GAP Insurance 2025: What It Covers, Who Needs It, and Best Providers

Published on August 4, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

GAP Insurance 2025: What It Covers, Who Needs It, and Best Providers

In today’s auto finance landscape, where loans stretch longer and vehicles depreciate quickly, GAP insurance in 2025 is more relevant than ever. If your car is totaled or stolen and its market value is less than what you still owe, GAP insurance bridges the difference—potentially saving you thousands.

This complete guide covers how GAP works, who needs it, how much it costs, and the best ways to get covered in 2025.

What Is GAP Insurance and Why Is It Important in 2025?

GAP stands for Guaranteed Asset Protection. It covers the “gap” between what your car is worth and what you still owe on your loan or lease if your vehicle is totaled or stolen.

With rising vehicle prices and extended financing terms (often 72–84 months), many drivers owe more than the car is worth—especially in the first 2–3 years. GAP insurance is designed to eliminate that risk.

How GAP Insurance Works

Let’s break it down with a real-world example:

Scenario:

- Your car is totaled in an accident.

- You owe $28,000 on your auto loan.

- The car’s actual cash value (ACV) is only $22,000.

- Your standard auto insurance pays $22,000.

- You’re still responsible for the remaining $6,000—unless you have GAP insurance.

GAP insurance pays that $6,000, so you’re not stuck with payments on a car you can no longer drive.

What Does GAP Insurance Cover in 2025?

GAP Insurance Covers:

- Total loss from accidents (if your car is declared a total loss)

- Theft with no recovery

- Remaining loan/lease balance not covered by regular insurance

GAP Insurance Does Not Cover:

- Vehicle repairs

- Past-due payments or penalties

- Extended warranties or loan rollovers

- Negative equity from trade-ins (unless specified)

Who Should Buy GAP Insurance in 2025?

GAP insurance isn’t for everyone, but it’s ideal for:

- New Car Buyers: New vehicles lose up to 20% in value during the first year.

- High Loan-to-Value Borrowers: If you made a small down payment (less than 20%).

- Long-Term Loans (60+ Months): Greater risk of owing more than the car is worth.

- Leased Vehicle Drivers: Most lease contracts require GAP or similar protection.

When Should You Skip GAP Insurance?

You may not need GAP if:

- Your loan balance is low compared to the car’s market value.

- You purchased the car with a large down payment (25% or more).

- You own the vehicle outright.

- Your car has strong resale value and depreciates slowly (e.g., Toyota Tacoma, Subaru Outback).

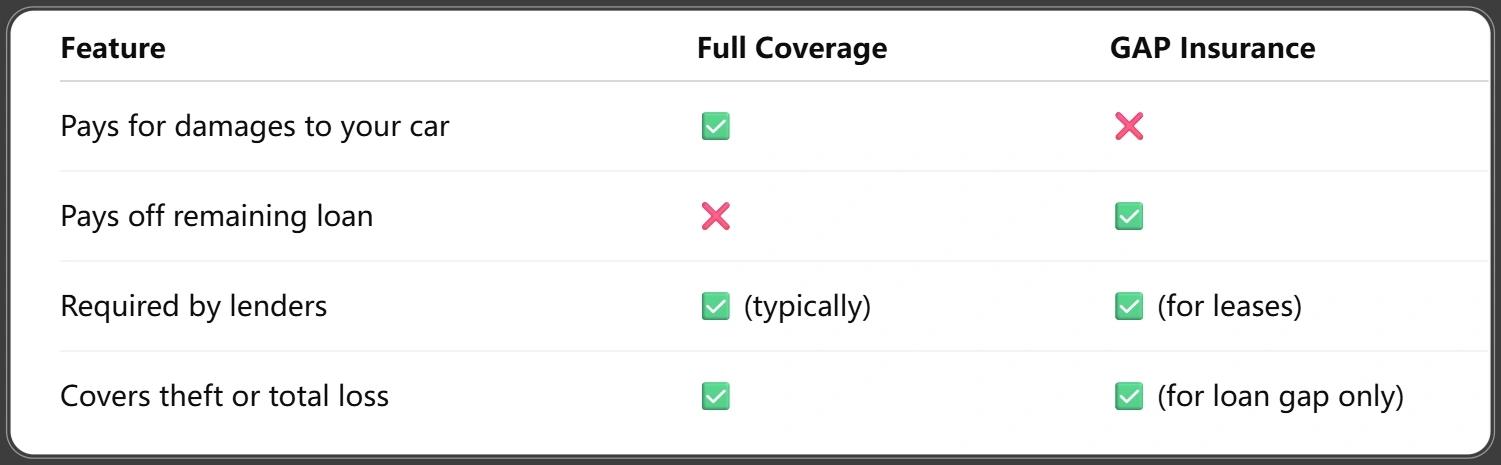

GAP Insurance vs Full Coverage: What’s the Difference?

This is one of the most common sources of confusion.

NAIC. (2025). Publications – Statistical and Forecasting Tools for Insurance Industry [Webpage].

They are complementary, not interchangeable. GAP steps in after full coverage pays.

