Car Insurance for Bad Credit 2025: How to Get Coverage & Keep Your Rates Low

Published on August 4, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

Car Insurance for Bad Credit 2025: How to Get Coverage & Keep Your Rates Low

If your credit score is less than perfect, you’re not alone—and insurers know this too. In 2025, car insurance for bad credit often means higher rates, but there are proven ways to still get coverage affordably. This guide walks you through how credit affects premiums, how to shop wisely, and how to improve your rates fast.

Why Do Insurers Use Credit Scores in 2025?

Insurance companies use credit-based insurance scoring to predict risk of claims and non-payment. It’s not a credit check for lending—it’s a statistical tool indicating:

- Propensity for filing claims

- Ability to maintain continuous coverage

- Likelihood of lapses or cancellations

Most insurers see a strong correlation between poor credit and higher claim costs—so even in 2025, credit remains a core part of your rate.

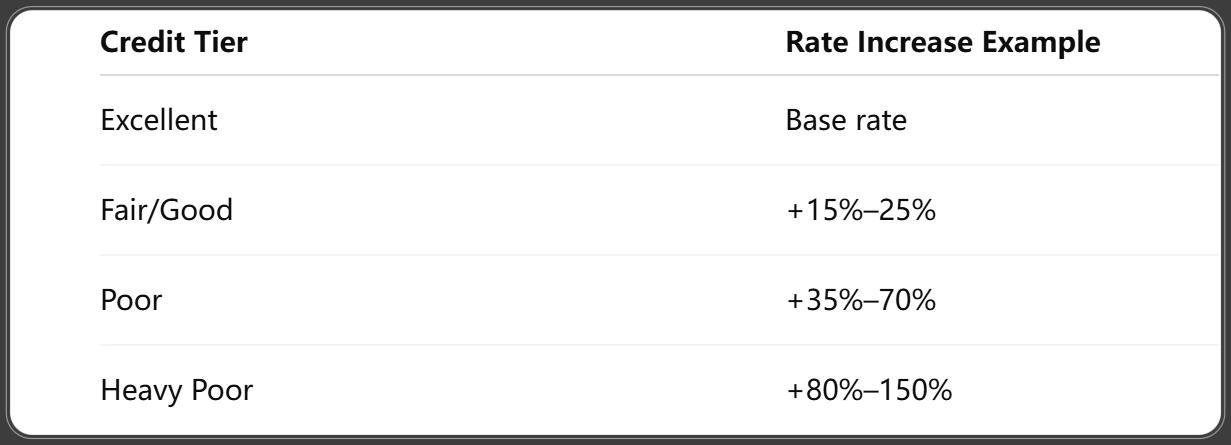

How Much Does Bad Credit Raise Insurance Rates?

Here’s what you can expect in 2025:

If the average driver pays $1,300/year, someone with poor credit may pay $1,800–$2,300 annually, depending on other risk factors.

Which States Allow Credit-Based Pricing?

Many states still permit credit-based insurance underwriting, but some have bans or restrictions:

- Credit allowed: Texas, Florida, Ohio, North Carolina, etc.

- Credit prohibited or restricted: California, Massachusetts, Hawaii, Utah (partial)

If you live in a credit‑restricted state, you may avoid credit-related rate hikes—even with less-than-stellar credit.

Top Insurance Companies for Bad Credit Drivers in 2025

Certain insurers offer better options when credit is weak:

- The General – Known for covering higher-risk drivers, minimal credit impact

- Dairyland / Acceptance – Non-standard policies with flexible underwriting

- Progressive – Chrome app / snapshot override can help offset credit risk

- GEICO – May offer fair options in insured driver pool, especially in credit-conscious states

- Non-standard specialists – Local brokers often offer assigned-risk alternatives

Getting quotes from at least three providers—including non-standard insurers—is essential.

How to Get Insurance If You Have Poor Credit

Don't let poor credit shut you out:

- Buy through independent agents who can quote to multiple insurers

- Apply for coverage at state residual markets or assigned-risk pools if rejected

- Consider a co-signer with healthy credit where allowed

- Use insurers willing to ignore credit or weight it less heavily

These paths provide access to legal minimum coverage until you rebuild credit.

