Car Insurance for Electric Cars 2025: Best Rates, Coverage Options, and Industry Changes

Published on August 4, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

Car Insurance for Electric Cars 2025: Best Rates, Coverage Options, and Industry Changes

As electric vehicles (EVs) become mainstream in 2025, one essential cost drivers must understand is car insurance for electric cars. EVs are unique—both in design and repair—and these differences affect how insurers price coverage, offer discounts, and process claims.

In this guide, we’ll explore the car insurance for electric cars 2025 landscape, including the best companies, EV-specific coverages, average costs, and smart tips to reduce your premium.

Why Car Insurance for Electric Vehicles Is Different

Electric vehicles have advanced technology that distinguishes them from traditional gas-powered cars. This impacts how insurers calculate risk and cost.

Key Differences:

- Battery systems are expensive to repair or replace after accidents

- Advanced electronics and software increase the complexity of repairs

- Specialized parts and labor may require certified EV repair shops

- Lightweight materials may be more prone to damage but improve safety

Because of these factors, EV insurance often includes unique add-ons or higher premiums.

How Electric Vehicles Affect Insurance Rates in 2025

In 2025, the average EV insurance policy is still slightly more expensive than for traditional vehicles, though the gap is shrinking.

Why EVs May Cost More to Insure:

- Higher MSRP and replacement value

- Greater repair costs due to specialized parts

- Risk of battery fires and other emerging risks

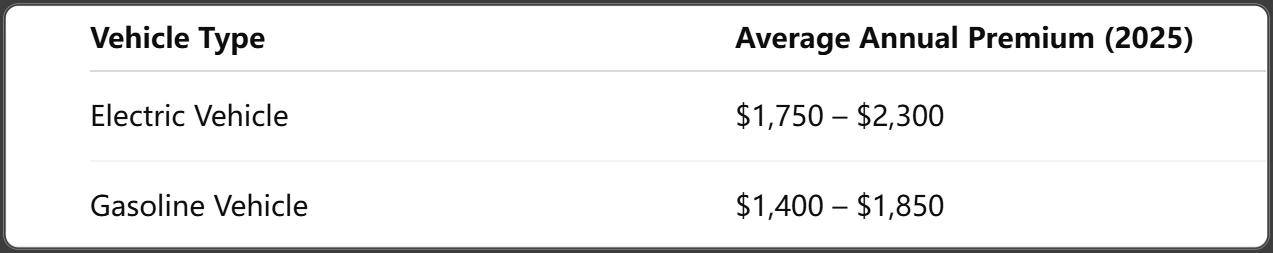

Average Premiums:

Insurance Research Council. (2025, March 27). Personal Auto Insurance Affordability: Countrywide Trends and State Comparisons [Research Brief].

However, the introduction of EV-friendly insurance programs is bringing rates down—especially for models with high safety ratings and lower accident frequency.

Most Common Insurance Coverage Types for EVs

All EVs must meet standard state minimum coverage, but EV owners often opt for more robust policies.

Common Coverages:

- Liability – Covers damage to others (required)

- Collision – Covers damage to your EV in an accident

- Comprehensive – Covers theft, weather, and non-collision damage

- Uninsured/Underinsured Motorist – Protection from drivers with insufficient coverage

- Battery Coverage – Some insurers now offer dedicated battery replacement protection

