Car Insurance for Teens 2025: Cheapest Rates, Smart Discounts, and Safety Tips

Published on August 4, 2025

Michael Reyes

Auto Insurance Specialist

Michael Reyes is an auto insurance specialist with 8+ years in claims and agent roles; expert in premiums, telematics, and young-driver discounts.

Car Insurance for Teens 2025: Cheapest Rates, Smart Discounts, and Safety Tips

For parents and young drivers alike, car insurance for teens in 2025 is one of the biggest financial hurdles to hitting the road. With high premiums, limited experience, and stricter underwriting, getting coverage for a teen can feel overwhelming—but with the right approach, it doesn’t have to break the bank.

This guide will walk you through how much teen insurance costs in 2025, which companies offer the best rates, how to take advantage of discounts, and what safety practices can keep both your premiums and your teen safe.

Why Car Insurance for Teens Costs More

Teen drivers are among the riskiest to insure. Insurance companies rely on historical claim data, and teens unfortunately top the charts for:

- Accident frequency

- Speeding and distracted driving violations

- Nighttime and weekend crashes

Their lack of driving experience means they’re statistically 3x more likely to be involved in an accident than older drivers.

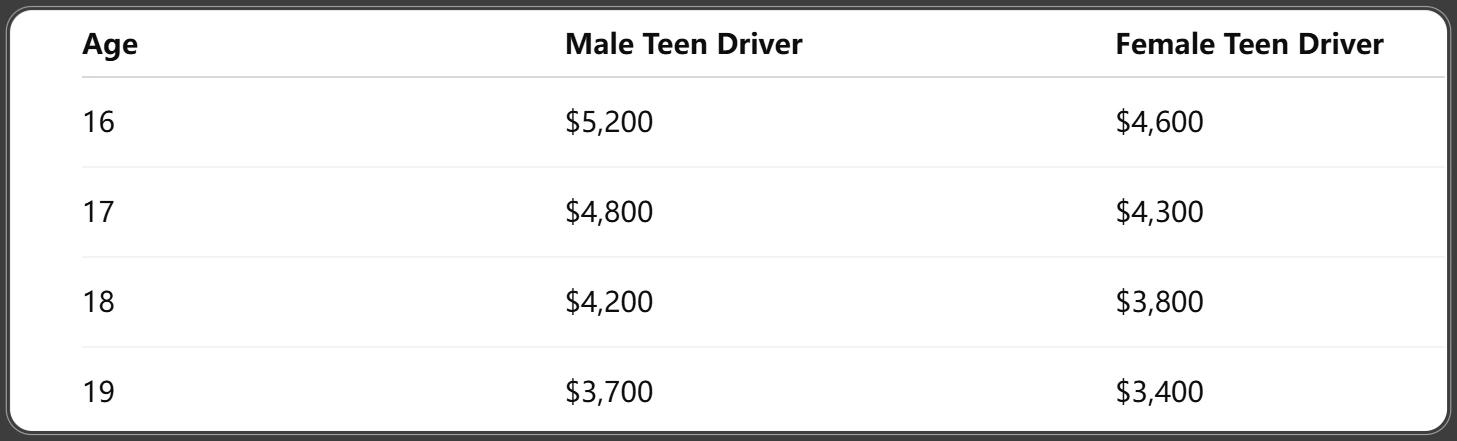

Average Cost of Teen Car Insurance in 2025

Insurance for teens is more expensive than any other age group. Here's what you can expect in 2025.

National Average Annual Premiums:

ValuePenguin (LendingTree). (2025, July 8). State of Auto Insurance in 2025 [Web report].

Tip: Adding a teen to a family policy often reduces the cost by up to 60% compared to getting them a separate plan.

