild costs.

Final Tips:

- Confirm your policy includes inflation guard.

- Adjust your percentage based on inflation trends.

- Reassess your dwelling value annually.

- Combine inflation guard with other advanced coverages for complete protection.

In 2025, staying ahead of inflation is not just smart—it’s essential. Make sure your policy evolves with the market, not against it.

You Might Also Like

Home Insurance Replacement Cost 2025: The Ultimate Guide to Full Home Protection

Aug 1, 2025Home Insurance for Rental Property 2025: 15 Key Updates Landlords Must Know

Aug 1, 2025Home Insurance Cancellation Rights 2025: Know Your Legal Protections & Next Steps

Aug 1, 20259 Critical Steps for Getting Home Insurance After a Claim in 2025

Aug 1, 2025Top 17 Must-Know Facts About Home Insurance for Condos 2025

Aug 1, 2025