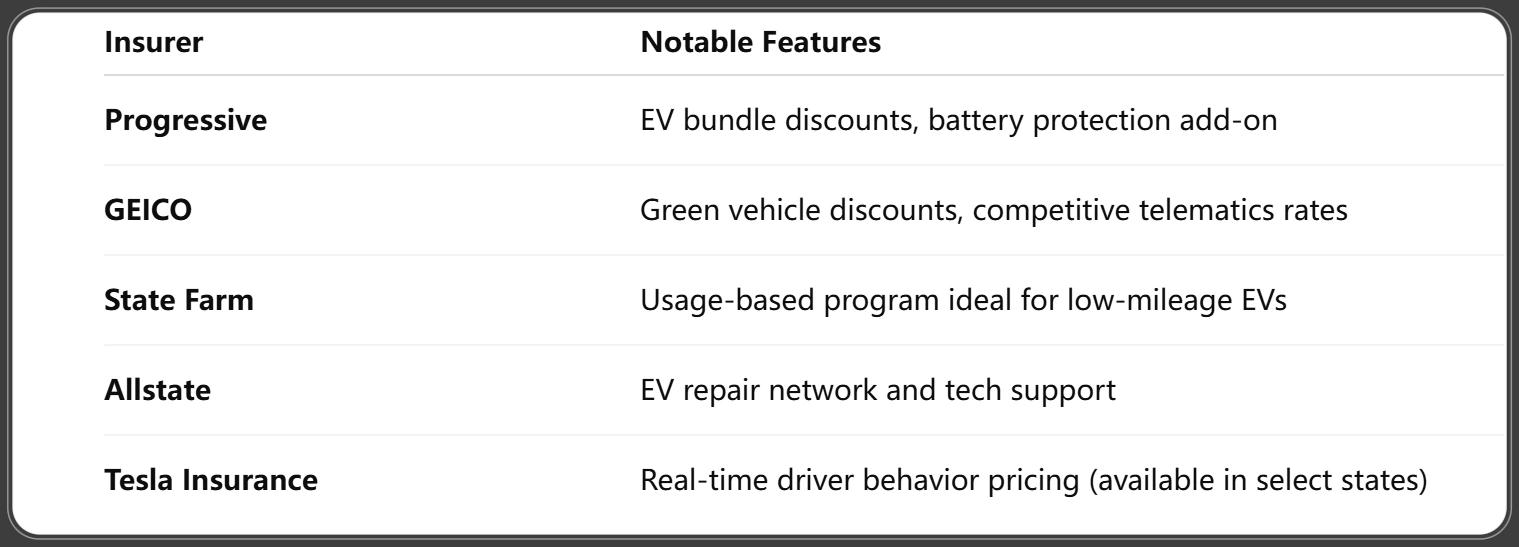

Best Insurance Companies for Electric Cars in 2025

Here are some of the top insurers offering EV-specific policies:

LexisNexis Risk Solutions. (2025, June 12). 2025 U.S. Auto Insurance Trends Report [Press release].

Tesla’s in-house insurance is gaining traction with lower rates for Tesla owners based on vehicle telematics.

State-by-State Differences in EV Insurance Rates

Insurance premiums for electric vehicles vary widely depending on where you live.

States with Lower EV Insurance Premiums:

- California – Due to incentives and a large repair network

- Oregon – EV-friendly policies and low accident rates

- Colorado – Strong usage-based insurance support

Higher Cost States:

- Michigan – High base insurance rates overall

- Florida – Increased risk of storm-related damage

- Louisiana – High accident and claim frequency

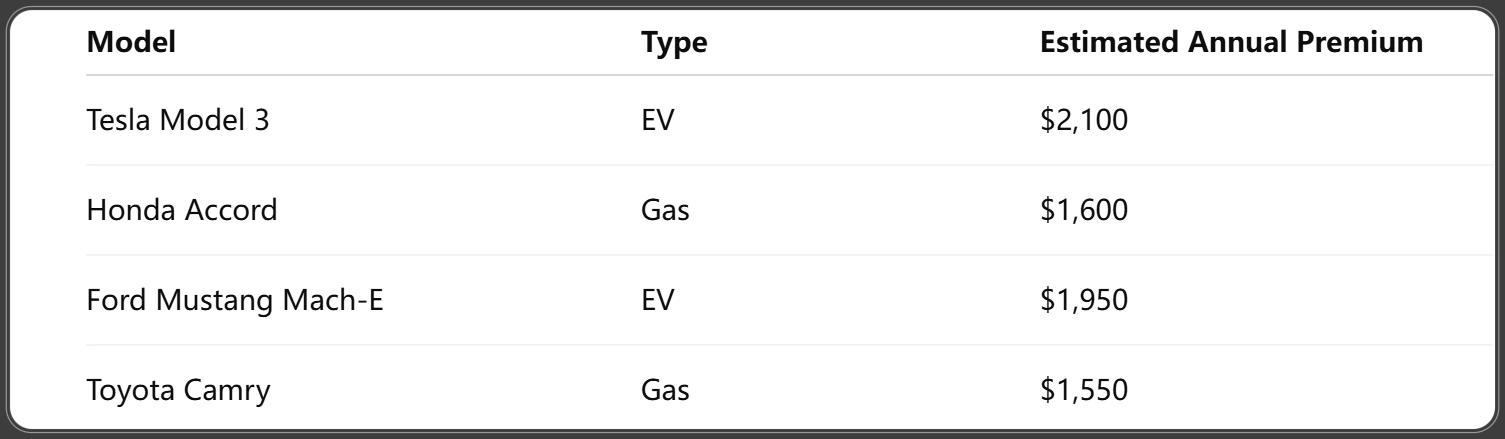

Insurance Cost Comparison: EVs vs Gas Cars in 2025

Here’s a side-by-side cost look at comparable models:

AgencyChecklists.com. (2025, March 17). NAIC 2025 Market Share: Top 25 Private Passenger Auto Insurers [Web report].