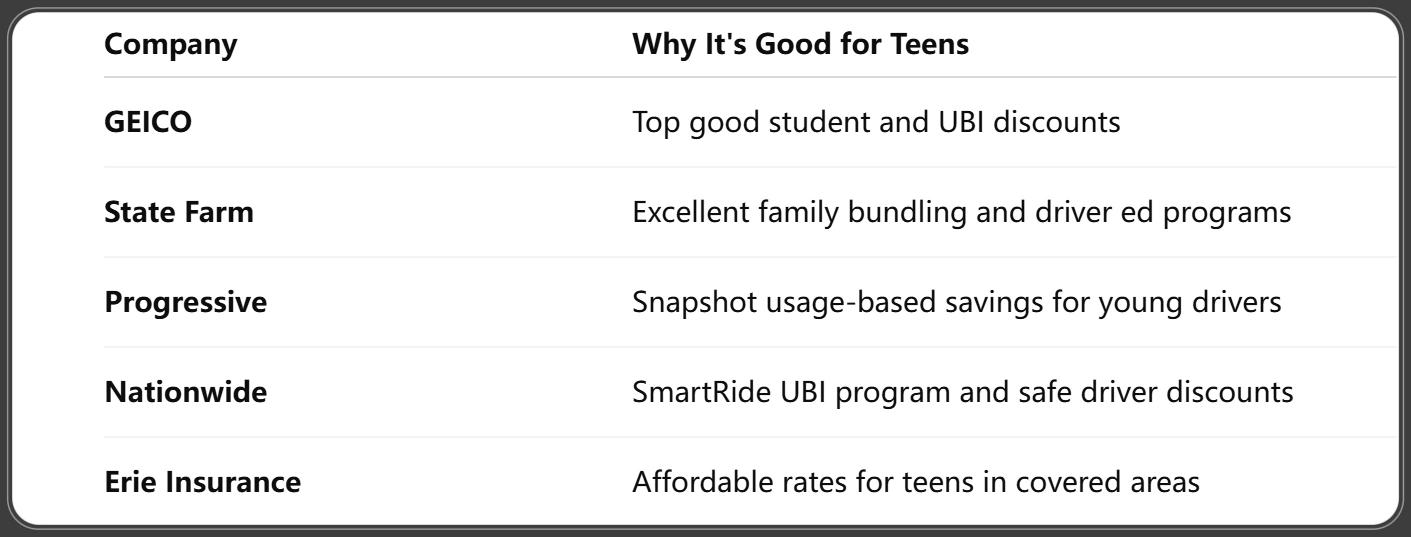

Cheapest Car Insurance Companies for Teens in 2025

Some insurers are more teen-friendly than others, offering competitive rates and flexible programs.

Best Providers:

PropertyCasualty360. (2025, April 14). NAIC: Top auto insurers of 2025 [Web article].

Look for companies that offer strong digital tools, teen driver education, and generous multi-driver discounts.

Best Discounts Available for Teen Drivers

Teens can access a variety of discounts—some require a little effort, others come from driving habits.

Popular Discounts:

- Good Student Discount: GPA of 3.0 or higher can save 10–25%

- Driver Training Discount: Certified courses reduce risk and cost

- Usage-Based Insurance (UBI): Safe driving tracked via apps can save 15–40%

- Multi-Car & Multi-Policy Discounts: Bundle with home or renters insurance

- Low-Mileage Discounts: Ideal for students not driving often

Should You Add a Teen to a Family Policy or Separate?

Add to Family Policy:

- Pros: Cheaper rates, easier management, extended coverage

- Cons: Entire policy may see a rate increase after a claim

Separate Policy:

- Pros: Keeps teen’s risk isolated

- Cons: Much more expensive, fewer discounts

Verdict: 90% of families save more by adding the teen to their policy.

Required Coverage for Teen Drivers by State

All states require minimum liability insurance, but for teens, consider going beyond the minimum.

Recommended Add-Ons:

- Collision – Covers repairs if your teen crashes into something

- Comprehensive – Theft, vandalism, or weather-related damage

- Uninsured/Underinsured Motorist – Essential protection if others lack proper coverage

Some states, like New York and California, require higher coverage thresholds for drivers under 18.

How to Lower Teen Insurance Costs in 2025

Saving on teen car insurance is possible with the right choices. Here’s how to bring down the premium:

Proven Ways to Save:

- Choose the Right Car: Smaller, safer, older vehicles cost less to insure.

- Raise Deductibles: A higher deductible lowers the monthly rate but increases out-of-pocket costs during a claim.

- Shop Around: Get at least three quotes—rates vary significantly between providers.

- Bundle Policies: Combine auto, home, or renters insurance for added savings.

- Enroll in Safe Driving Programs: Defensive driving and UBI programs reward responsible driving.

Top Safety Tips for Teen Drivers

Insurance companies and parents agree—safety comes first. Educating teens on responsible driving is not just about saving money; it’s about saving lives.

Essential Safety Tips:

- No Phone Use While Driving: Enforce no-text and no-call rules.

