Guaranteed Issue Life Insurance: No‑Medical Exams Explained (2025 Buyer’s Guide)

Published on July 29, 2025

Emma Carter

Senior Insurance Editor

Emma Carter is a senior insurance editor with 12 years in P&C publishing and agency work; she simplifies policy details for everyday readers.

Guaranteed Issue Life Insurance: No‑Medical Exams Explained (2025 Buyer’s Guide)

Life insurance plays a vital role in protecting your loved ones financially. But what if you’ve been denied coverage, have health concerns, or simply don’t want to undergo a medical exam? That’s where guaranteed issue life insurance steps in.

In this comprehensive guide, you’ll learn everything about guaranteed issue life insurance: no‑medical exams explained—from how it works, who it’s for, how much it costs, to the pros and cons. Whether you're exploring final expense coverage or need an alternative to traditional policies, this 2025 guide has you covered.

What Is Guaranteed Issue Life Insurance?

Definition and Key Features

Guaranteed issue life insurance is a type of whole life policy that offers automatic acceptance without a medical exam. Applicants are not required to answer health questions, provide medical records, or undergo lab testing.

Key features:

- No medical exams required

- Fixed premiums for life

- Permanent coverage (as long as premiums are paid)

- Typically small death benefits ($2,000–$25,000)

Guaranteed Acceptance vs Simplified Issue

- Guaranteed issue = No medical questions, no health checks, and 100% acceptance for eligible age ranges.

- Simplified issue = No exam, but some health questions; not all applicants are approved.

No Medical Exam: What That Really Means

“No medical exam” means no bloodwork, no doctor visits, and no physicals. However, insurers may still verify age and identity through public records and may implement a waiting period for full benefits.

Who Can Benefit from Guaranteed Issue Policies?

Seniors Over 50 or 60

Guaranteed issue is commonly marketed to older adults, especially those between ages 50 to 80, who may face higher denial rates for traditional policies.

Individuals with Health Conditions

If you have:

- Cancer

- Diabetes

- Heart disease

- Kidney failure

- Or are terminally ill

…you likely qualify under guaranteed issue since health doesn’t affect eligibility.

People Denied Traditional Coverage

This policy offers a second chance to those rejected due to health, age, or occupation.

Final Expense Planning

Many use guaranteed issue to cover funeral costs, unpaid medical bills, or debts left behind—avoiding financial stress for loved ones.

How Does Guaranteed Issue Compare to Other Life Insurance?

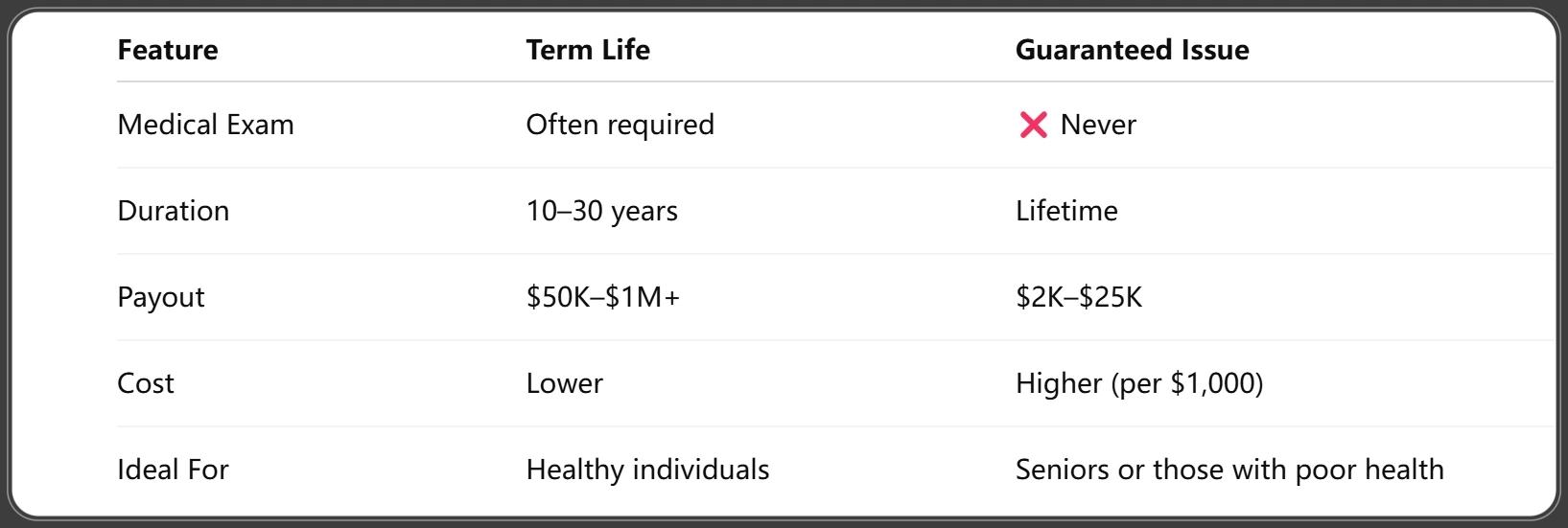

Term Life vs Guaranteed Issue

CSG Actuarial. (2025, February 21). Life Insurance Facts and Statistics 2025. Retrieved February 21, 2025.

