Life Insurance Rates by Age: How Your Premium Changes Over Time (Complete 2025 Guide)

Published on July 29, 2025

Emma Carter

Senior Insurance Editor

Emma Carter is a senior insurance editor with 12 years in P&C publishing and agency work; she simplifies policy details for everyday readers.

Life Insurance Rates by Age: How Your Premium Changes Over Time (Complete 2025 Guide)

Life insurance is one of the smartest financial tools you can use to protect your loved ones. But did you know that your age is one of the biggest factors in determining how much you’ll pay for coverage? This guide explores life insurance rates by age: how your premium changes over time, and why buying early could save you thousands of dollars over the life of your policy.

Why Age Is a Major Factor in Life Insurance Pricing

The Actuarial Logic Behind Age-Based Premiums

Life insurance is all about risk. The older you are, the higher your risk of passing away during the policy term, and the higher the premium you’ll pay. Insurance companies use actuarial tables—statistical models based on millions of people—to determine how likely you are to file a claim (i.e., pass away) at each age.

How Insurers Evaluate Mortality Risk

In addition to age, insurers assess:

- Gender

- Medical history

- Family health background

- Lifestyle factors (smoking, skydiving, etc.)

But age is the primary variable in all underwriting decisions.

The Cost of Waiting Too Long

Delaying your purchase by just 5 or 10 years can double—or even triple—your premium. In some cases, waiting too long could result in denial of coverage due to age or health conditions.

How Term and Whole Life Policies React to Age

Term Life Rate Increases by Age Group

Term life is the most popular option, and rates go up with every passing decade. A healthy 25-year-old pays far less than a 45-year-old for the same coverage and term length.

Whole Life Premium Structures

Whole life insurance typically has level premiums, meaning the cost stays the same for life. However, buying it at 50 or 60 makes it far more expensive upfront than purchasing in your 20s or 30s.

Which Is Better as You Age?

- Younger buyers benefit most from term life with lower costs and higher coverage.

- Older buyers might consider whole life or final expense policies for legacy planning or covering funeral costs.

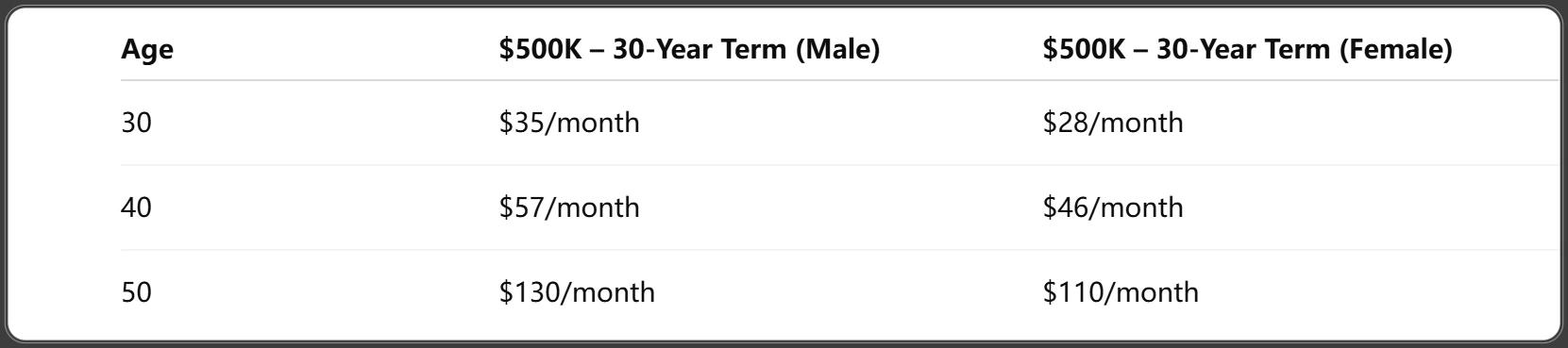

Life Insurance Rate Chart by Age (2025 Estimates)

Sample Monthly Premiums (Term Life)

Feather-Insurance. (2025, July 4). Top Life Insurance Statistics, Trends & Facts (2025). Retrieved July 4, 2025.

Whole Life Premium Examples

Whole life premiums are significantly higher. For example:

- Male, age 30, $100K coverage: ~$90/month

- Male, age 50, $100K coverage: ~$200/month

- Male, age 60, $100K coverage: ~$310/month

Premium Escalation Timeline

Premiums begin to climb quickly after age 40. After 50, each passing year significantly increases costs and limits your options.

Life Insurance Rates in Your 20s

Why It’s the Best Time to Buy

- You’re at peak health

- Lock in low, level premiums

- Ideal time for long-term term policies (30 years)

Average Costs

As little as $12–$18 per month for a $250,000 term policy.

Tips for Young Adults

- Choose a 30-year term to cover long-term debt and future family needs.

- Consider convertible term if unsure about permanent insurance.

Life Insurance Rates in Your 30s

Cost Trends and Health Factors

Still very affordable—often just a few dollars more than in your 20s. However, minor health issues may start impacting rates.

Ideal Term Lengths

- 20- or 30-year terms to cover mortgage and child-rearing years.