- Limit Passengers: Extra passengers raise the risk of distractions and accidents.

- Drive During Daylight: Avoid nighttime driving until more experience is gained.

- Stick to the Speed Limit: Speeding is a leading cause of fatal teen crashes.

- Practice Defensive Driving: Always be alert and anticipate others’ mistakes.

Teaching teens to avoid high-risk behaviors reduces accident likelihood—and insurance premiums.

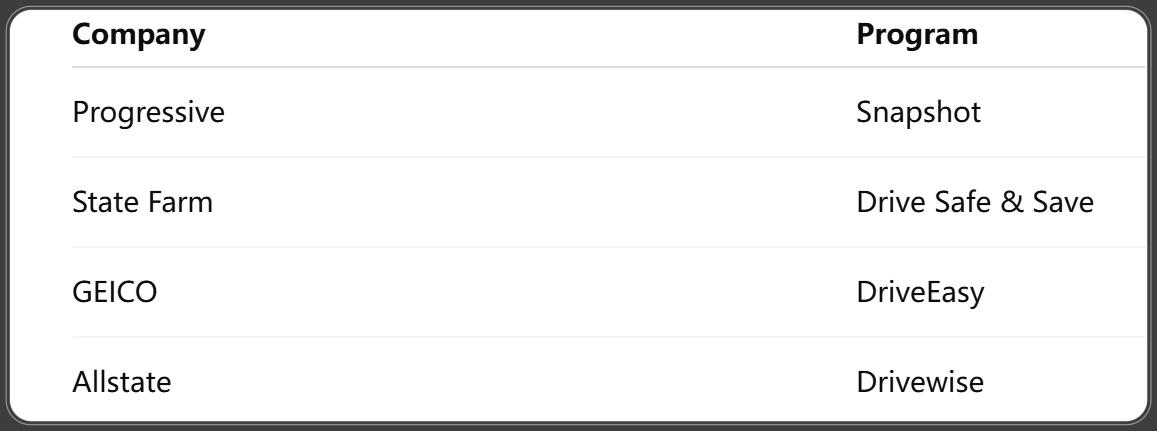

Telematics and Usage-Based Insurance for Teens

Many insurers offer UBI (usage-based insurance) that uses technology to monitor real-time driving behavior.

What It Tracks:

- Braking and acceleration

- Speeding incidents

- Mileage and driving hours

- Phone usage

Best UBI Programs in 2025:

Insurance Research Council. (2025, March 27). Personal Auto Insurance Affordability: Countrywide Trends and State Comparisons [Research Brief].

Safe behavior is often rewarded with up to 30% off after the initial review period.

