Home Insurance for Rental Property 2025: 15 Key Updates Landlords Must Know

Published on August 1, 2025

Sarah Patel

Homeowners & Property Insurance Expert.

Sarah Patel is a property underwriter-turned-writer with 10 years in the field; she focuses on flood, wildfire, and replacement-cost planning for homeowners.

Owning rental property can be a smart investment—but only if it’s properly protected. In 2025, landlord risks are on the rise, and policies are evolving fast. From new liability rules to smart tech discounts, home insurance for rental property 2025 is more than just a policy—it's a necessity.

In this guide, we’ll walk through everything landlords need to know to keep their rental homes secure, compliant, and fully covered in today’s insurance climate.

What Is Rental Property Insurance and Why It’s Different From Homeowners Insurance

Rental property insurance, also called landlord insurance, is specifically designed to protect properties that are not owner-occupied. Unlike standard homeowners insurance, which covers your personal residence, landlord policies protect income-generating homes leased to tenants.

Why You Need It:

- Standard policies may deny claims if the home is rented out.

- Tenants bring different risks: liability, damage, and income interruption.

- Legal requirements in some states now mandate landlord coverage.

In 2025, many providers now flag rentals during underwriting using AI and public records. Trying to "hide" your rental status could lead to a denied claim or even legal action.

Key Components of Rental Property Insurance in 2025

A complete landlord insurance policy should include the following:

1. Dwelling Coverage

Pays to repair or rebuild the structure if damaged by covered events (e.g., fire, storm, vandalism).

2. Landlord Liability

Protects you if someone gets injured on your property and holds you liable.

3. Loss of Rental Income

Covers lost rent if the home becomes uninhabitable due to a covered loss (e.g., fire, flood).

4. Optional Coverages

- Vandalism/malicious mischief by tenants

- Building ordinance upgrades

- Appliance and HVAC system damage

New Coverage Trends and Policy Features in 2025

What's Emerging in 2025:

- Smart device integration (leak detectors, thermostats) reduces premiums.

- Mold, sewer backup, and flood endorsements more common.

- Rent guarantee insurance: covers rent if a tenant stops paying.

- Digital-first claims processing: mobile uploads, AI adjusters, 24-hour approvals.

Policies are now more customizable than ever, allowing landlords to tailor protections to property type, rental frequency, and tenant risk level.

How AI and Risk-Based Pricing Are Changing Rental Property Insurance

Insurers in 2025 use real-time data to personalize pricing and evaluate risk. Key features include:

- Risk scoring algorithms: consider past tenant behavior, ZIP code trends, and maintenance history.

- AI underwriting: identifies underinsured properties and suggests coverage upgrades.

- Dynamic pricing models: adjust premiums based on updated risk data and regional claims.

This means two identical homes on the same street can have different premiums based on occupancy, upgrades, and even Wi-Fi-connected devices.

Legal Requirements for Rental Insurance in 2025

Some states have enacted stricter landlord compliance laws:

- Mandatory rental registration and insurance disclosure

- Laws in California, Oregon, and New York now require proof of landlord insurance for certain types of rental licenses.

- Fines or noncompliance may lead to eviction bans or permit revocation.

Always check your city or county's landlord-tenant ordinance to confirm legal coverage requirements.

Understanding Named Perils vs. All-Risk Policies

Named Perils

Covers only the risks specifically listed (e.g., fire, theft, hail).

All-Risk (Open Peril)

Covers everything except what’s specifically excluded.

In 2025:

- All-risk policies are preferred for higher-value rentals.

- Named peril plans may be cheaper, but carry more denial risks.

- Always review exclusions for mold, tenant damage, pest infestations, and earthquake/flood events.

How Much Coverage Do You Really Need in 2025?

Coverage depends on:

- Rebuild cost per square foot in your ZIP code

- Dwelling type (single-family, duplex, multi-unit)

- Whether you’re furnishing the unit (student rentals, Airbnbs)

Pro Tips:

- Don’t rely on market value—focus on replacement cost.

- Liability coverage should start at $500,000 minimum.

- Consider an umbrella policy if you own multiple units.

Cost of Rental Property Insurance in 2025

In 2025, rental property insurance costs have increased moderately due to inflation, climate risks, and evolving liability standards.

Average Premiums:

- Single-family rental (SFH): $1,200–$2,000 annually

- Multi-family duplex/triplex: $2,500–$5,000 annually

- Short-term rental (Airbnb/VRBO): $3,000–$6,500 annually

Premiums vary based on:

- Property location and ZIP code risk level

- Building age and materials

- Claims history and property upgrades

- Tenant profile (e.g., long-term vs. short-term renters)

Factors That Impact Rental Property Insurance Rates

1. Location

- Coastal properties or wildfire zones cost more.

- Proximity to emergency services lowers premiums.

2. Property Condition

- Older wiring, outdated plumbing, or lack of HVAC maintenance can increase rates.

3. Claims History

- Previous property or personal claims raise red flags.

4. Tenant Type

- Student housing, vacation rentals, or multi-tenant units are deemed higher risk.

