Life Insurance for Seniors Over 60: What You Need to Know (2025 Expert Guide)

Published on July 29, 2025

Emma Carter

Senior Insurance Editor

Emma Carter is a senior insurance editor with 12 years in P&C publishing and agency work; she simplifies policy details for everyday readers.

Life Insurance for Seniors Over 60: What You Need to Know (2025 Expert Guide)

As we age, our financial priorities shift—but one thing that remains constant is the desire to protect those we love. For many people over 60, life insurance offers a way to leave behind a meaningful legacy, cover final expenses, and provide financial peace of mind. Whether you’re retired, planning your estate, or simply want to ensure your family isn’t left with debt, this guide explains everything you need to know about life insurance for seniors over 60.

Why Life Insurance Still Matters After 60

Financial Protection for Loved Ones

Even if your children are grown and your mortgage is paid off, your death could still leave your family with:

- Medical bills

- Funeral expenses

- Unsettled debts

Life insurance provides a tax-free death benefit to help ease these financial burdens.

Covering Final Expenses and Debt

Funeral and burial costs can range from $7,000 to $12,000. Without insurance, this burden often falls on surviving family members. A small final expense policy can ensure those costs are covered.

Estate Planning and Legacy Gifts

Many seniors use whole life insurance as a tool to:

- Pass on wealth

- Cover estate taxes

- Leave gifts to grandchildren or charities

Can You Still Get Life Insurance Over 60?

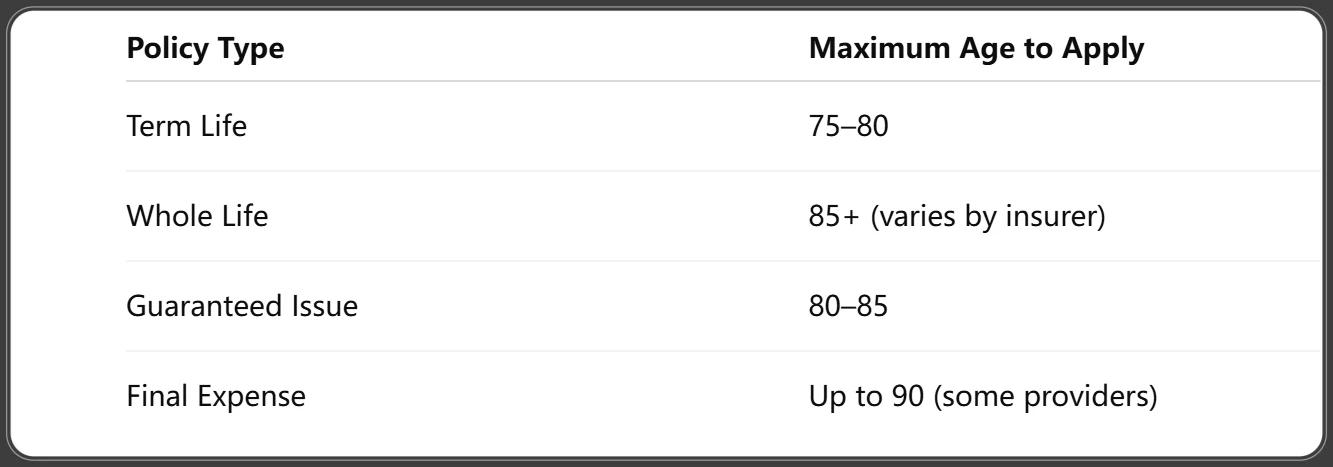

Maximum Age Limits by Policy Type

LIMRA. (2025). 2025 Facts About Life Insurance Sheet [Fact sheet]. Retrieved June 2025.

What Insurers Look for in Older Applicants

- Age

- Medical history

- Prescription usage

- Lifestyle (e.g., smoking, driving history)

How Health Impacts Approval

While health matters, there are no-exam and guaranteed acceptance policies available if you have preexisting conditions.