Premiums depend on safety ratings, parts availability, driver history, and mileage.

Tips to Lower Your Electric Car Insurance Premium

Although EV insurance can cost more, there are several ways to save:

Smart Saving Strategies:

- Bundle Policies: Combine auto and home insurance for discounts.

- Safe Driving Programs: Enroll in telematics or usage-based insurance (UBI) that tracks driving behavior.

- Higher Deductibles: Choose a larger deductible to reduce monthly premiums.

- Low-Mileage Discounts: EVs are often driven fewer miles—take advantage of pay-per-mile insurance.

- Shop Around: Rates can vary dramatically between insurers for the same EV model.

Also, don’t forget to maintain a clean driving record and install anti-theft devices, which can further reduce costs.

EV Insurance and Federal/State Incentives in 2025

While insurance itself isn’t subsidized, other EV-related incentives can indirectly reduce your total ownership cost.

Relevant Incentives:

- Federal EV Tax Credit: Up to $7,500 for qualifying vehicles—can offset insurance costs

- State Rebates: Some states offer insurance premium rebates or discounts for owning zero-emission vehicles

- Green Car Discounts: Many insurers reward environmentally friendly choices with 5%–10% off

Ask your provider if they recognize eco-friendly drivers or vehicles under their pricing models.

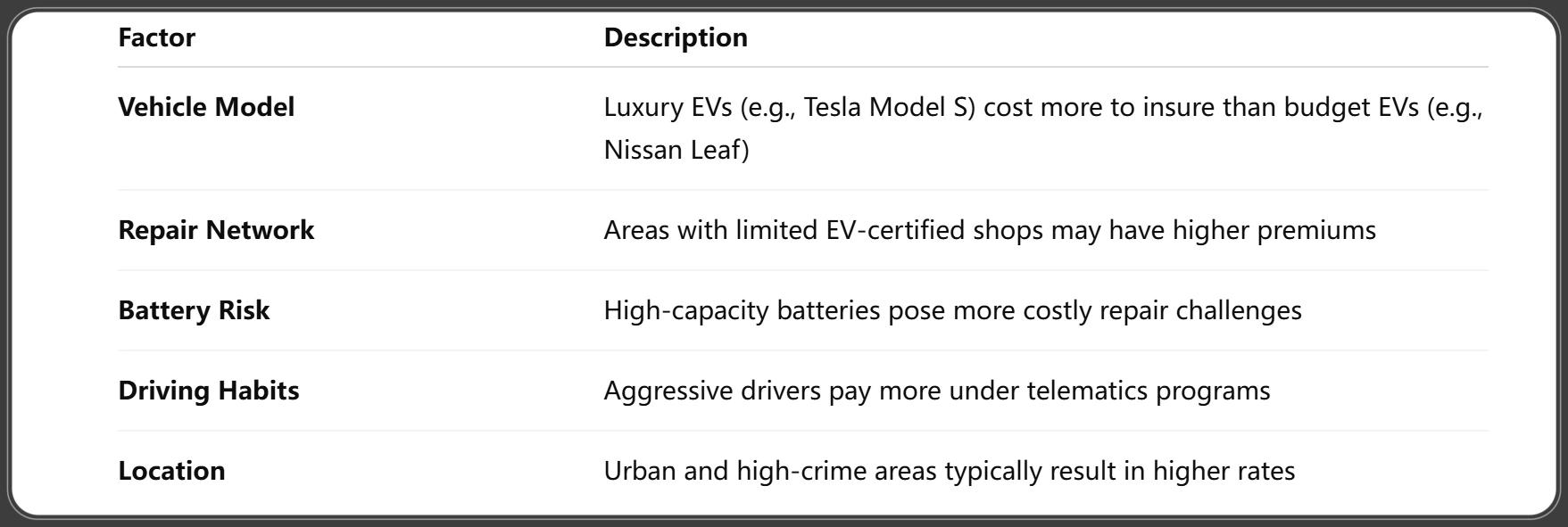

Factors That Impact EV Insurance Rates in 2025

Several elements influence how much you’ll pay for electric car coverage:

NAIC. (2025). Insurance Industry Snapshots and Analysis Reports – Industry Snapshots 2025 [Webpage].

