Why Young Adults Need Life Insurance: A Beginner’s Guide (2025 Edition)

Published on July 29, 2025

Emma Carter

Senior Insurance Editor

Emma Carter is a senior insurance editor with 12 years in P&C publishing and agency work; she simplifies policy details for everyday readers.

Why Young Adults Need Life Insurance: A Beginner’s Guide (2025 Edition)

When you’re young, life is full of dreams, adventures, and possibilities—not insurance paperwork. But here's the truth: life insurance isn’t just for the old or wealthy. It’s one of the smartest financial decisions a young adult can make. This beginner’s guide to why young adults need life insurance will break down how it works, why it matters, and how you can start protecting your future today.

What Is Life Insurance and How Does It Work?

Basic Terms Explained (Premium, Term, Beneficiary)

- Premium: The monthly (or annual) payment you make to keep your policy active.

- Term: The length of time your policy is in effect (e.g., 10, 20, or 30 years).

- Beneficiary: The person or entity who receives the payout (death benefit) if you pass away.

Types of Life Insurance Policies

- Term Life Insurance: Affordable, temporary coverage.

- Whole Life Insurance: Permanent coverage with a savings component (cash value).

- Universal Life Insurance: Flexible permanent coverage with adjustable premiums.

Who Gets the Money and When?

If you die while the policy is active, your beneficiary receives a lump-sum payout, which is typically tax-free.

Common Misconceptions Among Young Adults

“I Don’t Have Dependents”

Even if you're single with no kids, you may still have:

- Student loans with a cosigner

- Credit card debt

- Family who’d handle your final expenses

“It’s Too Expensive”

For young, healthy adults, term life insurance can cost less than $1 per day—cheaper than a streaming subscription.

“I’m Too Young to Think About Death”

Life insurance isn’t about expecting the worst. It’s about protecting your goals and the people who matter most in case life throws a curveball.

The Financial Benefits of Buying Life Insurance Early

Locking in Low Premiums While Healthy

Rates are lowest when you’re young and healthy. A 25-year-old may pay less than $20/month for $500,000 in coverage.

Guaranteed Insurability

Buying early means you won’t be denied coverage later—even if you develop a medical condition.

Long-Term Financial Planning

- Some policies build cash value

- Can supplement emergency savings or future borrowing

- Helps build a solid financial foundation

Who Should Young Adults Name as Beneficiaries?

Parents or Guardians

If they co-signed your loans or would be responsible for funeral costs, they should be first in line.

Partners or Spouses

They may rely on your income or shared living expenses.

Siblings or Charitable Organizations

No dependents? Leave a legacy by naming a sibling or donating to a cause that matters to you.

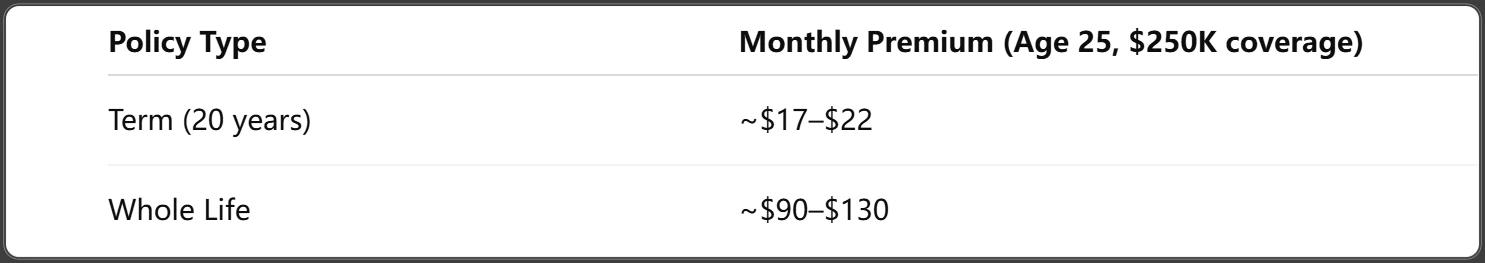

Term Life vs Whole Life for Young Adults

Cost Comparison

LIMRA. (2025, January 8). What’s Ahead for the U.S. Individual Life Insurance Market in 2025? [Web article]. Retrieved January 8, 2025.

Flexibility and Coverage Duration

- Term: Great for covering debts, mortgage, or temporary needs.

- Whole Life: Offers lifetime coverage plus cash value—but at a higher cost.

Which One Makes More Sense for Beginners?

Term life is usually the best starting point for young adults due to its affordability and simplicity.

