Car Insurance for High Risk Drivers 2025: Cheapest Options, State Rules, and Proven Saving Tips

Published on August 4, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

Car Insurance for High Risk Drivers 2025: Cheapest Options, State Rules, and Proven Saving Tips

Finding affordable car insurance for high risk drivers in 2025 can be tough—but it's not impossible. Whether you’ve had a DUI, multiple accidents, or poor credit, insurers label you as high risk based on the likelihood of future claims. This can lead to higher premiums, denied coverage, or the need for specialized policies like SR-22 or FR-44.

In this complete guide, we’ll explore how the insurance industry views high-risk drivers in 2025, the best companies to work with, how to save money, and how to move toward lower-risk status.

Who Is Considered a High-Risk Driver in 2025?

Insurers consider you high risk if your driving history, age, or financial record shows signs of increased claim potential.

Common Reasons:

- DUI or DWI convictions

- Multiple at-fault accidents

- Speeding or reckless driving violations

- Lapsed insurance coverage

- Poor credit score (used in many states)

- Teen or senior drivers with little experience or delayed reflexes

Even a single offense can bump you into this category, especially if it’s severe or recent.

Why High-Risk Drivers Pay More for Insurance

Insurance companies use complex algorithms to assess your claim risk. The higher your risk, the more you’ll pay.

Contributing Factors:

- Higher chance of future accidents

- More expensive claim payouts

- Increased likelihood of non-payment or policy lapses

Insurers mitigate this risk with higher premiums, deductibles, or coverage limits.

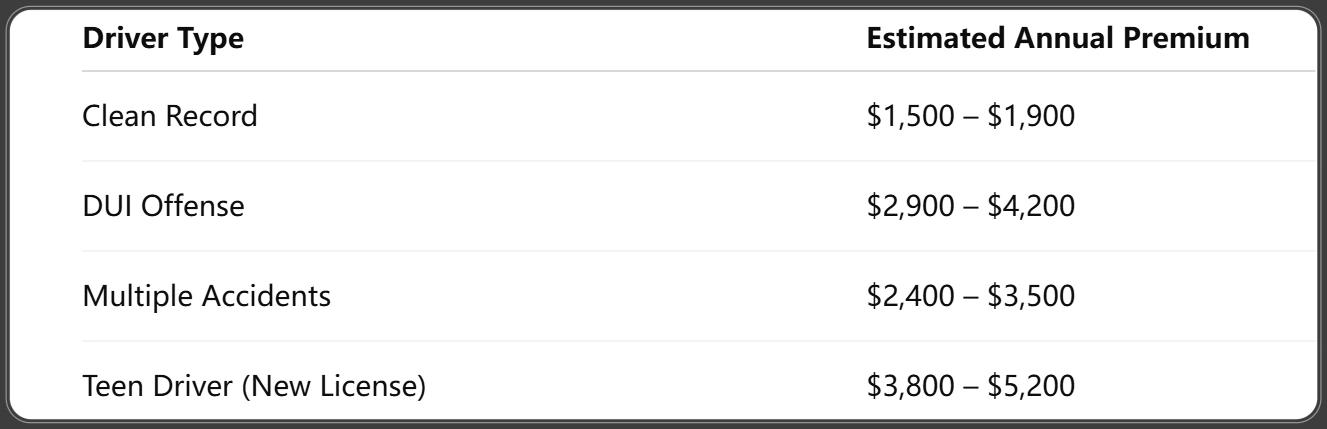

How Much Does High-Risk Car Insurance Cost in 2025?

In 2025, a high-risk driver may pay double or even triple the standard rate.

Average Premiums:

NAIC. (2025). Insurance Industry Snapshots and Analysis Reports – Industry Snapshots 2025 [Webpage].

Premiums also vary by state, vehicle type, and insurance history.