Family Planning Considerations

Now’s a good time to increase coverage to include dependents and spouse.

Life Insurance Rates in Your 40s

What to Expect in Pricing

Premiums begin to rise significantly—expect to pay 2x what you would have in your 30s.

Renewing Existing Term Policies

If you bought in your 20s, your policy might be halfway done. You can often renew or convert to permanent insurance, but rates will be higher.

Buying with Existing Health Conditions

High blood pressure, cholesterol, or mild diabetes can increase premiums. Consider no-exam policies if you’re borderline.

Life Insurance Rates in Your 50s

Higher Premiums and Shorter Terms

At this stage, expect premiums to triple or quadruple compared to younger ages. Most insurers offer 10–20 year terms.

Whole Life as a Wealth Tool

Many opt for whole life or universal life insurance for estate planning or tax-advantaged wealth transfer.

Getting Medical Exams vs No-Exam Options

Medical exams often yield better rates, but no-exam policies provide convenience with faster approval (albeit at a higher price).

Life Insurance Rates in Your 60s and Beyond

Coverage Options for Seniors

- 10-year term policies

- Guaranteed issue life (no medical exam)

- Final expense insurance

Term Life Availability

Limited, but possible up to age 75. Coverage amounts and terms are smaller and more expensive.

Final Expense and Guaranteed Issue Plans

Best for covering funeral and basic legacy expenses. No health questions required, but benefits are capped (usually $5,000–$25,000).

Sample Quotes from Real Providers (2025)

10-, 20-, and 30-Year Term Examples

LIMRA. (2025). U.S. Individual Life Insurance – Overall Life Sales, First Quarter 2025 [PDF report]. Retrieved March/April 2025.

Male vs Female Pricing Differences

Women consistently pay 10–20% less due to statistically longer life expectancy.

Smoker vs Non-Smoker Rates

- 30-Year-Old Male (Smoker): $82/month for $250K

- 30-Year-Old Male (Non-Smoker): $18/month for $250K

Smoking can more than quadruple your premium.

Other Factors That Influence Life Insurance Premiums

Health and Medical History

- BMI

- Blood pressure

- Cholesterol

- Family history (e.g., early heart disease)

Occupation and Lifestyle Risks

- Pilots, construction workers, or high-risk jobs may face surcharges.

- Hobbies like scuba diving or racing may also increase rates.

Policy Amount and Riders

- Higher coverage = higher premium

- Add-ons like child riders, return of premium, and accidental death increase cost

How to Lock in the Best Life Insurance Rate

Apply Young and Healthy

It’s simple: the younger and healthier you are, the cheaper your rate. Lock it in now—especially if you anticipate future health issues.

Bundle or Ladder Policies

Consider laddering: multiple term policies that expire at different intervals (e.g., 10, 20, 30 years) to save money long-term.

Compare Quotes Annually

Use platforms like Policygenius, Ladder Life, or SelectQuote to compare top providers quickly.

When to Reevaluate or Upgrade Your Policy

Major Life Events That Trigger Reassessment

- Marriage

- Birth of a child

- Buying a home

- Starting a business

Converting Term to Whole Life

Many term policies offer a conversion clause, allowing you to switch to permanent coverage without a medical exam.

Canceling or Replacing Older Policies

Sometimes a newer policy can offer better terms if your health has improved. Just be sure not to cancel your existing coverage until the new one is active.

Frequently Asked Questions

What is the cheapest age to buy life insurance?

Typically between age 25–35. The earlier you buy, the lower your locked-in rate.

Does life insurance get more expensive every year?

If you lock in a term or whole life policy, your rate stays the same. Otherwise, annual renewable term policies increase each year.

Can you be denied life insurance because of age?

Yes, most insurers stop offering traditional term life after age 75–80, though guaranteed issue policies are available beyond that.

Is it better to buy term or whole life at 50+?

Depends on your goals. Term is cheaper, but whole life offers cash value and estate benefits.

Will rates change if I quit smoking?

Yes! After 12–24 months smoke-free, you may qualify for non-smoker rates, cutting your premium significantly.

How often should I compare my life insurance rate?

At least every 3–5 years or after major life changes.

Conclusion: Buy Early, Save More, and Protect What Matters

Age is the single most powerful factor affecting life insurance rates. The younger you are when you apply, the more affordable your coverage will be—and the more options you’ll have. Whether you're 25 or 65, there's still time to secure protection for your family and peace of mind for your future.

Take the next step today: compare quotes, assess your needs, and choose a policy that grows with you.

You Might Also Like

Whole Life Insurance 101: Is It Right for You?(2025)

Jul 30, 2025Use a Life Insurance Calculator to Find Your Perfect Coverage (2025 Smart Guide)

Jul 29, 2025Life Insurance for Seniors Over 60: What You Need to Know (2025 Expert Guide)

Jul 29, 2025Why Young Adults Need Life Insurance: A Beginner’s Guide (2025 Edition)

Jul 29, 2025Guaranteed Issue Life Insurance: No‑Medical Exams Explained (2025 Buyer’s Guide)

Jul 29, 2025