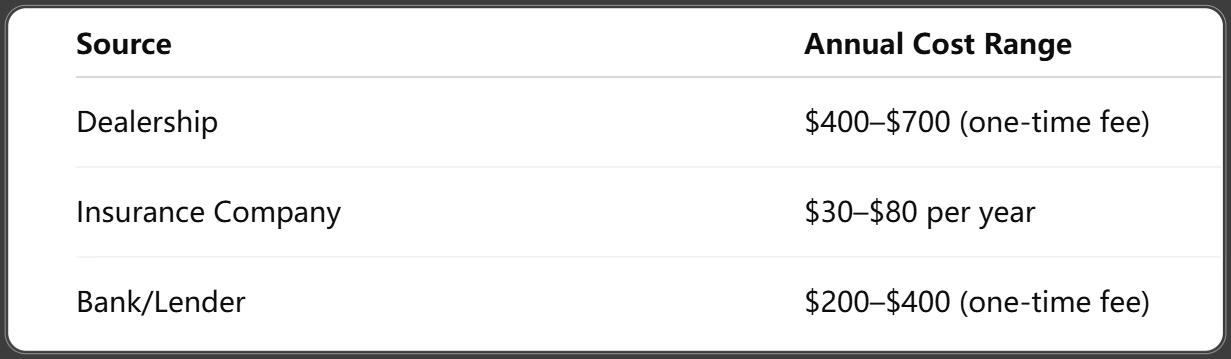

How Much Does GAP Insurance Cost in 2025?

The cost depends on the provider, the vehicle, and loan details.

Average Costs:

National Association of Insurance Commissioners. (2025). Auto Insurance Database Average Premium Supplement for 2023 [Press release]. Retrieved July 8, 2025.

Tip: GAP is usually cheaper through your insurer than through a dealer.

Best GAP Insurance Providers in 2025

Top Insurers Offering GAP:

- Progressive – Offers GAP coverage for leased and financed vehicles

- Allstate – GAP add-on with collision coverage

- GEICO – GAP alternatives like mechanical breakdown and new car replacement

- State Farm – Loan/lease payoff option for total losses

- Liberty Mutual – Add-on coverage for vehicle value protection

Finance Companies with GAP Options:

- Ally Bank

- Capital One Auto Finance

- Toyota Financial Services

Compare both to see where the best pricing and claim handling lies.

Can You Buy GAP Insurance After Buying a Car?

Yes! Many people don’t purchase GAP at the dealership—and that’s okay.

You can still get it if:

- Your car is less than 3 years old

- You still owe more than the car’s market value

- You purchase coverage through your insurer or lender

Time limit: Most companies allow GAP coverage within 12 to 18 months after vehicle purchase.

How to File a GAP Insurance Claim in 2025

Steps to File:

- File a claim with your primary insurer (collision/comprehensive).

- Request a settlement letter showing ACV and remaining loan balance.

- Contact your GAP provider with supporting documents.

- Submit proof of loan payoff amount and any insurance shortfall.

- Wait for claim review—most resolve in 30–45 days.

Keep payment records, loan details, and policy documents ready.

Common Myths About GAP Insurance

Many car owners misunderstand GAP insurance—here are the most common misconceptions.

Myth #1: Full coverage includes GAP.

Reality: Full coverage pays only for the car’s actual cash value—not what you owe on the loan. GAP fills the difference.

Myth #2: GAP covers everything, including repairs.

Reality: GAP does not cover repairs. It only applies when the vehicle is a total loss.

Myth #3: Everyone with a loan needs GAP insurance.

Reality: If you owe less than the car’s value or made a large down payment, GAP may not be necessary.

Myth #4: You can’t buy GAP after the car purchase.

Reality: You can often add it through your insurance company or lender within the first 12–18 months.

GAP Insurance Alternatives in 2025

If GAP doesn’t make sense for your situation, consider these alternatives:

1. New Car Replacement Insurance

- Offered by insurers like Liberty Mutual and Allstate.

- Replaces your car with a new model (not just ACV).

- Usually available for cars less than 1–2 years old.

2. Loan/Lease Payoff Coverage

- Similar to GAP but may have a payout cap (e.g., 25% of the vehicle’s value).

- Available from providers like State Farm.

3. Vehicle Return Protection

- Some dealerships offer this coverage if you need to return the car due to hardship (job loss, health issues).

While these may cost more, they’re valuable options depending on how your vehicle is financed.

Frequently Asked Questions About GAP Insurance 2025

1. Is GAP insurance required?

No. It’s optional, but many lenders and lease contracts strongly recommend or require it.

2. Does GAP insurance cover theft?

Yes—if your car is stolen and not recovered, GAP will pay off the remaining loan after your main insurance payout.

3. Can I cancel GAP insurance early?

Yes. If your loan balance drops below the car’s value, you can cancel GAP and request a refund on unused premiums.

4. How long do I need GAP insurance?

Only until your loan balance is lower than your car’s market value, typically 2–3 years.

5. Does GAP insurance cover negative equity?

Usually no. If you rolled over debt from a previous loan, GAP often won’t cover that portion—check your policy.

6. Is dealership GAP coverage refundable?

Yes, in most cases. If you pay off the loan early or cancel within a few months, you may get a partial refund.

Conclusion: Is GAP Insurance Worth It in 2025?

If you're financing or leasing a car in 2025, especially with a long loan or small down payment, GAP insurance is a smart move. It protects you from owing thousands on a car you no longer have due to an accident or theft.

GAP Insurance Is Most Valuable If:

- You owe more than the car’s current value.

- Your vehicle depreciates quickly.

- You lease or finance over 60+ months.

- You want peace of mind during the early loan period.

Always compare quotes from your insurer, dealer, and lender to get the best deal. And remember—GAP insurance is only necessary while you're upside down on the loan.

You Might Also Like

Car Insurance for Bad Credit 2025: How to Get Coverage & Keep Your Rates Low

Aug 4, 2025Car Insurance for Teens 2025: Cheapest Rates, Smart Discounts, and Safety Tips

Aug 4, 2025Car Insurance for High Risk Drivers 2025: Cheapest Options, State Rules, and Proven Saving Tips

Aug 4, 2025Car Insurance for Electric Cars 2025: Best Rates, Coverage Options, and Industry Changes

Aug 4, 2025Full Coverage Car Insurance: Is It Worth the Extra Cost? (2025 Breakdown)

Jul 29, 2025