Top 17 Must-Know Facts About Home Insurance for Condos 2025

Published on August 1, 2025

Sarah Patel

Homeowners & Property Insurance Expert.

Sarah Patel is a property underwriter-turned-writer with 10 years in the field; she focuses on flood, wildfire, and replacement-cost planning for homeowners.

Ultimate Guide to Home Insurance for Condos 2025

Homeownership is evolving, especially for condo dwellers in 2025. As urban living becomes more popular and condominium communities continue to rise, home insurance for condos 2025 is more important than ever. This guide walks you through everything you need to know—from new regulations to tips on saving money—so your condo and everything in it stays protected.

What Is Condo Insurance and Why Is It Essential in 2025?

Condo insurance, often called HO-6 insurance, is designed specifically for condominium owners. It protects the interior of your unit and your personal belongings, while the condo association typically covers the building’s exterior and common areas through a “master policy.”

Key Differences From Homeowners Insurance

- Condo insurance doesn’t cover the building’s structure outside your unit—that’s the HOA’s job.

- It focuses on interior walls, appliances, fixtures, and personal items.

- There’s a shared responsibility between you and the condo association, which can get complicated without the right coverage.

The 2025 Twist

Due to recent extreme weather patterns, cyber risks, and inflation, insurers have updated policy terms and exclusions. Not carrying condo insurance in 2025 could leave you exposed to huge out-of-pocket expenses after even minor incidents.

Major Changes in Condo Insurance Laws in 2025

Laws affecting condo insurance have tightened in many states, especially those frequently hit by natural disasters.

New Legislation to Watch

- Stricter flood insurance mandates for coastal condos.

- Disclosure rules requiring HOAs to clearly define what the master policy covers.

- Digital liability coverage requirements for smart condos equipped with IoT systems.

HOA vs. Personal Policy Responsibilities

HOAs are typically responsible for:

- Exterior walls

- Roof

- Shared amenities

You’re responsible for:

- Walls-in (including drywall and flooring)

- Fixtures

- Personal property

- Liability inside your unit

Reading your HOA’s bylaws and master policy details is essential.

Types of Condo Insurance Coverage

Understanding what your HO-6 policy covers ensures you're not caught off guard.

Personal Property

Protects everything inside your condo—furniture, clothes, electronics, and more.

Dwelling (Walls-In)

Covers built-in features like countertops, cabinets, floors, and sometimes windows.

Liability

Protects you if someone gets injured inside your condo and decides to sue.

Loss of Use

Pays for hotel stays or rentals if your unit becomes uninhabitable due to covered damages.

Loss Assessment

Covers shared losses when the condo association’s policy falls short (e.g., roof damage).

Master Policy vs. Individual Policy: Know the Difference

There are two types of HOA master policies:

- Bare Walls-In: Covers only the basic structure.

- All-Inclusive: Includes interior elements like plumbing and light fixtures.

Your individual HO-6 policy fills in the gaps, especially for renovations, luxury upgrades, or customizations.

What's Typically Not Covered in Condo Insurance?

It’s just as crucial to know what your insurance doesn’t cover.

- Flood damage (requires separate FEMA-backed flood insurance)

- Earthquake damage

- Termite infestations

- Wear and tear or poor maintenance

- Business-related equipment or liability

Always review your policy’s exclusion list thoroughly.

How to Calculate the Right Coverage for Your Condo

To avoid underinsuring or overpaying, calculate your insurance needs carefully.

Personal Property

- Use a home inventory app.

- Estimate the replacement cost (not the original purchase price).

Dwelling Coverage

- Use tools like Replacement Cost Estimators.

- Consider upgrades, custom fixtures, and flooring when calculating coverage needs.

The Role of Deductibles in Condo Insurance

A deductible is the amount you pay out of pocket before insurance kicks in.

Choosing the Right Deductible in 2025

- Higher deductibles = lower premiums, but more risk.

- HOA master policies might require you to match or exceed a specific deductible.

Always balance affordability with emergency preparedness.