Insurance companies also factor in weather exposure, such as flood or wildfire risk, which affects battery systems.

Do EVs Qualify for Usage-Based Insurance?

Yes! Many insurers in 2025 offer UBI plans for electric vehicles.

Benefits of UBI for EVs:

- Tracks mileage, braking, speed, and acceleration

- Ideal for EV owners who drive infrequently or short commutes

- Average savings: 10%–30% for safe drivers

Top UBI programs include:

- Progressive Snapshot

- State Farm Drive Safe & Save

- GEICO DriveEasy

- Tesla’s Real-Time Premium Adjuster

These programs reward EV drivers who already benefit from quiet operation and low emissions.

Claims and Repairs: Unique Challenges for EV Owners

Electric vehicles present new claims and repair challenges for insurers:

Key Considerations:

- Battery Fire Risk: While rare, lithium-ion battery fires are harder to extinguish and costlier to repair

- Limited Repair Shops: EV-certified technicians are fewer, increasing labor costs and wait times

- Specialized Parts: Body and tech components may need to be ordered directly from manufacturers

These factors often make comprehensive and collision coverage more critical for EV owners.

Insurance Requirements for EV Leases and Loans

Most lenders require full coverage, which includes:

- Liability

- Comprehensive

- Collision

- Often, GAP insurance, which covers the difference between your EV’s value and the remaining loan amount if totaled

For leased EVs, the leasing company may mandate higher limits, so always review your contract before purchasing a policy.

Emerging Trends in EV Insurance for 2025 and Beyond

The insurance industry is adapting to EVs through:

- AI-Powered Claims: Faster damage assessments via AI and machine learning

- EV-Specific Underwriting: Algorithms tailored for battery risk and usage behavior

- Expansion of Tesla and Rivian Insurance: More manufacturers are offering in-house policies

- Autonomous Driving Considerations: As semi-autonomous EVs grow, insurers adjust liability frameworks

These trends will continue reshaping how premiums are calculated and how policies are customized.

Frequently Asked Questions About Electric Vehicle Insurance in 2025

1. Are electric cars more expensive to insure in 2025?

Generally yes, but the gap is shrinking due to better safety tech and more competition among insurers.

2. Does EV insurance cover the battery?

Some insurers offer battery-specific protection, while others include it under collision or comprehensive coverage.

3. Which EV has the cheapest insurance rates?

Affordable models like the Chevy Bolt EUV and Hyundai Kona Electric tend to have the lowest premiums.

4. Can I get usage-based insurance for my EV?

Yes. Most major insurers offer UBI discounts, especially useful for EVs used for short commutes or local driving.

5. What happens if my EV is totaled?

You’ll receive the actual cash value unless you have GAP insurance, which covers remaining loan/lease balances.

6. Does Tesla offer its own insurance?

Yes. Tesla Insurance is expanding in 2025, using real-time data from your car to adjust monthly premiums based on driving behavior.

Conclusion: Choosing Smart Coverage for Your EV in 2025

Getting the right car insurance for electric cars in 2025 means balancing protection, price, and perks. As EV technology continues to evolve, insurers are offering more flexible, eco-conscious, and affordable options than ever before.

Final Tips:

- ✅ Compare multiple quotes before choosing

- ✅ Look for EV-friendly discounts and UBI programs

- ✅ Stay informed about federal and state EV incentives

- ✅ Review your lease/loan requirements before picking a policy

- ✅ Choose insurers with strong EV repair networks

You Might Also Like

GAP Insurance 2025: What It Covers, Who Needs It, and Best Providers

Aug 4, 2025Car Insurance for Bad Credit 2025: How to Get Coverage & Keep Your Rates Low

Aug 4, 2025Car Insurance for Teens 2025: Cheapest Rates, Smart Discounts, and Safety Tips

Aug 4, 2025Car Insurance for High Risk Drivers 2025: Cheapest Options, State Rules, and Proven Saving Tips

Aug 4, 2025Full Coverage Car Insurance: Is It Worth the Extra Cost? (2025 Breakdown)

Jul 29, 2025