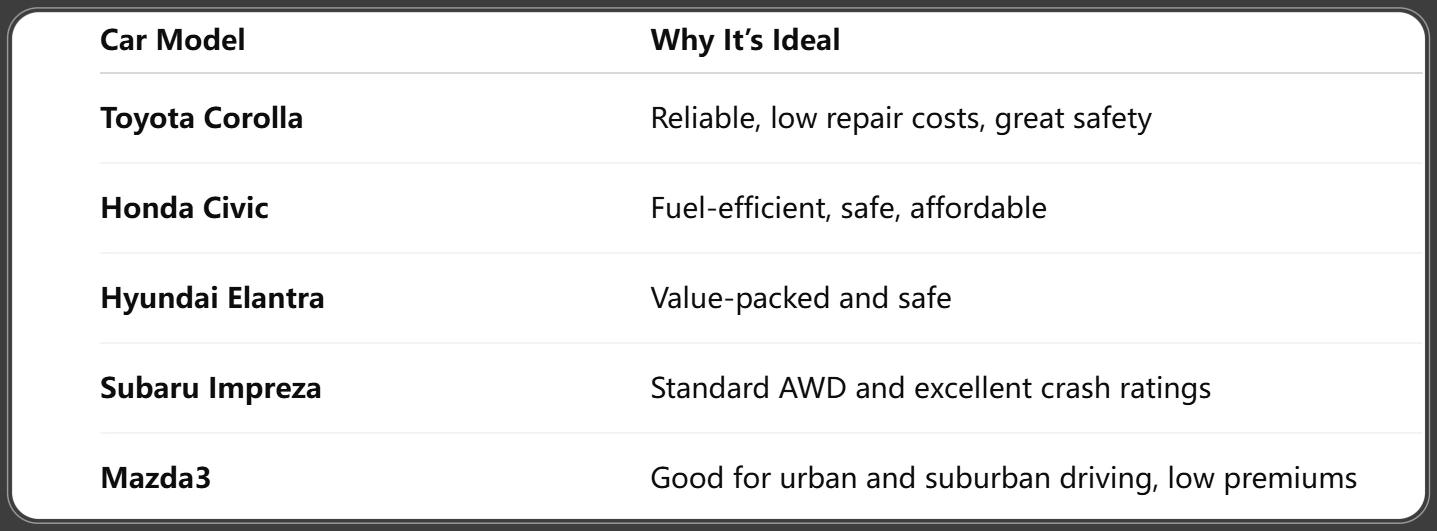

Best Cars for Teens to Lower Insurance Premiums

The type of car your teen drives significantly impacts insurance rates. Look for vehicles with:

- High safety ratings

- Low horsepower

- Affordable parts and repair costs

Top Affordable Teen Cars in 2025:

LexisNexis Risk Solutions. (2025, June 12). 2025 U.S. Auto Insurance Trends Report [Press release].

Avoid sports cars, luxury vehicles, or anything with turbocharged engines—these spike premiums fast.

College Students and Car Insurance in 2025

Going off to college? Here's what students and parents need to know.

Scenarios:

- Student Attends College In-State: Keep teen on the family policy.

- Out-of-State College: Notify your insurer—some states require separate policies.

- No Car on Campus: Ask for a “student away at school” discount, typically 5–15%.

Tip: Maintain continuous coverage to avoid higher premiums later due to lapses.

Gender and Age Factors in Teen Car Insurance

Gender-Based Pricing:

- Males under 20 often pay more due to higher accident rates.

- Some states (e.g., California, Michigan, Hawaii) prohibit gender-based pricing.

Age Factors:

- 16–17-year-olds pay the most.

- Rates gradually decrease after age 18 with a clean record.

Parents should regularly update their insurer on mileage, grades, and driving status for the best rates.

What Happens If a Teen Has an Accident?

Immediate Impacts:

- Premium Increases: Up to 50–100% depending on severity.

- Policy Changes: Higher deductibles or required accident forgiveness add-ons.

Long-Term:

- The accident remains on the record for 3–5 years.

- Future claims and insurer shopping may become harder.

Make sure your teen knows the post-accident process and has emergency contacts stored.

Frequently Asked Questions About Teen Car Insurance in 2025

1. What’s the cheapest way to insure a teen?

Adding them to a parent’s policy is usually the most cost-effective method.

2. Can a teen get their own car insurance?

Yes, but it's much more expensive and may require a co-signer or additional documentation.

3. What GPA qualifies for a good student discount?

Typically a 3.0 (B average) or higher qualifies for savings between 10–25%.

4. Do teens need full coverage?

If the vehicle is financed, full coverage is required. Otherwise, it’s based on the value of the car and family preference.

5. Will car insurance get cheaper as teens age?

Yes. Rates typically drop at ages 19, 21, and 25, assuming a clean record.

6. Can my teen drive my car without being on the policy?

They must be listed if they live in your household and have regular access to the vehicle.

Conclusion: Helping Your Teen Get the Best Car Insurance in 2025

Navigating car insurance for teens in 2025 can feel like a challenge—but it doesn’t have to be expensive or stressful. By understanding the costs, choosing the right insurer, and encouraging safe driving habits, you’ll set your teen up for success both on the road and with their finances.

Final Tips:

- ✅ Shop around and compare quotes

- ✅ Use every discount available

- ✅ Enroll in UBI or safe driving programs

- ✅ Choose the right car for safety and affordability

- ✅ Reinforce responsible driving at home

You Might Also Like

GAP Insurance 2025: What It Covers, Who Needs It, and Best Providers

Aug 4, 2025Car Insurance for Bad Credit 2025: How to Get Coverage & Keep Your Rates Low

Aug 4, 2025Car Insurance for High Risk Drivers 2025: Cheapest Options, State Rules, and Proven Saving Tips

Aug 4, 2025Car Insurance for Electric Cars 2025: Best Rates, Coverage Options, and Industry Changes

Aug 4, 2025Full Coverage Car Insurance: Is It Worth the Extra Cost? (2025 Breakdown)

Jul 29, 2025