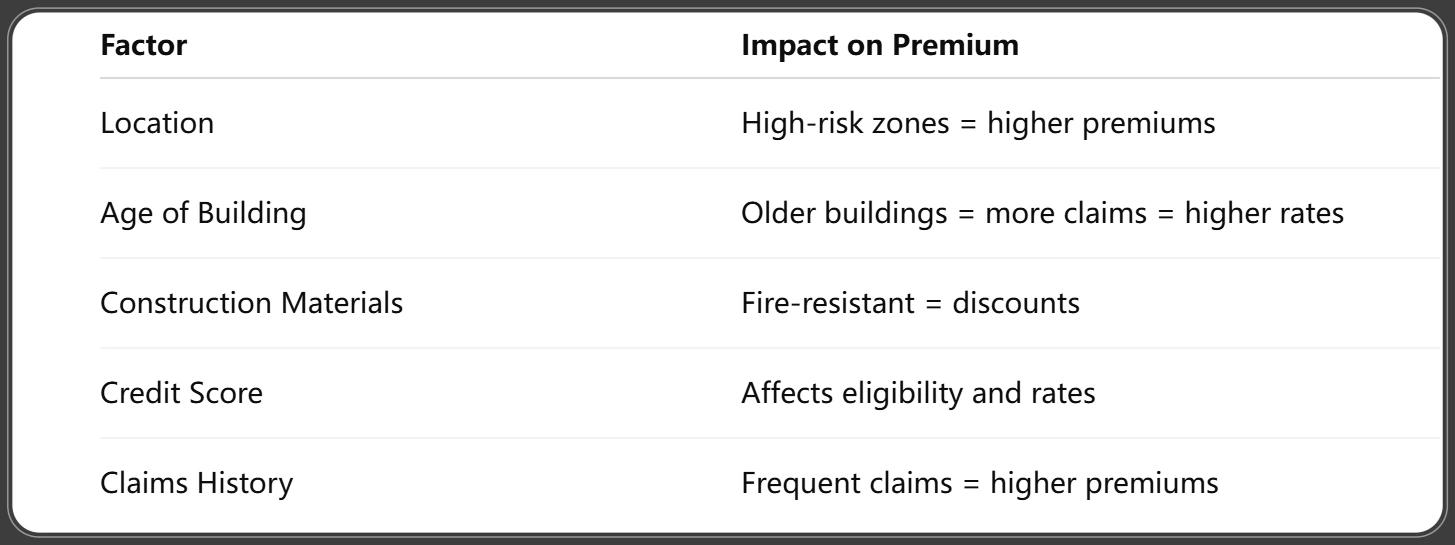

Factors Affecting Condo Insurance Premiums in 2025

Insurers weigh several factors to calculate your premium:

Tips to Save on Home Insurance for Condos in 2025

Everyone loves a discount. Here’s how to shave off costs:

- Bundle policies (auto + condo)

- Install smart security systems (smart locks, leak detectors)

- Ask about loyalty discounts

- Increase your deductible wisely

- Maintain a clean claims history

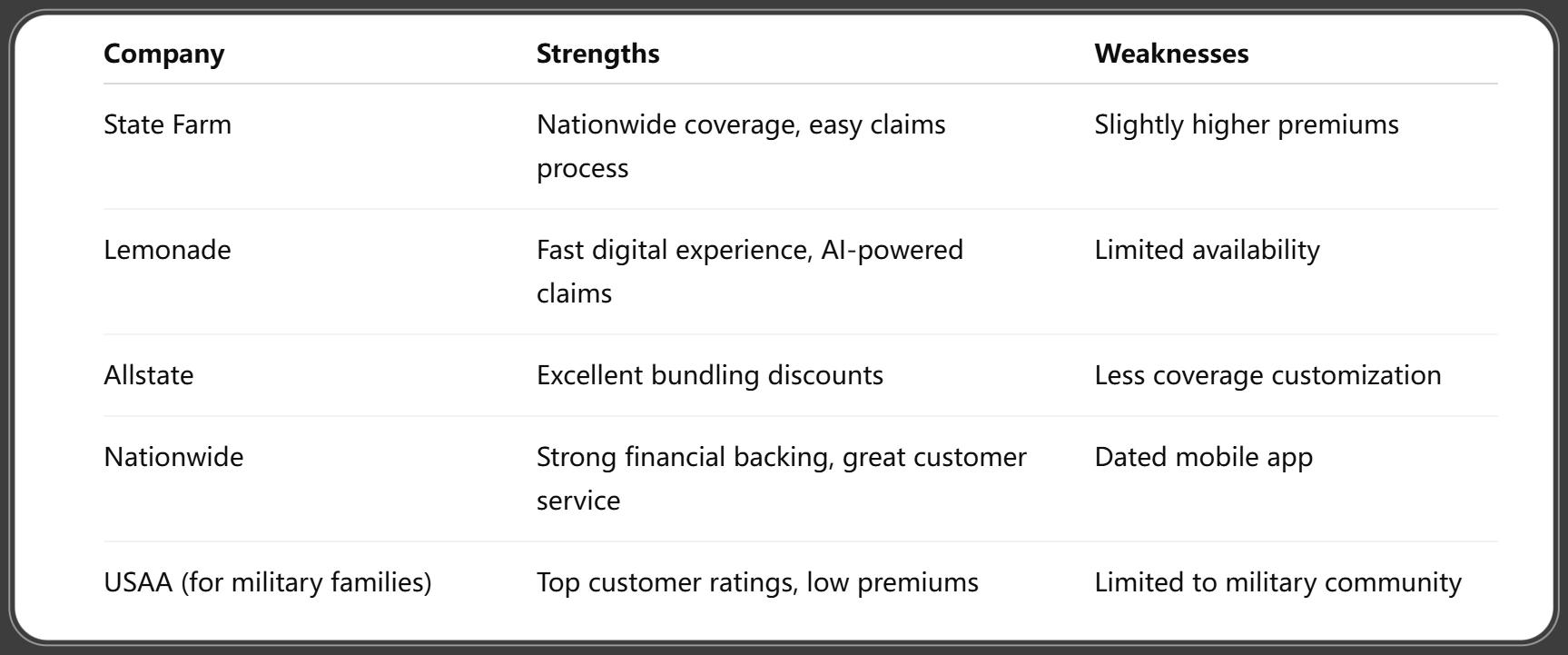

Comparing the Best Condo Insurance Providers in 2025

Here are five top-rated providers for condo insurance this year:

Always get at least three quotes to compare.