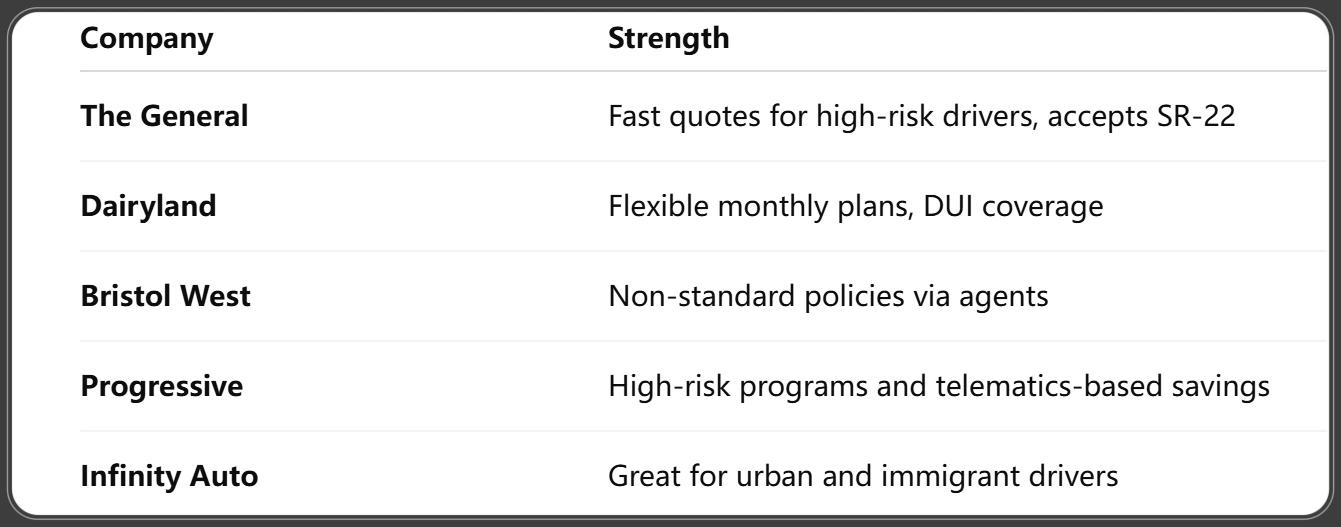

Cheapest Car Insurance Companies for High-Risk Drivers

While big insurers may reject or overcharge high-risk applicants, some specialize in non-standard auto insurance.

Top Providers in 2025:

NAIC. (2025, February 14). Advancing State-Based Regulation at Home and Abroad: NAIC Announces 2025 Initiatives [News release].

How SR-22 and FR-44 Forms Affect Your Policy

SR-22 (or FR-44 in some states like Florida and Virginia) is not a policy—it’s a proof of financial responsibility your insurer files with the state.

You May Need One If You:

- Had a DUI/DWI

- Were caught driving uninsured

- Had your license suspended

SR-22 must usually be maintained for 3 years. Missing a payment or letting your coverage lapse can restart your requirement or suspend your license again.

State-by-State Differences for High-Risk Auto Insurance

Each state sets its own rules and costs.

Most Expensive States:

- Michigan

- Florida

- Louisiana

States with Assigned Risk Plans:

- Offer last-resort coverage if you're denied everywhere else

- Usually more expensive but guaranteed

Assigned risk pools are administered by your state insurance department.

How to Get Insurance If You're Denied by Major Companies

If mainstream insurers turn you down, you're not out of options.

Alternative Routes:

- Non-Standard Insurance Providers: Companies that specialize in high-risk auto policies (e.g., The General, Dairyland, National General).

- Independent Brokers: Work with agents who can compare multiple high-risk insurers on your behalf.

- State-Assigned Risk Pools: These government-backed programs guarantee coverage but typically come with higher premiums and fewer customization options.

Check with your state insurance commissioner to find assigned risk pool contacts if you're struggling to find any coverage.

Strategies to Lower Car Insurance Costs as a High-Risk Driver

Though premiums are higher, you can still take steps to reduce them.

Proven Cost-Saving Tips:

- Take a Defensive Driving Course: Many insurers offer up to 10% off for certified training.

- Increase Your Deductible: Choosing a higher deductible lowers your monthly premium.

- Use a Cheaper Car: High-risk drivers benefit from driving low-cost, older vehicles.

- Limit Mileage: Less driving equals lower risk.

- Maintain Continuous Coverage: Gaps in insurance increase your risk profile.

- Improve Your Credit Score: In most states, credit history impacts your rates.

The more proactive you are, the quicker you can graduate out of the high-risk category.