Insurers in 2025 also review smart tech installations, structural upgrades, and occupancy records to adjust your premium.

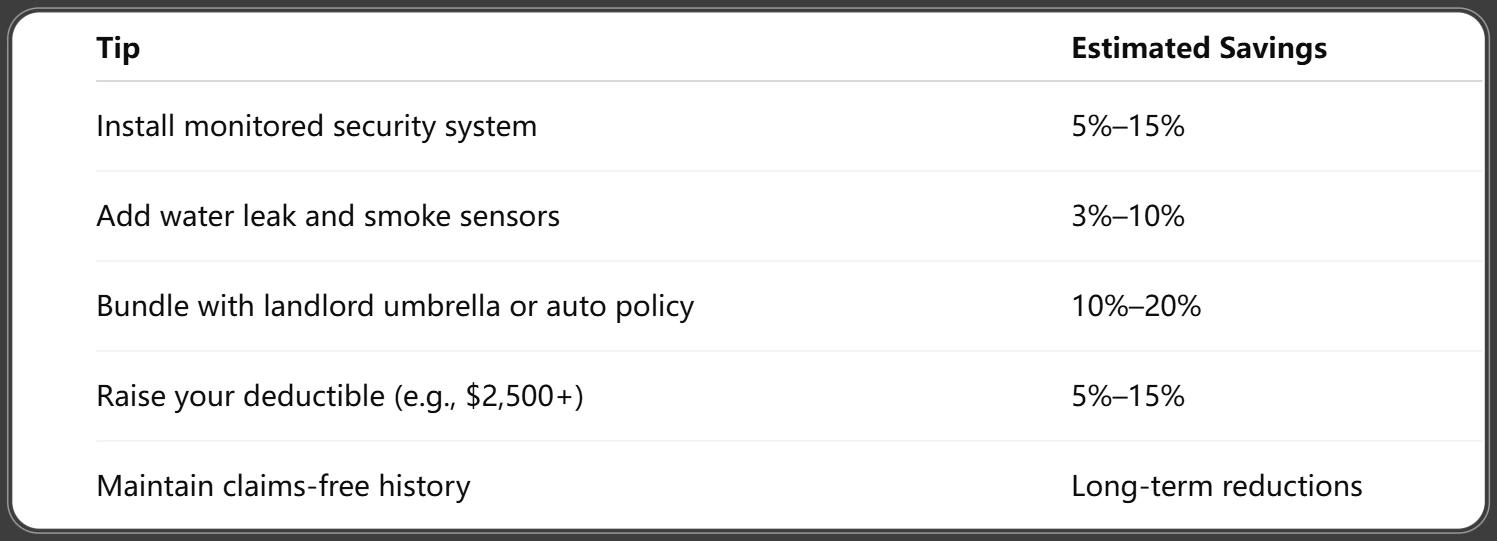

Tips to Reduce Premiums Without Cutting Coverage

You don’t have to sacrifice protection to save money. Try these strategies:

Additionally, insurers may offer loyalty, multi-property, or paid-in-full discounts—be sure to ask.

The Role of Tenant Insurance in Landlord Protection

Landlords are increasingly requiring tenants to carry renter’s insurance—and for good reason.

Benefits to Landlords:

- Reduces your liability for tenant property damage

- Covers tenant negligence (e.g., fire from cooking)

- May reduce your own insurance claims (and keep your premiums lower)

In 2025, some providers offer "tenant liability waivers" that allow landlords to enroll tenants in base-level coverage if they fail to purchase their own.