Situations Where Life Insurance Really Helps Young Adults

Student Loan Debt with a Cosigner

If your parents helped with your loans, life insurance ensures they’re not stuck with debt after your passing.

Young Families with Kids

You want to make sure your child has food, shelter, and education—even if you’re not there.

Business Ownership or Side Hustles

If someone depends on your income or you have small business debt, insurance protects your work and partners.

Can You Afford It? Monthly Costs for Young Adults (2025)

Premium Examples by Age and Gender

IAIS. (2025, June 9). Global Insurance Market Report (Mid-Year Update) [PDF]. Retrieved June 9, 2025.

No-Exam Policy Options

Companies like Ladder, Fabric, and Ethos offer instant approval policies without a medical exam—perfect for busy young adults.

Budget-Friendly Starter Policies

Even $100,000 of coverage for a 20-year term can cost less than $10/month.

The Role of Employer-Provided Life Insurance

Group Coverage Basics

Many employers offer 1x–2x your salary in free group life coverage.

Limitations of Work-Based Policies

- Ends if you leave your job

- Usually not enough to cover long-term needs

- No control over terms or beneficiaries

Why You Still Need a Personal Plan

A private policy gives you full control and stays with you no matter where you work.

Real Stories: Young Adults Who Benefited from Life Insurance

Covering Final Expenses Unexpectedly

A 28-year-old with no dependents died in an accident. His $250K policy paid off student loans and funeral costs, relieving his parents of financial stress.

Supporting Family After a Tragedy

A young mother passed unexpectedly. Her term policy ensured her child had financial support and stability.

Using Cash Value for Emergencies

A 35-year-old used the cash value in his whole life policy to pay off medical bills after a job loss.

How to Buy Life Insurance as a Beginner

Choosing the Right Type and Amount

Ask:

- Do I have debt?

- Who relies on me financially?

- What do I want to protect?

Use these answers to decide between term vs whole and how much coverage to get.

Comparing Quotes Online

Use tools like:

- Policygenius

- Quotacy

- Ladder

They let you see real prices in minutes.

Working with a Licensed Agent

Not sure what to choose? A licensed life insurance agent can walk you through options—often at no extra cost.

Tips to Maximize Value and Minimize Costs

Apply Young and Healthy

The earlier you buy, the cheaper it is—even if you don’t think you “need” it yet.

Ask About Discounts and Riders

- Non-smoker discounts

- Accelerated death benefit riders

- Waiver of premium

Avoid Over-Insuring Too Early

Start with what you need now—you can always increase your coverage later.

What Happens If You Cancel or Outlive the Policy?

Term Life Outcomes

- If you outlive the term: The policy ends, no payout (like renting a safety net)

- Some companies offer return-of-premium riders

Cash Value Withdrawals

Whole life policies accumulate cash you can borrow against—but it may reduce your death benefit.

Converting Term to Permanent Coverage

Many term policies let you convert to whole life later—no medical exam required.

Frequently Asked Questions

Do I really need life insurance if I’m single?

Yes—especially if you have debts, cosigners, or want to leave something for family or causes.

What if I have no debt or kids?

Then a small policy may be enough for now—just to cover funeral costs or future financial planning.

Can I change my beneficiary later?

Absolutely. Most policies allow you to update beneficiaries anytime.

Is life insurance a waste if I outlive the term?

No. It gave you protection during your most financially vulnerable years. Consider converting or upgrading if needed.

Will my premiums go up as I age?

Not if you lock in a term or whole life policy now. Otherwise, yes—they’ll rise if you wait to apply later.

What if I get sick later in life?

Your current policy remains active. Buying young protects you from being denied coverage later.

Conclusion: Secure Your Future Early and Build a Financial Foundation

Life insurance is not about preparing for death—it’s about protecting life. As a young adult, it’s one of the smartest, most affordable investments you can make for yourself and those you love. Whether it’s student debt, family planning, or simply wanting peace of mind, life insurance gives you a head start toward financial security.

Don’t wait until life gets complicated—start today while rates are low and options are wide.

You Might Also Like

Whole Life Insurance 101: Is It Right for You?(2025)

Jul 30, 2025Use a Life Insurance Calculator to Find Your Perfect Coverage (2025 Smart Guide)

Jul 29, 2025Life Insurance for Seniors Over 60: What You Need to Know (2025 Expert Guide)

Jul 29, 2025Guaranteed Issue Life Insurance: No‑Medical Exams Explained (2025 Buyer’s Guide)

Jul 29, 2025Life Insurance Rates by Age: How Your Premium Changes Over Time (Complete 2025 Guide)

Jul 29, 2025