Strategies to Improve Premiums Despite Bad Credit

Smart steps to reduce premiums now:

- Work toward improving your credit score (pay bills on time, reduce debt)

- Raise your deductible—it lowers your premium

- Complete a defensive driving or safe driver course

- Bundle auto with renters/home insurance for discounts

- Stay claim-free—small claims can make credit-related premiums even higher

Even if credit remains low temporarily, other actions can offset the cost.

Does Credit Affect All Parts of My Policy?

Credit impacts most policy aspects:

- Liability coverage: premium is increased based on credit score

- Collision / Comprehensive: also influenced by credit scoring

- Discount eligibility: Some discounts (like loyalty, bundling) may be restricted if credit is poor

Only usage-based insurance and promotional credits may override credit risk.

What to Do If You Are Denied Coverage Due to Credit

Insurance denial isn’t the end:

- Request written denial—state your reason

- Seek coverage via assigned-risk pool or non-standard insurer

- Some states allow insurer to reconsider after improving credit or payment history

- If denied based solely on credit in prohibited states, you may file a complaint with your state insurance regulator

You are legally entitled to at least minimum required coverage.

How Long Bad Credit Affects Your Rates

Credit-based pricing typically reflects your credit snapshot—but insurers update scores annually. You may escape poor credit pricing once:

- Your credit score rises to fair/good

- You maintain at least 12 months of continuous coverage

- You drive claim-free for at least 3 years

Keep renewing and avoiding incidents—gradual improvements follow.

Misconceptions About Bad Credit and Auto Insurance

Myth: You can’t get insurance with bad credit.

Fact: Coverage is available—even if rates are high—through non-standard insurers and state programs.

Myth: Credit score is a fixed insurance penalty.

Fact: Insurers recalculate rates, so improving credit matters.

Myth: All companies use credit the same way.

Fact: Some ignore credit entirely or weigh it minimally.

Usage-Based Insurance for Bad Credit Drivers

UBI offers hope:

- Programs like Progressive Snapshot, GEICO DriveEasy, State Farm Drive Safe & Save

- Good driving behavior can override credit risk and reduce premiums by up to 30%

- Especially useful if you have poor credit but drive safely, infrequently, or responsibly

Enroll early and maintain clean behavior to maximize discounts.

Frequently Asked Questions About Car Insurance & Bad Credit

1. How long does bad credit affect auto rates?

Roughly 1–3 years, depending on improvement and insurer policies.

2. Can improving my credit lower my insurance cost?

Yes—once your score hits fair/good, ask for a rate review.

3. Do all insurers penalize for bad credit?

No. Non-standard insurers and assigned-risk carriers may ignore it or use it less.

4. Is credit-based pricing legal everywhere?

No. Some states prohibit it—check your state’s rules.

5. Does a bankruptcy permanently affect insurance rates?

Bankruptcy typically affects your rate for 3–5 years, but you may qualify for non-standard options and safe-driver discounts.

6. Can SR‑22 filings impact my premium beyond credit?

Yes—requirements like SR‑22 add expense and may compound premium increases.

Conclusion: Managing Bad Credit Without Breaking the Bank

Your credit score shouldn’t lock you out of buying auto insurance, but it may cost more. In 2025, by being proactive—shopping wisely, improving credit, and using usage-based tools—you can regain affordable coverage. Stay consistent, and your risk profile will improve over time.

Quick Checklist:

- ✅ Shop quotes from standard and non-standard insurers

- ✅ Compare rates in your state market

- ✅ Work on improving your credit score

- ✅ Consider UBI to reward safe driving

- ✅ Stay continuously insured and claim-free

With the right approach, you can control the cost of insurance—regardless of your credit history.

You Might Also Like

GAP Insurance 2025: What It Covers, Who Needs It, and Best Providers

Aug 4, 2025Car Insurance for Teens 2025: Cheapest Rates, Smart Discounts, and Safety Tips

Aug 4, 2025Car Insurance for High Risk Drivers 2025: Cheapest Options, State Rules, and Proven Saving Tips

Aug 4, 2025Car Insurance for Electric Cars 2025: Best Rates, Coverage Options, and Industry Changes

Aug 4, 2025Full Coverage Car Insurance: Is It Worth the Extra Cost? (2025 Breakdown)

Jul 29, 2025