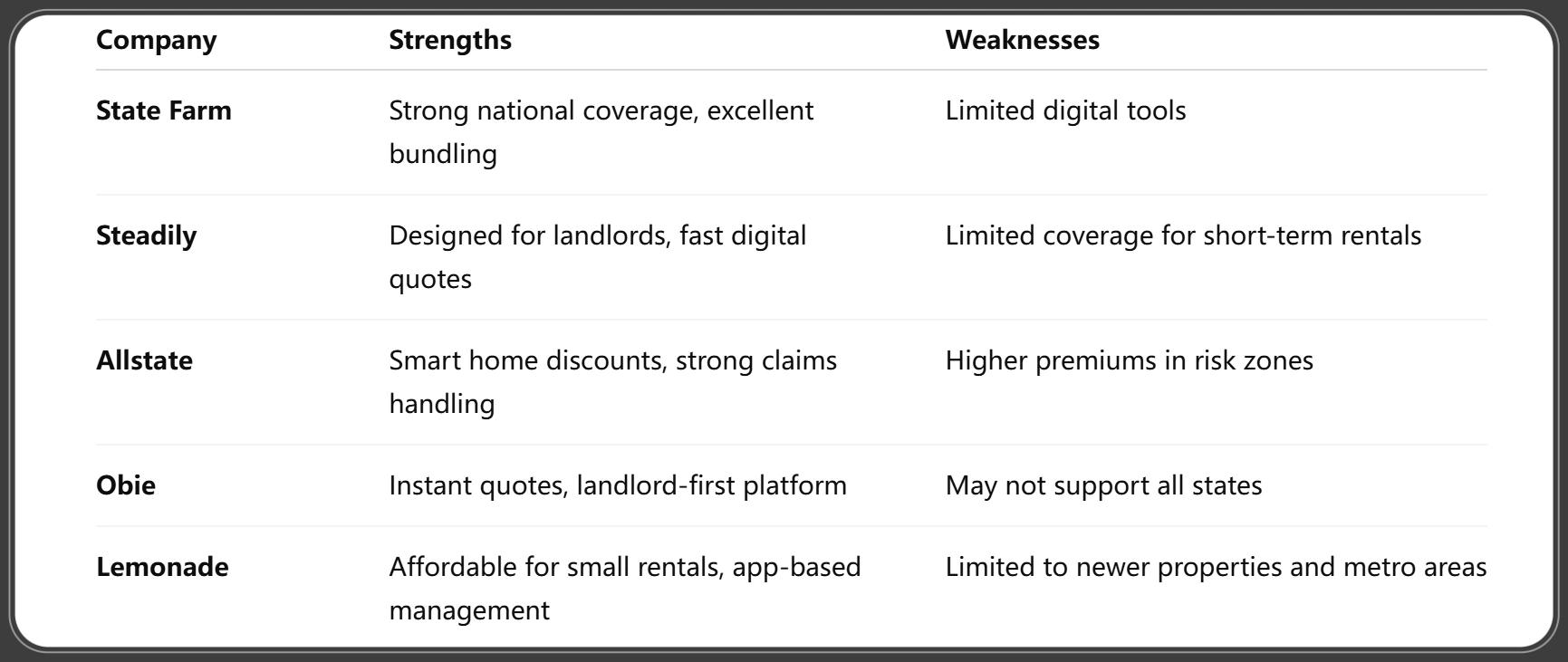

Best Rental Property Insurance Providers in 2025

Here are top insurers for landlord policies based on value, flexibility, and innovation:

Always compare at least three quotes before choosing a provider.

How to File a Claim for a Rental Property in 2025

If disaster strikes or damage occurs:

- Document everything (photos, videos, repair estimates).

- Notify your insurer as soon as possible.

- Coordinate with your tenant to collect incident details.

- Keep receipts for temporary repairs or loss mitigation.

- Avoid unnecessary delays—file your claim within 72 hours.

Pro tip: Use claim tracking apps or portals provided by your insurer for faster updates and approvals.

Short-Term Rentals and Airbnb Insurance in 2025

Standard landlord policies do not cover vacation rentals unless explicitly endorsed.

2025 Requirements:

- Use commercial landlord coverage or specialized Airbnb add-ons.

- Platforms like Airbnb and Vrbo offer host guarantees, but these are not insurance.

- Many local laws now require proof of short-term rental insurance to issue permits or licenses.

Common Coverage Gaps:

- Guest injuries

- Property damage by short-term renters

- Theft of owner’s belongings

Get a vacation rental endorsement or standalone short-term rental policy to ensure full protection.

Frequently Asked Questions About Rental Property Insurance in 2025

1. Is landlord insurance tax-deductible?

Yes. Premiums for rental property insurance are generally tax-deductible as a business expense.

2. Does my landlord policy cover tenant belongings?

No. Tenants must carry their own renter’s insurance for personal property.

3. What’s the difference between personal liability and landlord liability?

Landlord liability protects your legal responsibility as a rental owner, while personal liability covers incidents at your primary residence.

4. Can I use standard homeowners insurance if I rent occasionally?

Not in most cases. Even occasional rentals void homeowners policies without the right endorsements.

5. How much liability coverage should landlords carry?

At least $500,000, though $1 million is recommended—especially for multi-unit or high-traffic properties.

6. Do I need different insurance for furnished rentals?

Yes. You'll need contents coverage or add a rider for furnishings like beds, sofas, and appliances.

Conclusion: Insure Smart and Stay Protected in 2025

The rental property insurance landscape has evolved dramatically—and so must your policy.

Final Checklist for 2025:

- ✅ Verify your policy includes loss of rent, liability, and tenant damage coverage.

- ✅ Require tenants to carry renter’s insurance.

- ✅ Use smart technology for discounts and protection.

- ✅ Shop around for competitive rates and landlord-specific providers.

- ✅ Ensure you're covered for short-term or furnished rentals if applicable.

In 2025, protecting your rental isn’t just about bricks and mortar—it’s about staying informed, staying insured, and staying ahead.

You Might Also Like

Home Insurance Replacement Cost 2025: The Ultimate Guide to Full Home Protection

Aug 1, 2025Home Insurance Cancellation Rights 2025: Know Your Legal Protections & Next Steps

Aug 1, 2025Home Insurance Inflation Guard 2025: Why You Absolutely Need It Now

Aug 1, 20259 Critical Steps for Getting Home Insurance After a Claim in 2025

Aug 1, 2025Top 17 Must-Know Facts About Home Insurance for Condos 2025

Aug 1, 2025