Best Types of Life Insurance for Seniors Over 60

Term Life Insurance

- Provides coverage for a specific period (10, 15, or 20 years)

- Ideal if you need coverage for a limited time

- Lower premiums than whole life

- Expires if you outlive the term

Whole Life Insurance

- Coverage lasts your entire life

- Builds cash value over time

- Premiums are fixed for life

- More expensive, but offers long-term value

Guaranteed Issue Life Insurance

- No medical exam or health questions

- Guaranteed approval (usually ages 50–80)

- Lower coverage amounts ($5,000–$25,000)

- Includes a 2-year waiting period

Final Expense Insurance

- Specifically designed to cover funeral and burial costs

- Coverage typically ranges from $5,000 to $30,000

- Simplified underwriting or no exam required

Cost of Life Insurance After Age 60 (2025 Rates)

Sample Quotes by Age and Gender

Bankrate. (2025, June 27). Life Insurance Facts and Statistics 2025. Retrieved June 27, 2025.

Rates are estimates for 10-year term, non-smokers in average health.

Term vs Whole Life Price Comparison

- Term (65-year-old male, 10-year, $100K): ~$85/month

- Whole Life (65-year-old male, $100K): ~$250/month

Monthly Budgeting Tips

- Choose a smaller death benefit if cost is a concern

- Opt for term life if you only need temporary coverage

- Compare policies from multiple insurers

Life Insurance for Seniors with Health Issues

No-Exam and Simplified Issue Options

Great for those with conditions like:

- High blood pressure

- Diabetes

- Cancer (after remission)

- COPD or heart disease

These policies skip the medical exam and ask basic health questions.

Guaranteed Acceptance Policies

If you’ve been denied coverage before, this is your best option. Policies come with:

- 2-year graded benefit period

- Full payout for accidental death immediately

- Premium refund + interest if death occurs early

Tips for Getting Approved with Preexisting Conditions

- Shop early—rates and availability decline with age

- Avoid tobacco for 12+ months to qualify as a non-smoker

- Disclose all medications honestly

How Much Coverage Do Seniors Actually Need?

Final Expense Coverage

- $10,000–$20,000 is usually sufficient

- Designed to pay for cremation, burial, and related costs

Paying Off Mortgages or Debts

Still owe on your home or credit cards? Consider a larger term life policy to help your family avoid financial stress.

Providing Income Support for Spouses

Social Security benefits may reduce when one spouse dies. Life insurance can fill the gap for a surviving partner.

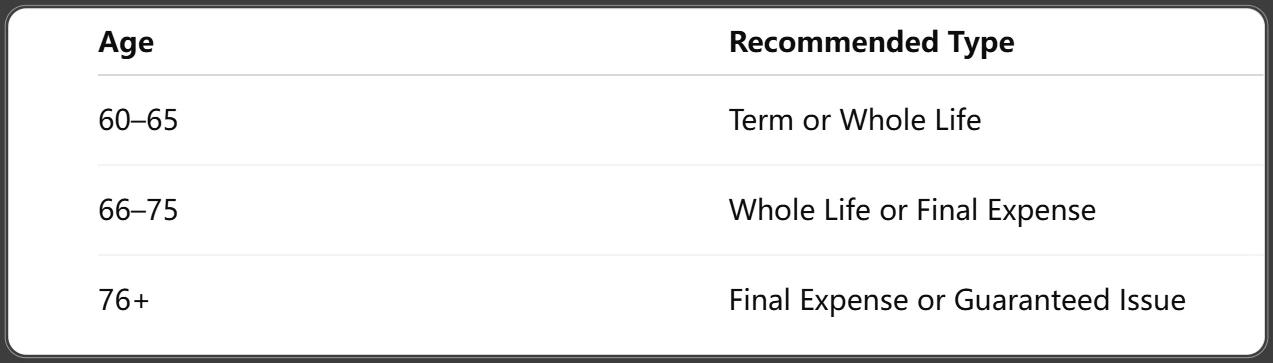

When Should Seniors Choose Term vs Whole Life?

Age and Policy Duration Considerations

MoneyGeek. (2025, May 30). Life Insurance Facts, Stats and Coverage Trends. Retrieved May 30, 2025.