Claims Process for Condo Insurance Explained

Here’s how the claims process typically works in 2025:

- Document the damage (photos, videos)

- Contact your insurer ASAP

- Fill out the claim form (usually online)

- Adjuster visits or requests more info

- Settlement offer is issued

Claims processing can take 3 days to 3 weeks, depending on the complexity.

Special Considerations for High-Rise and Luxury Condos

Luxury and high-rise condos come with unique risks and higher replacement costs, so your insurance should match that value.

Key Points for High-Rise Units

- Elevator liability and shared infrastructure often result in higher HOA assessments.

- Fire spread risks are different in vertical buildings, which may affect liability premiums.

For Luxury Condo Owners

- Upgrade coverage for custom finishes, imported materials, or designer elements.

- Opt for extended replacement cost instead of standard actual cash value.

Insurers now offer high-value condo policies that include art, wine collections, or rare fixtures.

Rental vs. Owner-Occupied Condo Insurance Needs

Whether you rent out your condo or live in it affects the type of insurance you need.

If You’re Renting It Out

- Buy landlord insurance or a special rider.

- Covers loss of rental income, liability from tenant injuries, and building damage.

- Doesn’t protect your tenant’s property—they need renter’s insurance.

If You Occupy the Condo

- Standard HO-6 policy works.

- Add unit owners rental to others endorsement if you rent occasionally.

HOAs might restrict rentals, so always check HOA bylaws first.

Condo Insurance for Vacation Homes in 2025

Vacation condos come with seasonal and geographic considerations.

Common Risks

- Vacancy exclusions after 30-60 days (for unoccupied units).

- Burglary, mold, water damage while you're away.

How to Stay Protected

- Install remote monitoring systems (humidity, water leak sensors).

- Get vacation home endorsements or standalone vacation home policies.

Insurers now offer flexible policies for Airbnb or short-term rental coverage too.

Environmental Risks and Condo Insurance in 2025

Climate change is reshaping the insurance landscape, particularly for condo communities near coasts, mountains, and wildlands.

Rising Environmental Threats

- Wildfires in the West

- Hurricanes and flooding on the coasts

- Winter storm damage in the Northeast

What’s Changed in 2025

- Higher premiums in climate-impacted ZIP codes.

- More insurers require separate windstorm or flood coverage.

- Smart insurers are offering climate-adjusted risk scoring for tailored premiums.

Pro tip: Invest in mitigation improvements (storm shutters, non-combustible siding) for potential discounts.

Frequently Asked Questions About Condo Insurance in 2025

1. Do I need condo insurance if my HOA has a master policy?

Yes. The master policy covers the structure and shared areas, not your personal belongings or interior fixtures.

2. How much does condo insurance cost in 2025?

National average: $460–$900 annually, depending on your location, building age, and coverage level.

3. Is flood insurance included in my condo policy?

No. You must purchase separate flood insurance, usually through the National Flood Insurance Program (NFIP) or private providers.

4. What happens if I make renovations to my condo?

Notify your insurer. You may need to increase your dwelling coverage to account for added value or luxury features.

5. Can I bundle condo insurance with other policies?

Yes! Bundling with auto, life, or umbrella policies can reduce your premiums by up to 25%.

6. Does condo insurance cover my roommate’s belongings?

No. Each person needs their own condo or renters policy, unless they're a named insured.

Conclusion: Stay Protected and Informed in 2025

Condo insurance isn’t just a legal or lender requirement—it’s your safety net. In 2025, as property values climb and climate risks grow, your home insurance for condos 2025 policy needs to be as modern as your lifestyle.

Quick Recap:

- Understand your HOA’s master policy.

- Choose the right HO-6 coverage for your needs.

- Stay updated with legal changes and climate-related risks.

- Shop around and use smart tech to reduce costs.

With the right policy in place, your condo—and everything in it—is safe, sound, and secure.

You Might Also Like

Home Insurance Replacement Cost 2025: The Ultimate Guide to Full Home Protection

Aug 1, 2025Home Insurance for Rental Property 2025: 15 Key Updates Landlords Must Know

Aug 1, 2025Home Insurance Cancellation Rights 2025: Know Your Legal Protections & Next Steps

Aug 1, 2025Home Insurance Inflation Guard 2025: Why You Absolutely Need It Now

Aug 1, 20259 Critical Steps for Getting Home Insurance After a Claim in 2025

Aug 1, 2025