Whole Life vs Guaranteed Issue

Guaranteed issue is technically a form of whole life, but standard whole life policies offer:

- Higher coverage limits

- Cash value accumulation

- Stricter underwriting

Simplified Issue vs Guaranteed Issue

Simplified issue requires a health questionnaire. Premiums are lower than guaranteed issue, but approval isn’t guaranteed.

What’s Covered and What’s Not?

Death Benefits

Your beneficiary receives a tax-free lump sum—often used to pay for burial, medical bills, or debt.

Graded Benefit Periods

Most policies include a 2- or 3-year waiting period. If death occurs during this time from natural causes, the insurer refunds your premiums plus interest instead of paying the full death benefit.

Accidental Death vs Natural Causes

If you pass away due to an accident during the graded period, full benefits are usually paid out.

Pros and Cons of Guaranteed Issue Life Insurance

Advantages

- No medical exam or health questions

- Guaranteed approval for qualifying ages

- Fixed premiums for life

- Ideal for final expense coverage

Drawbacks

- Higher cost per $1,000 coverage

- Low coverage limits

- Waiting period for natural death claims

When It Makes the Most Sense

- You've been declined for traditional life insurance

- You have terminal or serious health conditions

- You need just enough coverage for final expenses

Understanding the Graded Benefit Period

How Long It Lasts

Typically 2 years, though some insurers may extend it to 3 years depending on the policy.

What Happens If You Die Within 2 Years?

- Natural death: Beneficiary receives a refund of premiums plus 5–10% interest

- Accidental death: Full death benefit is paid

Refund of Premiums with Interest

This safety net ensures your premiums aren't “wasted” if you pass away early—your family still receives something back.

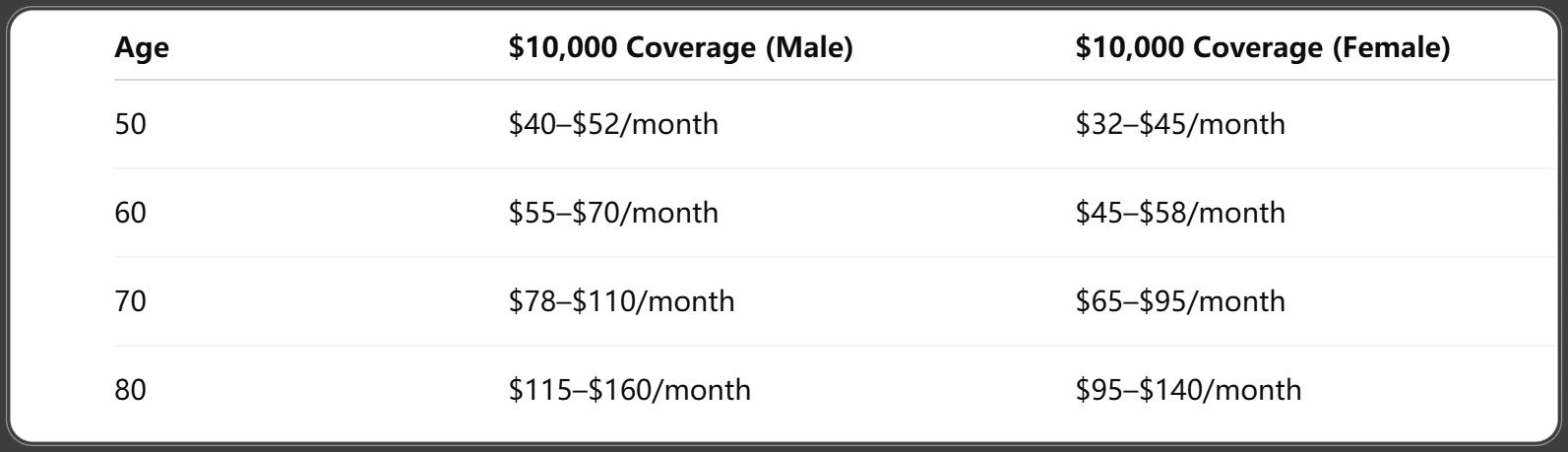

Typical Costs and Coverage Amounts (2025 Data)

Average Premium Ranges by Age

LIMRA. (2025, January 8). What’s Ahead for the U.S. Individual Life Insurance Market in 2025? [Web article]. Retrieved January 8, 2025.