Term Life Pros and Cons for Seniors

Pros:

- Affordable

- High coverage amounts

- Good for short-term needs

Cons:

- Expires at end of term

- May not be renewable after a certain age

Benefits of Whole Life for Estate Planning

- Never expires

- Offers cash value growth

- Used to transfer wealth or cover estate taxes

Top Life Insurance Companies for Seniors in 2025

Mutual of Omaha

- Known for senior policies

- Offers simplified issue and final expense plans

- Ages: 45–85

AIG

- Offers guaranteed issue life

- Up to $25,000 with no medical exam

- Ages: 50–80

Transamerica

- Term and whole life for seniors

- Competitive rates for healthy individuals

- Ages: Up to 85

Gerber Life

- Final expense insurance and guaranteed issue

- Good for applicants aged 50–80

- Quick online application

Ethos and Online Providers

- Instant approval

- No-exam options

- Ideal for tech-savvy seniors

How to Apply for Life Insurance Over 60

What to Expect in the Application Process

- Choose policy type and coverage amount

- Answer health questions (if required)

- Schedule a medical exam (if necessary)

Documents and Medical Info You May Need

- Government ID

- Prescription list

- Physician contact details

- Financial info (for higher coverage)

Getting Instant Online Quotes

Visit platforms like:

- Policygenius

- Ethos Life

- SelectQuote

These sites provide real-time quotes and policy comparisons.

Common Myths About Senior Life Insurance

“I’m Too Old to Be Approved”

Many insurers offer coverage up to age 85 or even 90—you just have to find the right product.

“It’s Always Too Expensive”

Policies can be affordable, especially for final expense or simplified issue options.

“I Don’t Need It if I’m Debt-Free”

It’s not just about debt—it’s about leaving peace of mind and a legacy for loved ones.

Tips to Save on Life Insurance as a Senior

Compare Multiple Policies

Rates and benefits vary widely. Use online tools or work with a broker to get the best deal.

Choose the Right Coverage Amount

Don’t over-insure—calculate your needs based on:

- Debts

- Burial costs

- Income replacement

Avoid Overpaying for Riders You Don’t Need

Optional add-ons like accidental death riders may not be necessary, especially after age 65.

Frequently Asked Questions

What’s the oldest age I can get life insurance?

Most policies cap applications at 85, though some final expense plans go to 90+.

Is term life worth it after 60?

Yes, if you need temporary coverage—like to cover a mortgage or income gap.

Can I get coverage without a medical exam?

Absolutely. No-exam and guaranteed issue policies are widely available for seniors.

What happens if I outlive my term policy?

Coverage ends. Some policies allow conversion to permanent life, but premiums may rise.

How much coverage is enough for final expenses?

Typically between $10,000–$25,000, depending on your burial preferences and medical debts.

Can I name a charity as my beneficiary?

Yes! Many seniors choose to leave a legacy by donating to religious, medical, or educational organizations.

Conclusion: Plan Ahead and Leave a Lasting Legacy

Life insurance for seniors over 60 isn’t just possible—it’s practical and meaningful. Whether you want to protect your family, cover end-of-life costs, or leave a legacy, there's a policy designed for your needs and budget.

Don’t wait. The earlier you apply, the more affordable and flexible your options will be. Speak to a licensed agent, compare quotes, and choose a plan that gives you peace of mind—and your loved ones the support they deserve.

You Might Also Like

Whole Life Insurance 101: Is It Right for You?(2025)

Jul 30, 2025Use a Life Insurance Calculator to Find Your Perfect Coverage (2025 Smart Guide)

Jul 29, 2025Why Young Adults Need Life Insurance: A Beginner’s Guide (2025 Edition)

Jul 29, 2025Guaranteed Issue Life Insurance: No‑Medical Exams Explained (2025 Buyer’s Guide)

Jul 29, 2025Life Insurance Rates by Age: How Your Premium Changes Over Time (Complete 2025 Guide)

Jul 29, 2025