Usage-Based Insurance for High-Risk Drivers

Usage-based insurance (UBI) is a game changer for high-risk drivers who are committed to safer driving habits.

How It Works:

- Insurers track your driving with an app or device.

- They monitor braking, acceleration, speed, mileage, and time of day.

- Safe drivers get premium discounts, sometimes as high as 30%.

Best UBI Programs in 2025:

- Progressive Snapshot

- GEICO DriveEasy

- Allstate Drivewise

- State Farm Drive Safe & Save

These programs reward good driving behavior, even for high-risk policyholders.

How Long You Stay Labeled High-Risk in 2025

Most high-risk classifications aren’t permanent.

Timeline:

NAIC. (2025). Publications – Statistical and Forecasting Tools for Insurance Industry [Webpage].

Keep your record clean and maintain insurance to requalify for standard rates sooner.

Special Considerations for Young, Senior, and Immigrant Drivers

Different groups may face higher rates, even without major violations.

Young Drivers:

- Seen as inexperienced

- Benefit from good student discounts and family policies

Senior Drivers (65+):

- Risk increases due to slower reflexes

- Consider refresher driving courses for discounts

Immigrant Drivers:

- May lack U.S. driving history

- Some insurers accept foreign licenses, others require a U.S. record

- Use insurers familiar with immigrant driver coverage, like Infinity or Kemper

How High-Risk Car Insurance Works for Rideshare and Delivery Drivers

Driving for Uber, Lyft, DoorDash, or similar platforms? You’re seen as commercial risk.

Tips:

- Notify your insurer—you may need a rideshare endorsement or commercial policy

- Failing to disclose this use can void your coverage

- Some companies offer specialized hybrid policies for personal and commercial driving

Examples: Progressive Rideshare, GEICO Rideshare, and Allstate Ride for Hire.

Avoiding Scams and Predatory Insurers in the High-Risk Market

High-risk drivers are more vulnerable to scams. Be cautious.

Red Flags:

- Promises of “guaranteed lowest rates” without background checks

- Cash-only payments

- No written policy or official documents

How to Verify:

- Check licensing with your state’s insurance department

- Look up reviews on Better Business Bureau (BBB) and AM Best

- Avoid unlicensed agents and third-party websites with no contact info

Frequently Asked Questions About High-Risk Auto Insurance in 2025

1. Can I get high-risk insurance after a DUI?

Yes. Many insurers offer SR-22 filing and coverage for DUI-convicted drivers, though at a higher cost.

2. Is SR-22 insurance a separate policy?

No. It’s an add-on filed by your insurer proving you carry the state’s minimum required coverage.

3. How long will my rates be high after an accident?

Usually 3 years, depending on the severity and your insurer’s policy.

4. Can I switch insurers as a high-risk driver?

Yes, and shopping around is highly recommended. You may find better rates or discounts with another company.

5. What happens if I miss an SR-22 payment?

Your insurer will inform the DMV, which may lead to license suspension or reinstatement fees.

6. Do all states use credit scores to set premiums?

No. Some states (like California, Hawaii, and Massachusetts) prohibit using credit scores in auto rate calculations.

Conclusion: Smart Insurance Choices for High-Risk Drivers in 2025

Being labeled high-risk isn't the end of the road—it’s a temporary status. By maintaining a clean driving record, paying your premiums on time, and exploring telematics-based insurance, you can work your way back to affordable, standard coverage.

Final Checklist:

- ✅ Compare quotes from non-standard insurers

- ✅ Use usage-based insurance to demonstrate safe driving

- ✅ Take a defensive driving course

- ✅ Improve credit and coverage consistency

- ✅ Avoid scams and verify insurer credibility

You Might Also Like

GAP Insurance 2025: What It Covers, Who Needs It, and Best Providers

Aug 4, 2025Car Insurance for Bad Credit 2025: How to Get Coverage & Keep Your Rates Low

Aug 4, 2025Car Insurance for Teens 2025: Cheapest Rates, Smart Discounts, and Safety Tips

Aug 4, 2025Car Insurance for Electric Cars 2025: Best Rates, Coverage Options, and Industry Changes

Aug 4, 2025Full Coverage Car Insurance: Is It Worth the Extra Cost? (2025 Breakdown)

Jul 29, 2025