Maximum Coverage Limits

- Most insurers cap guaranteed issue life at $25,000

- Some allow up to $40,000 with underwriting or multiple policies

Male vs Female Rates

Women typically pay 10–20% less due to longer life expectancy.

Top Guaranteed Issue Life Insurance Providers (2025)

AIG

- Coverage: $5,000–$25,000

- Ages: 50–80

- Graded benefit: 2 years

- Trustpilot rating: 4.5/5

Mutual of Omaha

- Coverage: $2,000–$25,000

- Ages: 45–85

- Quick online application

- Strong customer support

Gerber Life

- Known for child policies, but also offers senior life

- Competitive pricing for ages 50+

- Solid brand trust

Great Western Insurance

- One of the few that covers people over 80

- Graded and modified benefit options

- Specializes in final expense planning

How to Apply and Qualify Instantly

What Information Is Needed

- Age

- Address

- Gender

- Beneficiary details

- Payment information

How Long Approval Takes

Instant or same-day approval is common. No waiting for lab results or paperwork.

Can You Buy Online or Over the Phone?

Yes—most providers allow e-signatures and online applications, with customer support by phone if needed.

Common Misconceptions About No-Medical Exam Insurance

“It Covers Everything Immediately”

False. Graded benefits mean your full coverage doesn’t kick in until after 2–3 years for natural causes.

“It’s Only for Sick People”

No. While designed for those with health issues, anyone can buy it—though younger and healthier people pay more for less coverage.

“It’s the Cheapest Option”

No. It's more expensive per $1,000 of coverage than traditional policies due to the insurer's higher risk.

Tips for Finding the Best Guaranteed Issue Policy

Compare Multiple Quotes

Use platforms like Policygenius, Trust & Will, or Ethos to compare guaranteed issue products side-by-side.

Check the Insurer’s Financial Strength

Look for an AM Best rating of A or higher to ensure the company can pay claims.

Read the Fine Print

- Graded benefit clauses

- Premium increases

- Exclusions for specific causes of death

Alternatives to Guaranteed Issue Life Insurance

Simplified Issue Life Insurance

Same quick application process, but with a short health questionnaire. Lower premiums if you qualify.

Group Life Through Employers

May offer guaranteed acceptance with no exam, especially during open enrollment. But coverage usually ends when employment does.

Term Life with No-Exam Options

Some insurers now offer term policies with no medical exam if you're under a certain age and in fair health.

Frequently Asked Questions

Is guaranteed issue life insurance a good deal?

Yes—if you’re uninsurable elsewhere. It offers peace of mind, even though it’s pricier per dollar of coverage.

Can anyone get guaranteed life insurance?

Most companies limit it to ages 50–80 or 85. Other than that, it’s open to nearly everyone.

How fast does coverage start?

Immediately for accidental death. Full benefits for natural causes usually start after 2–3 years.

What happens if I die during the waiting period?

Your family receives a refund of all paid premiums, often with 5–10% interest.

What’s the max coverage I can get?

Usually $25,000, but a few providers go higher or allow multiple policies.

Is guaranteed issue better than term life?

Only if you don’t qualify for term due to age or health. Otherwise, term is cheaper with more coverage.

Conclusion: Is Guaranteed Issue Life Insurance Right for You?

Guaranteed issue life insurance is a powerful tool for people who need peace of mind but can’t qualify for traditional coverage. It’s not for everyone—it costs more and offers less—but when medical history or age blocks your options, this policy ensures you’re still protected.

If you’re between 50 and 80, want to cover your final expenses, and don’t want to deal with medical exams, guaranteed issue might be your best choice. Just be sure to understand the waiting period, compare quotes, and choose a reliable insurer.

You Might Also Like

Whole Life Insurance 101: Is It Right for You?(2025)

Jul 30, 2025Use a Life Insurance Calculator to Find Your Perfect Coverage (2025 Smart Guide)

Jul 29, 2025Life Insurance for Seniors Over 60: What You Need to Know (2025 Expert Guide)

Jul 29, 2025Why Young Adults Need Life Insurance: A Beginner’s Guide (2025 Edition)

Jul 29, 2025Life Insurance Rates by Age: How Your Premium Changes Over Time (Complete 2025 Guide)

Jul 29, 2025